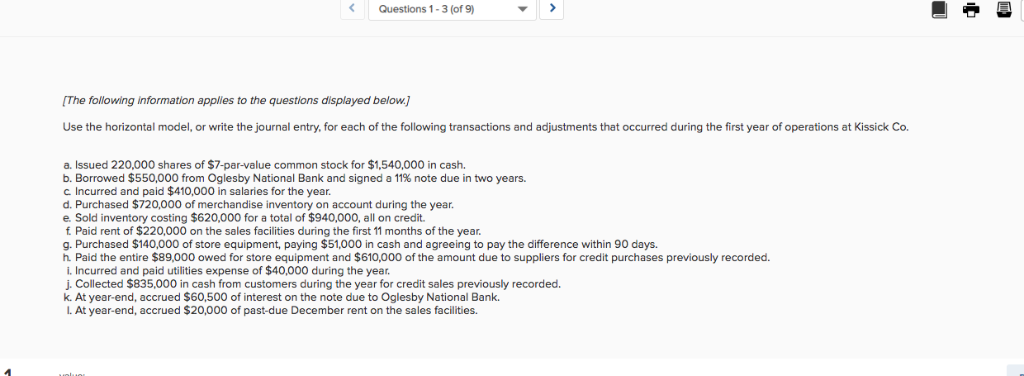

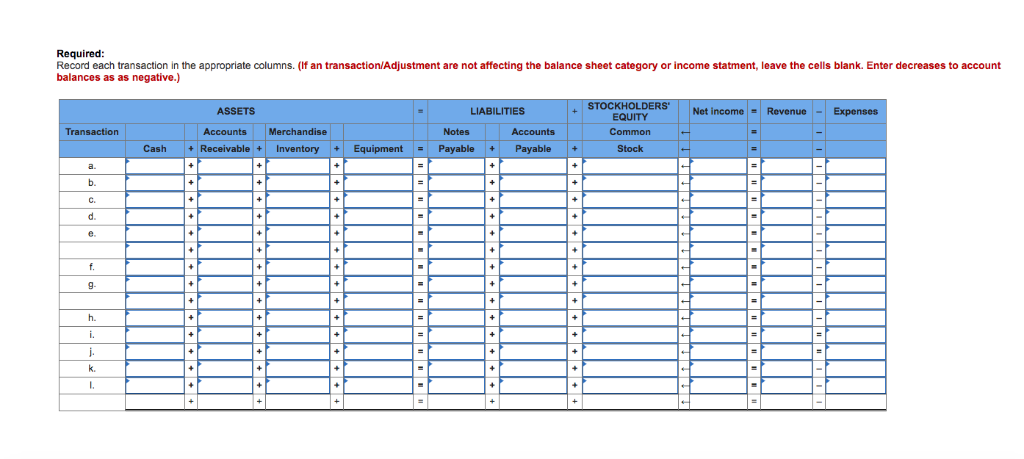

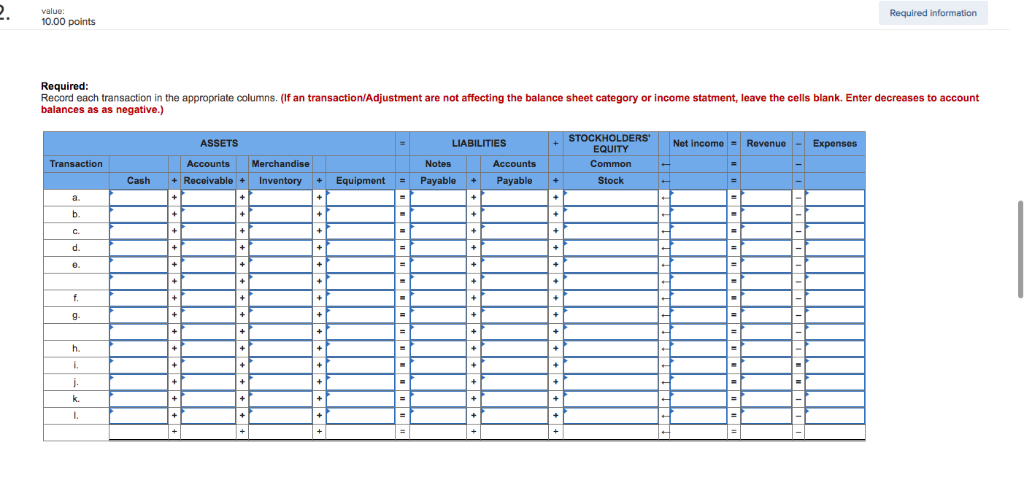

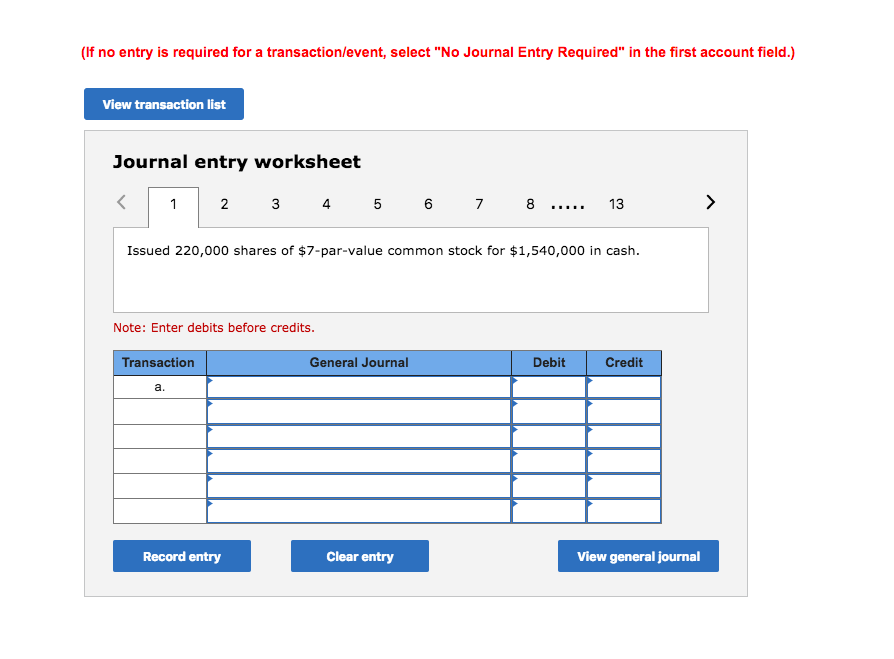

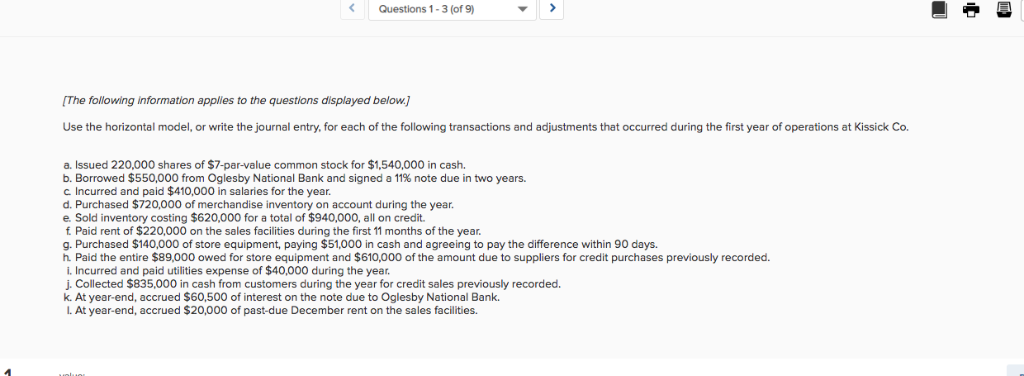

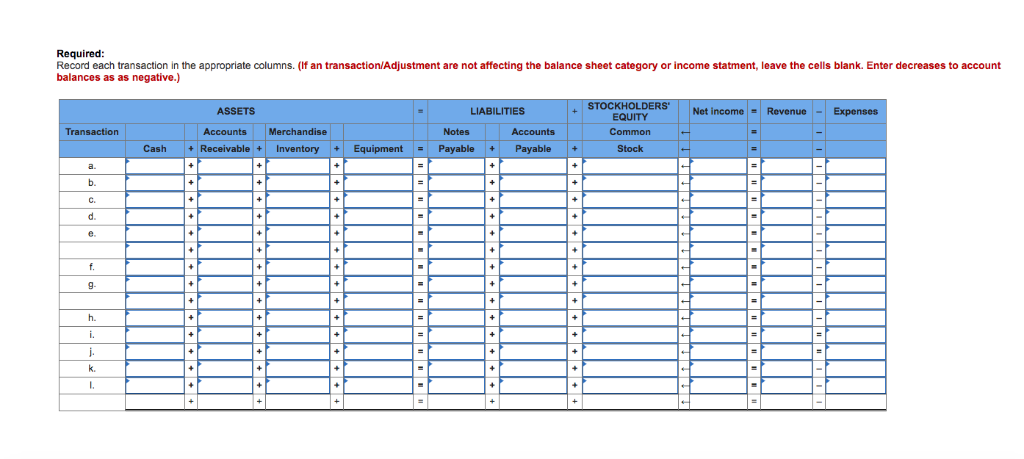

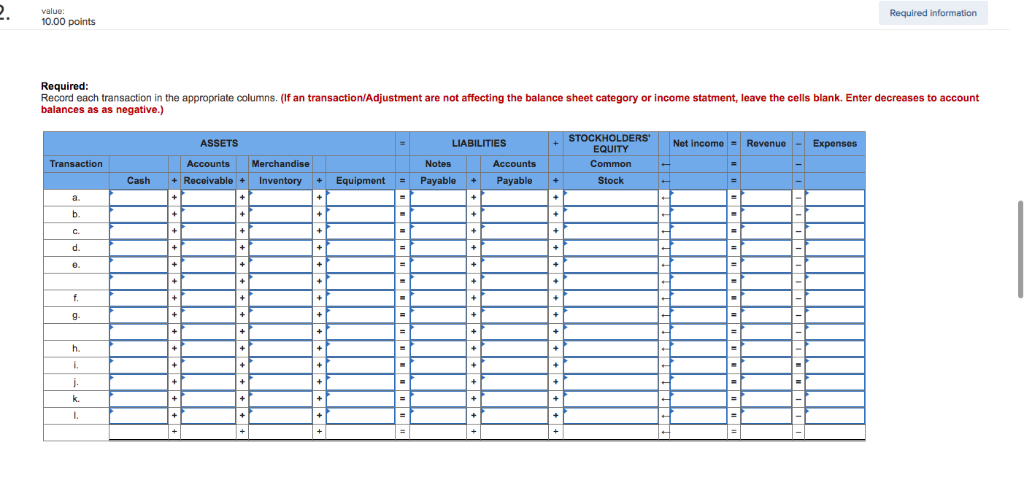

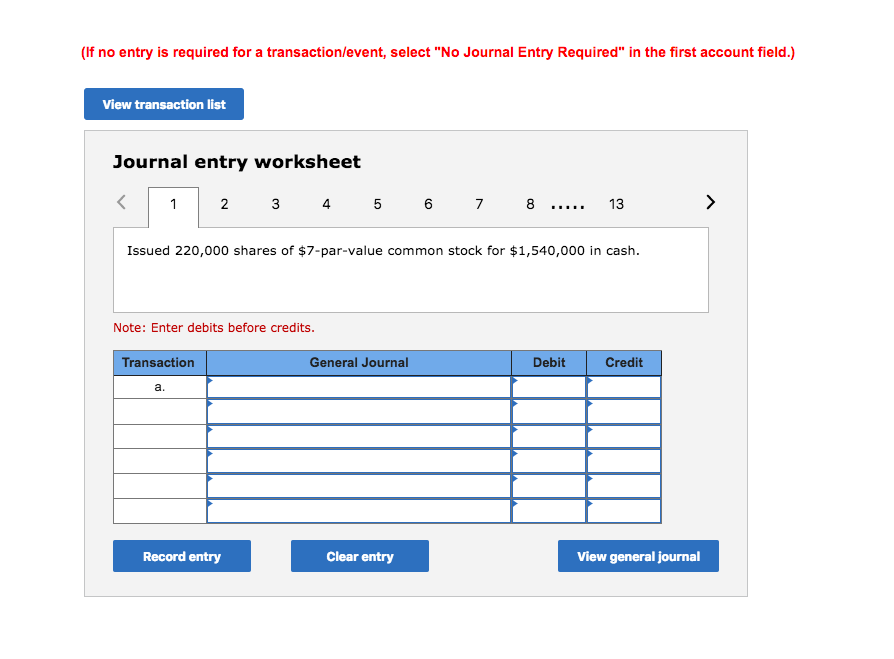

Questions 1-3 (of 9) [The following information applies to the questions displayed below Use the horizontal model, or write the journal entry, for each of the following transactions and adjustments that occurred during the first year of operations at Kissick Co. a. Issued 220,000 shares of $7-par-value common stock for $1,540,000 in cash. b. Borrowed $550,000 from Oglesby National Bank and signed a 11% note due in two years. c Incurred and paid $410,000 in salaries for the year. d. Purchased $720,000 of merchandise inventory on account during the year. e. Sold inventory costing $620,000 for