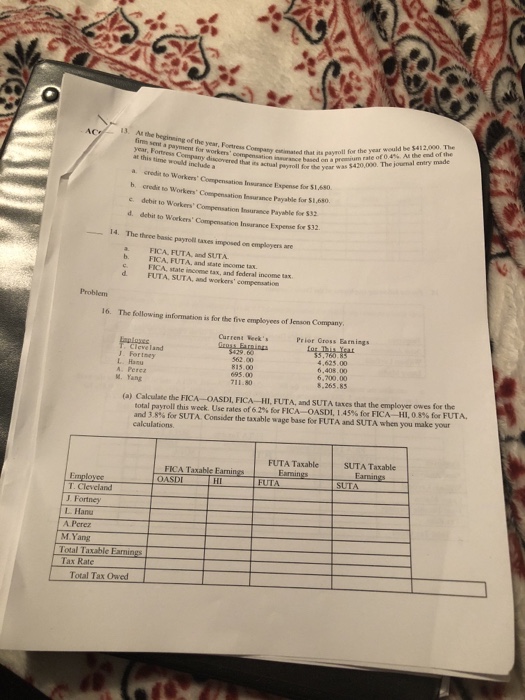

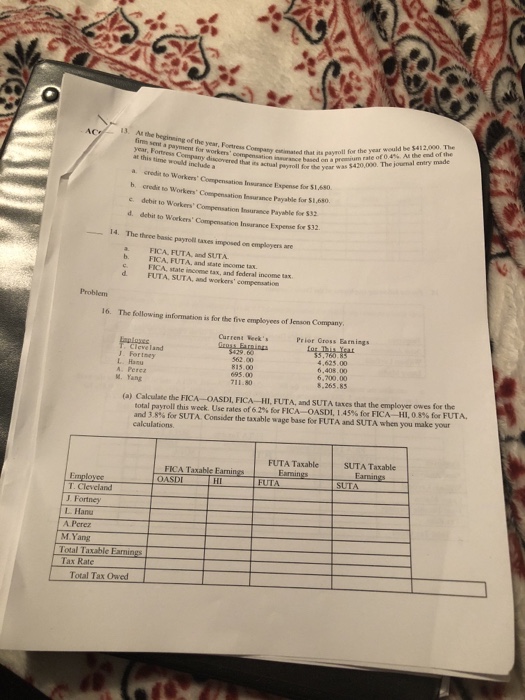

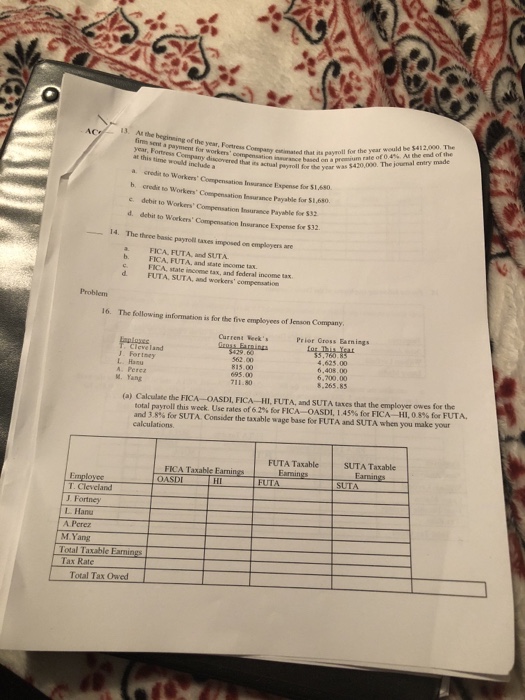

Questions 13-16

t this timew dstiol tmated that its paywoll for the year would be $412,000 The a. crodit to Workers' Compensation Insurance Expense for $1.680 b crodit to Workerns Compensation Insurance Payable for 51,680 13. At the beginsing of the a payment for Aethe ofthe Company discovered thast ins actual payroll for the year .nce based on apremium rate of04% was $420,000. The jounal entry made c. debit to Workers' Compensation Insurance Payable for 32 d. debit to Workers' Compensation Insurance Expense fow 532 14. The three bassc payroll taxes imposed on employers are a FICA FUTA, and SUTA b FICA, FUTA, and state income tax c. FICA, state income tax, and federal income tax d. FUTA, SUTA, and workers' compensation Problem 16. The following information is for the five employees of Jenson Company Current Weck'sPrior Cross Earn ings Fortsey LHamu A. Perez M. Yang 562.00 815.00 695.00 11.80 4,625.00 6,408.00 6,700.00 8,265.83 (a) Calculate the FICA-OASDI, FICA--HIFUTA, and SUTA taxes that the employer owes for the total pyroll this week. Use rates of 62% for FICA- ONSDL I ass ise na-illo se ise ruth. and 3.8% for suTA. Consider the usable wage base for FUTA and SUTA when you make your calculations FUTA Taxable SUTA Taxable HI FUTA SUTA T. Cleveland J. Fortney L. Hanu A Perez ing Tax Rate Total Tax Owed t this timew dstiol tmated that its paywoll for the year would be $412,000 The a. crodit to Workers' Compensation Insurance Expense for $1.680 b crodit to Workerns Compensation Insurance Payable for 51,680 13. At the beginsing of the a payment for Aethe ofthe Company discovered thast ins actual payroll for the year .nce based on apremium rate of04% was $420,000. The jounal entry made c. debit to Workers' Compensation Insurance Payable for 32 d. debit to Workers' Compensation Insurance Expense fow 532 14. The three bassc payroll taxes imposed on employers are a FICA FUTA, and SUTA b FICA, FUTA, and state income tax c. FICA, state income tax, and federal income tax d. FUTA, SUTA, and workers' compensation Problem 16. The following information is for the five employees of Jenson Company Current Weck'sPrior Cross Earn ings Fortsey LHamu A. Perez M. Yang 562.00 815.00 695.00 11.80 4,625.00 6,408.00 6,700.00 8,265.83 (a) Calculate the FICA-OASDI, FICA--HIFUTA, and SUTA taxes that the employer owes for the total pyroll this week. Use rates of 62% for FICA- ONSDL I ass ise na-illo se ise ruth. and 3.8% for suTA. Consider the usable wage base for FUTA and SUTA when you make your calculations FUTA Taxable SUTA Taxable HI FUTA SUTA T. Cleveland J. Fortney L. Hanu A Perez ing Tax Rate Total Tax Owed