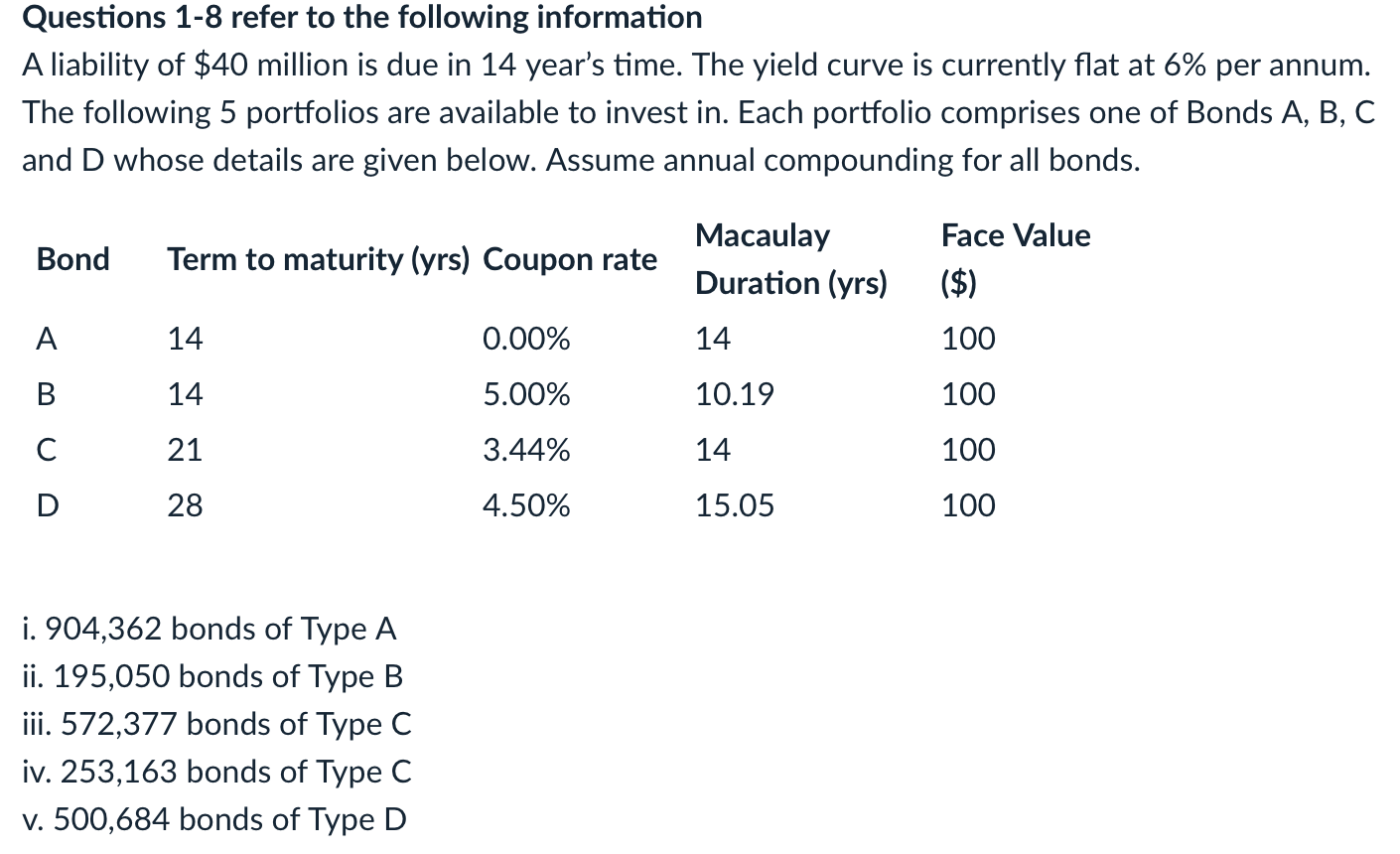

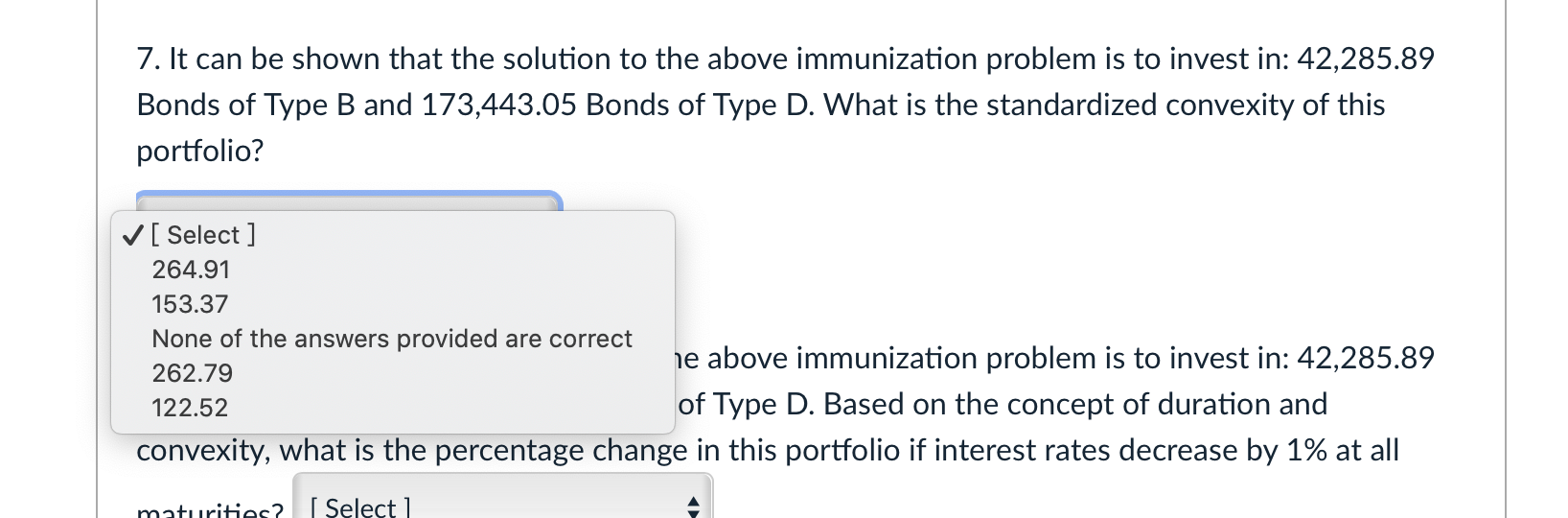

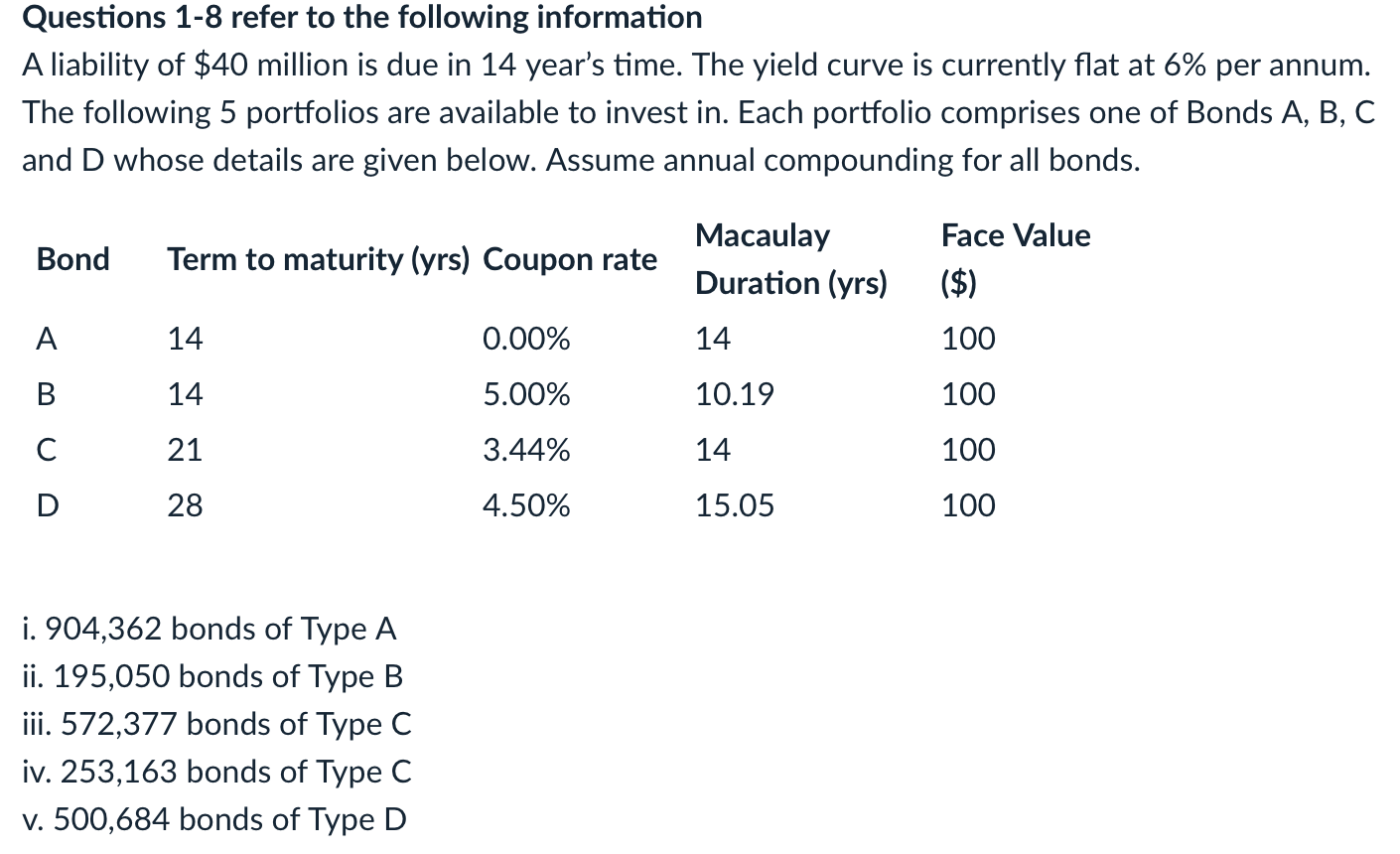

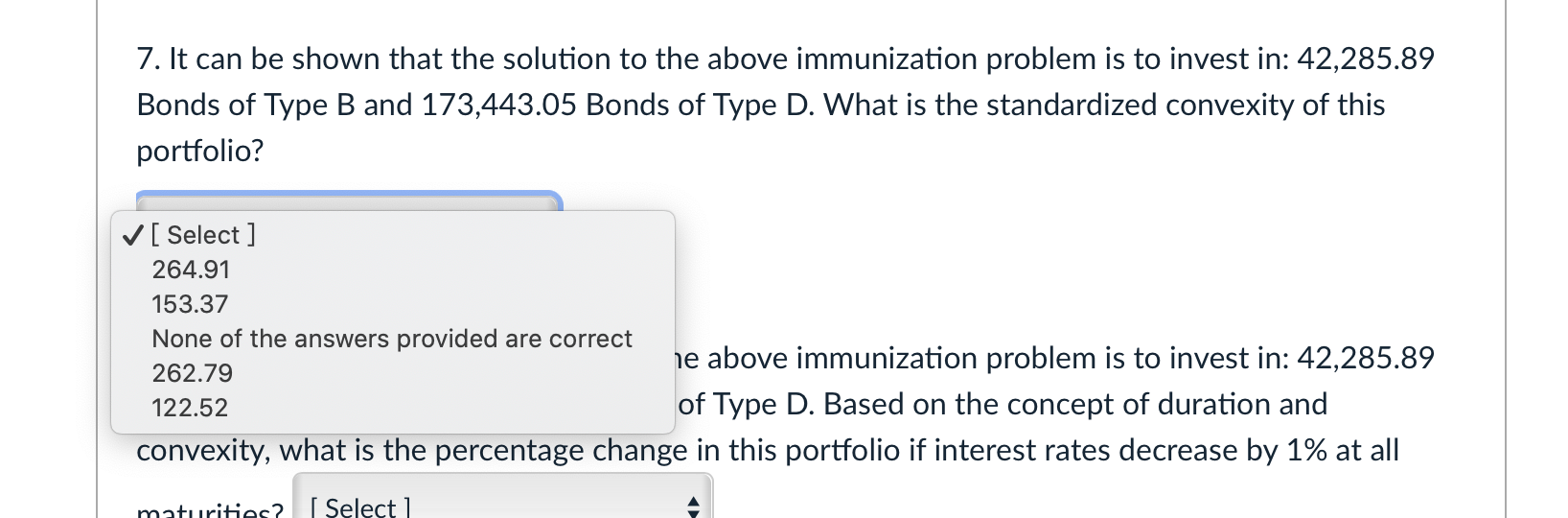

Questions 1-8 refer to the following information A liability of $40 million is due in 14 year's time. The yield curve is currently flat at 6% per annum. The following 5 portfolios are available to invest in. Each portfolio comprises one of Bonds A, B, C and D whose details are given below. Assume annual compounding for all bonds. Bond Term to maturity (yrs) Coupon rate Macaulay Duration (yrs) Face Value ($) A 14 0.00% 14 100 B 14 5.00% 