Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Questions 1-4 Please answer for questions based on the options inside of ( ) 1. What are you afraid of happening to your original equity

Questions 1-4 Please answer for questions based on the options inside of ( )

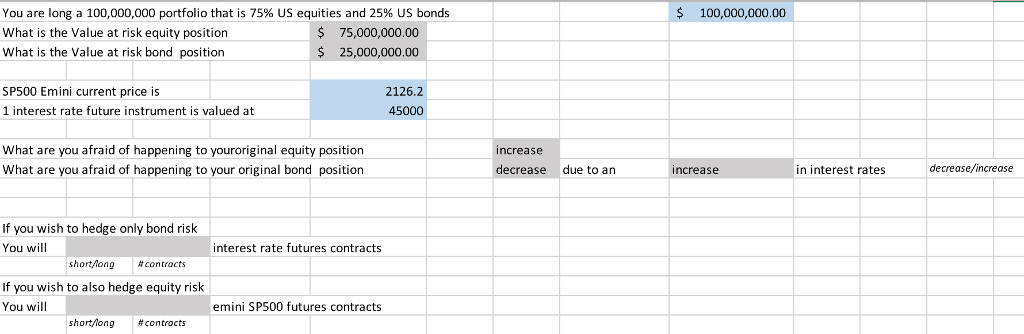

1. What are you afraid of happening to your original equity position? (decrease/increase)

2. What are you afraid of happening to your original bond position? (decrease/increase) due to an (decrease/increase) in interest rates

3. If you wish to hedge only bond risk:

You will (short/long) (# of contracts) interest rate futures contracts

4. If you wish to also hedge equity risk:

You will (short/long) (# of contracts) emini SP500 futures contracts

You are long a 100,000,000 portfolio that is 75% US equities and 25% US bonds What is the Value at risk equity position What is the Value at risk bond position 100,000,000.00 $ 75,000,000.00 $25,000,000.00 SP500 Emini current price is 1 interest rate future instrument is valued at 2126.2 45000 What are you afraid of happening to youroriginal equity position What are you afraid of happening to your original bond positio increase decrease due to an increase in interest rates decrease/increase If you wish to hedge only bond risk You will interest rate futures contracts short/long \#contracts If you wish to also hedge equity risk You will emini SP500 futures contracts short,long #controcts You are long a 100,000,000 portfolio that is 75% US equities and 25% US bonds What is the Value at risk equity position What is the Value at risk bond position 100,000,000.00 $ 75,000,000.00 $25,000,000.00 SP500 Emini current price is 1 interest rate future instrument is valued at 2126.2 45000 What are you afraid of happening to youroriginal equity position What are you afraid of happening to your original bond positio increase decrease due to an increase in interest rates decrease/increase If you wish to hedge only bond risk You will interest rate futures contracts short/long \#contracts If you wish to also hedge equity risk You will emini SP500 futures contracts short,long #controctsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started