Answered step by step

Verified Expert Solution

Question

1 Approved Answer

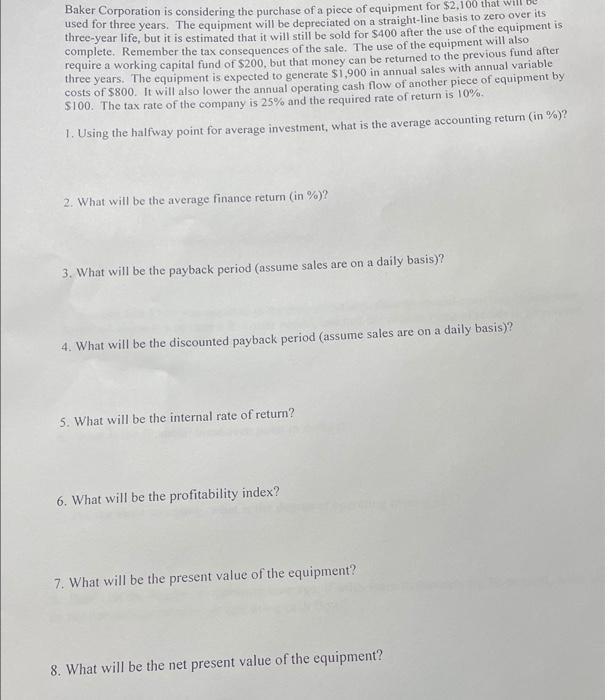

questions 1-8 please put formulas or step by step thankyou! Baker Corporation is considering the purchase of a piece of equipment for $2,100 that used

questions 1-8

Baker Corporation is considering the purchase of a piece of equipment for $2,100 that used for three years. The equipment will be depreciated on a straight-line basis to zero over its three-year life, but it is estimated that it will still be sold for $400 after the use of the equipment is complete. Remember the tax consequences of the sale. The use of the equipment will also require a working capital fund of $200, but that money can be returned to the previous fund after three years. The equipment is expected to generate $1,900 in annual sales with annual variable costs of $800. It will also lower the annual operating cash flow of another piece of equipment by $100. The tax rate of the company is 25% and the required rate of return is 10%. 1. Using the halfway point for average investment, what is the average accounting return (in %)? 2. What will be the average finance return (in %)? 3. What will be the payback period (assume sales are on a daily basis)? 4. What will be the discounted payback period (assume sales are on a daily basis)? 5. What will be the internal rate of return? 6. What will be the profitability index? 7. What will be the present value of the equipment? 8. What will be the net present value of the equipment please put formulas or step by step thankyou!

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started