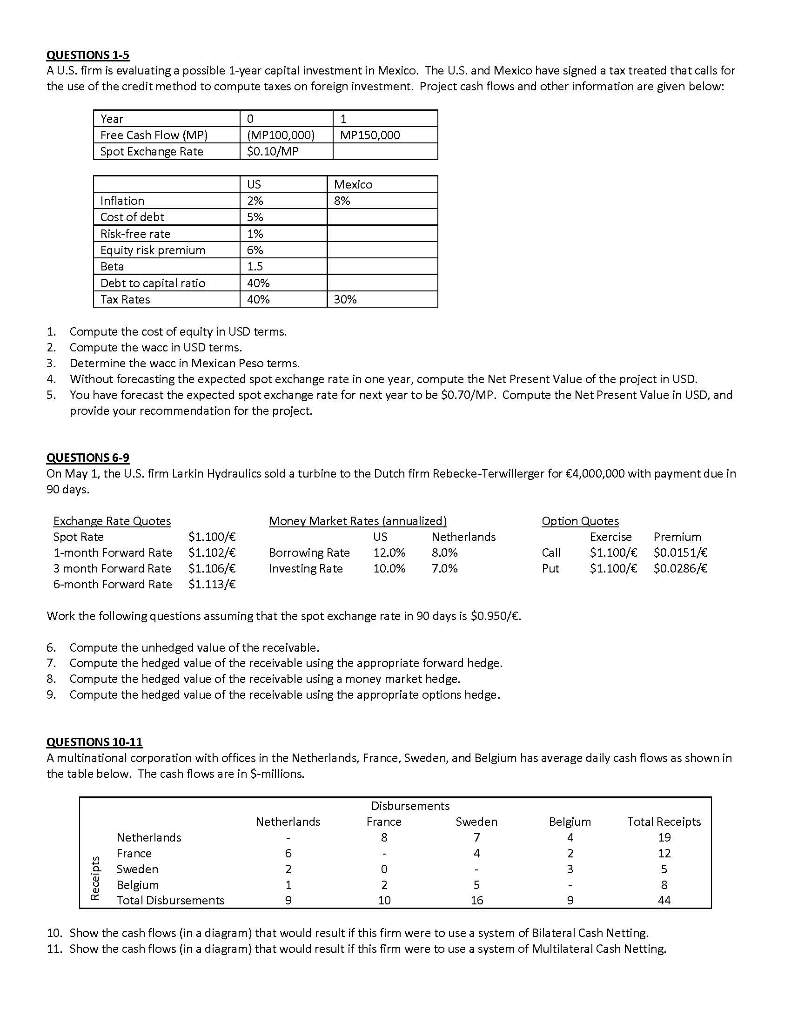

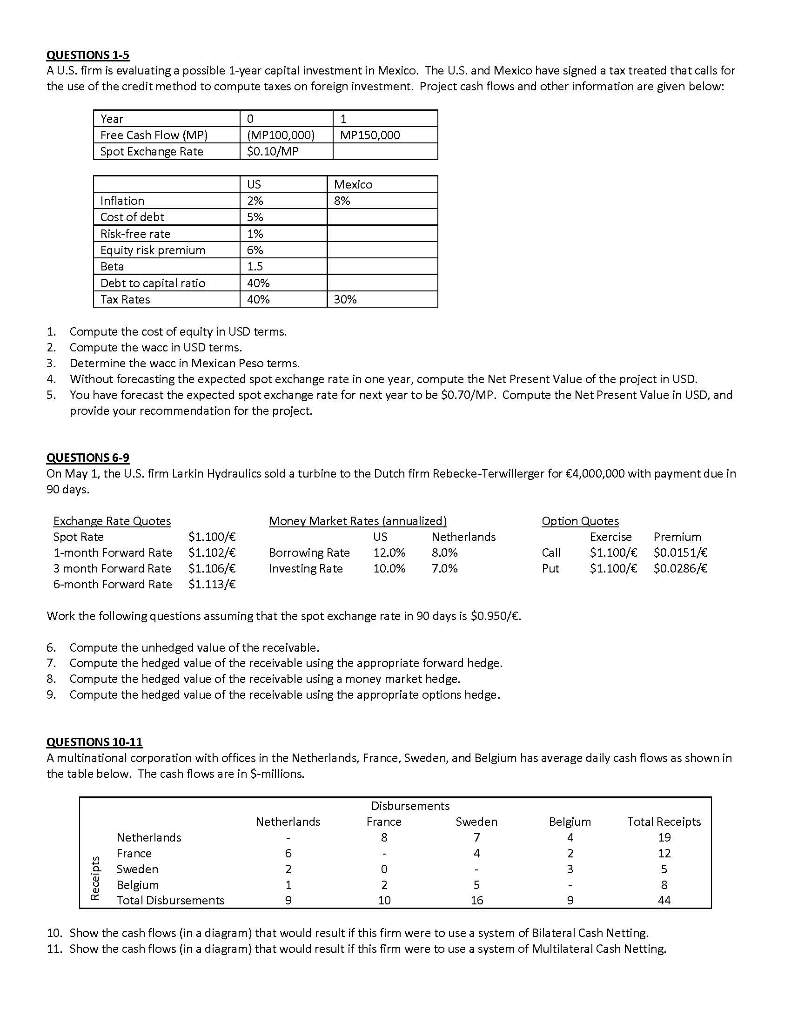

QUESTIONS 1-5 A U.S. firm is evaluating a possible 1-year capital investment in Mexico. The U.S. and Mexico have signed a tax treated that calls for the use of the credit method to compute taxes on foreign investment Project cash flows and other information are given below: Year Free Cash Flow (MP) Spot Exchange Rate 0 (MP100,000) $0.10/MP 1 MP150,000 Mexico 8% US 2% 5% 107 Inflation Cost of debt Risk-free rate Equity risk premium Beta Debt to capital ratio Tax Rates 6% 1.5 40% 40% 30% 1 Compute the cost of equity in USD terms. 2. Compute the wacc in USD terms. 3. Determine the wacc in Mexican Peso terms. 4. Without forecasting the expected spot exchange rate in one year, compute the Net Present Value of the project in USD. 5. You have forecast the expected spot exchange rate for next year to be $0.70/MP. Compute the Net Present Value in USD, and provide your recommendation for the project. QUESTIONS 6-9 On May 1, the U.S. firm Larkin Hydraulics sold a turbine to the Dutch firm Rebecke-Terwillerger for 4,000,000 with payment due in 90 days. Exchange Rate Quotes Spot Rate $1.100/ 1-month Forward Rate $1.102/ 3 month Forward Rate $1.106/ 6-month Forward Rate $1.113/ Money Market Rates (annualized) US Netherlands Borrowing Rate 12.0% 8.0% Investing Rate 10.0% 7.0% Option Quotes Exercise Call $1.100/ Put $1.100/ Premium $0.0151/ $0.0286/ Work the following questions assuming that the spot exchange rate in 90 days is $0.950/. 6. Compute the unhedged value of the receivable. 7. Compute the hedged value of the receivable using the appropriate forward hedge. 8. Compute the hedged value of the receivable using a money market hedge. 9. Compute the hedged value of the receivable using the appropriate options hedge. QUESTIONS 10-11 A multinational corporation with offices in the Netherlands, France, Sweden, and Belgium has average daily cash flows as shown in the table below. The cash flows are in S-millions. Disbursements France Sweden Netherlands 8 7 Belgium 4 2 4 Netherlands France Sweden Belgium Total Disbursements Total Receipts 19 12 5 8 44 6 2 1 9 3 0 2 10 5 16 9 10. Show the cash flows (in a diagram) that would result if this firm were to use a system of Bilateral Cash Netting. 