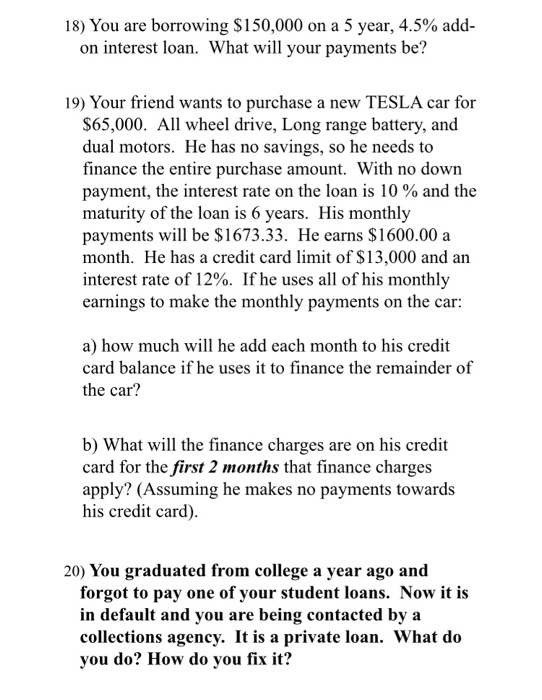

18) You are borrowing $150,000 on a 5 year, 4.5% add- on interest loan. What will your payments be? 19) Your friend wants to purchase a new TESLA car for $65,000. All wheel drive, Long range battery, and dual motors. He has no savings, so he needs to finance the entire purchase amount. With no down payment, the interest rate on the loan is 10 % and the maturity of the loan is 6 years. His monthly payments will be $1673.33. He earns $1600.00 a month. He has a credit card limit of $13,000 and an interest rate of 12%. If he uses all of his monthly earnings to make the monthly payments on the car: a) how much will he add each month to his credit card balance if he uses it to finance the remainder of the car? b) What will the finance charges are on his credit card for the first 2 months that finance charges apply? (Assuming he makes no payments towards his credit card). 20) You graduated from college a year ago and forgot to pay one of your student loans. Now it is in default and you are being contacted by a collections agency. It is a private loan. What do you do? How do you fix it? 18) You are borrowing $150,000 on a 5 year, 4.5% add- on interest loan. What will your payments be? 19) Your friend wants to purchase a new TESLA car for $65,000. All wheel drive, Long range battery, and dual motors. He has no savings, so he needs to finance the entire purchase amount. With no down payment, the interest rate on the loan is 10 % and the maturity of the loan is 6 years. His monthly payments will be $1673.33. He earns $1600.00 a month. He has a credit card limit of $13,000 and an interest rate of 12%. If he uses all of his monthly earnings to make the monthly payments on the car: a) how much will he add each month to his credit card balance if he uses it to finance the remainder of the car? b) What will the finance charges are on his credit card for the first 2 months that finance charges apply? (Assuming he makes no payments towards his credit card). 20) You graduated from college a year ago and forgot to pay one of your student loans. Now it is in default and you are being contacted by a collections agency. It is a private loan. What do you do? How do you fix it