10.19 100 21 3.44% 14 100 D 28 4.50% 15.05 100 i. 904,362 bonds of Type A ii. 195,050 bonds of Type B iii. 572,377 bonds of Type C iv. 253,163 bonds of Type C v. 500,684 bonds of Type D 7. It can be shown that the solution to the above immunization problem is to invest in: 42,285.89 Bonds of Type B and 173,443.05 Bonds of Type D. What is the standardized convexity of this portfolio? [Select ] 264.91 153.37 None of the answers provided are correct 262.79 ne above immunization problem is to invest in: 42,285.89 122.52 of Type D. Based on the concept of duration and convexity, what is the percentage change in this portfolio if interest rates decrease by 1% at all maturities? [ Select) Questions 1-8 refer to the following information A liability of $40 million is due in 14 year's time. The yield curve is currently flat at 6% per annum. The following 5 portfolios are available to invest in. Each portfolio comprises one of Bonds A, B, C and D whose details are given below. Assume annual compounding for all bonds. Bond Term to maturity (yrs) Coupon rate Macaulay Duration (yrs) Face Value ($) A 14 0.00% 14 100 B 14 5.00% 10.19 100 21 3.44% 14 100 D 28 4.50% 15.05 100 i. 904,362 bonds of Type A ii. 195,050 bonds of Type B iii. 572,377 bonds of Type C iv. 253,163 bonds of Type C v. 500,684 bonds of Type D 7. It can be shown that the solution to the above immunization problem is to invest in: 42,285.89 Bonds of Type B and 173,443.05 Bonds of Type D. What is the standardized convexity of this portfolio? [Select ] 264.91 153.37 None of the answers provided are correct 262.79 ne above immunization problem is to invest in: 42,285.89 122.52 of Type D. Based on the concept of duration and convexity, what is the percentage change in this portfolio if interest rates decrease by 1% at all maturities? [ Select)