11. Show the cash flows (in a diagram) that would result if this firm were to use a system of Multilateral Cash Netting. QUESTIONS 1-5 A U.S. firm is evaluating a possible 1-year capital investment in Mexico. The U.S. and Mexico have signed a tax treated that calls for the use of the credit method to compute taxes on foreign investment Project cash flows and other information are given below: Year Free Cash Flow (MP) Spot Exchange Rate 0 (MP100,000) $0.10/MP 1 MP150,000 Mexico 8% US 2% 5% 107 Inflation Cost of debt Risk-free rate Equity risk premium Beta Debt to capital ratio Tax Rates 6% 1.5 40% 40% 30% 1 Compute the cost of equity in USD terms. 2. Compute the wacc in USD terms. 3. Determine the wacc in Mexican Peso terms. 4. Without forecasting the expected spot exchange rate in one year, compute the Net Present Value of the project in USD. 5. You have forecast the expected spot exchange rate for next year to be $0.70/MP. Compute the Net Present Value in USD, and provide your recommendation for the project. QUESTIONS 6-9 On May 1, the U.S. firm Larkin Hydraulics sold a turbine to the Dutch firm Rebecke-Terwillerger for 4,000,000 with payment due in 90 days. Exchange Rate Quotes Spot Rate $1.100/ 1-month Forward Rate $1.102/ 3 month Forward Rate $1.106/ 6-month Forward Rate $1.113/ Money Market Rates (annualized) US Netherlands Borrowing Rate 12.0% 8.0% Investing Rate 10.0% 7.0% Option Quotes Exercise Call $1.100/ Put $1.100/ Premium $0.0151/ $0.0286/ Work the following questions assuming that the spot exchange rate in 90 days is $0.950/. 6. Compute the unhedged value of the receivable. 7. Compute the hedged value of the receivable using the appropriate forward hedge. 8. Compute the hedged value of the receivable using a money market hedge. 9. Compute the hedged value of the receivable using the appropriate options hedge. QUESTIONS 10-11 A multinational corporation with offices in the Netherlands, France, Sweden, and Belgium has average daily cash flows as shown in the table below. The cash flows are in S-millions. Disbursements France Sweden Netherlands 8 7 Belgium 4 2 4 Netherlands France Sweden Belgium Total Disbursements Total Receipts 19 12 5 8 44 6 2 1 9 3 0 2 10 5 16 9 10. Show the cash flows (in a diagram) that would result if this firm were to use a system of Bilateral Cash Netting. 11. Show the cash flows (in a diagram) that would result if this firm were to use a system of Multilateral Cash Netting