a total of $940,000, all on credit. f Paid rent of $220,000 on the sales facilities during the first 11 months of the year. g. Purchased $140,000 of store equipment, paying $51,000 in cash and agreeing to pay the difference within 90 days. h. Paid the entire $89,000 owed for store equipment and $610,000 of the amount due to suppliers for credit purchases previously recorded. i. Incurred and paid utilities expense of $40,000 during the year. j. Collected $835,000 in cash from customers during the year for credit sales previously recorded. k. At year-end, accrued $60,500 of interest on the note due to Oglesby National Bank. . At year-end, accrued $20,000 of past-due December rent on the sales facilities. Required Record each transaction in the appropriate columns. (If an transaction/Adjustment are not affecting the balance sheet category or income statment, leave the cells blank. Enter decreases to account balances as as negative.) STOCKHOLDERS Net income Revenue ASSETS LIABILITIES Expenses EQUITY Common Stock Accounts Merchandise Notes Accounts Saction Cash+Receivable+Inventory+Equipment Payable +Payable+ b. C. d. e. 9- F. k. Required information 10.00 points Required Record each transaction in the appropriate columns. (If an transaction/Adjustment are not affecting the balance sheet category or income statment, leave the cells blank. Enter decreases to account balances as as negative.) STOCKHOL ASSETS LIABILITIES Net incomeRevenue-Expenses EQUITY Common Stock Transaction Accounts Merchandise Notes Accounts Cash Receivable+Inventory EquipmentPayable Payable (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list Journal entry worksheet Issued 220,000 shares of $7-par-value common stock for $1,540,000 in cash. Note: Enter debits before credits. Transaction General Journal Debit Credit a. Record entry Clear entry View general journal