Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Questions 18-21 are based on the following information. Paul and Tina are age 66 and 62 respectfully. They file a joint return. They have

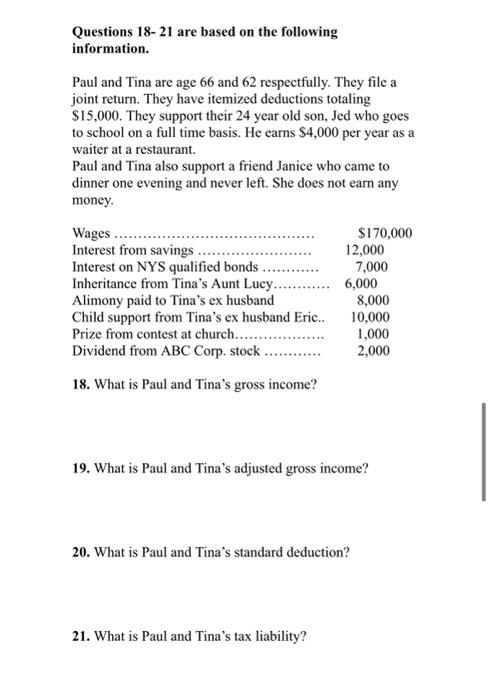

Questions 18-21 are based on the following information. Paul and Tina are age 66 and 62 respectfully. They file a joint return. They have itemized deductions totaling $15,000. They support their 24 year old son, Jed who goes to school on a full time basis. He earns $4,000 per year as a waiter at a restaurant. Paul and Tina also support a friend Janice who came to dinner one evening and never left. She does not earn any money. Wages Interest from savings. Interest on NYS qualified bonds Inheritance from Tina's Aunt Lucy... Alimony paid to Tina's ex husband Child support from Tina's ex husband Eric.. Prize from contest at church..... Dividend from ABC Corp. stock. 18. What is Paul and Tina's gross income? $170,000 12,000 21. What is Paul and Tina's tax liability? 7,000 6,000 20. What is Paul and Tina's standard deduction? 8,000 10,000 1,000 2,000 19. What is Paul and Tina's adjusted gross income?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

SOLUTION Here are the answers to your questions 18 What is Paul and Tinas gross income Paul and Tinas gross income is 170000 which is calculated by ad...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started