Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Questions 2 1 - 2 7 are based on the following information. Time left 1 : 5 3 : 5 3 Three friends, Tom and

Questions are based on the following information.

Time left ::

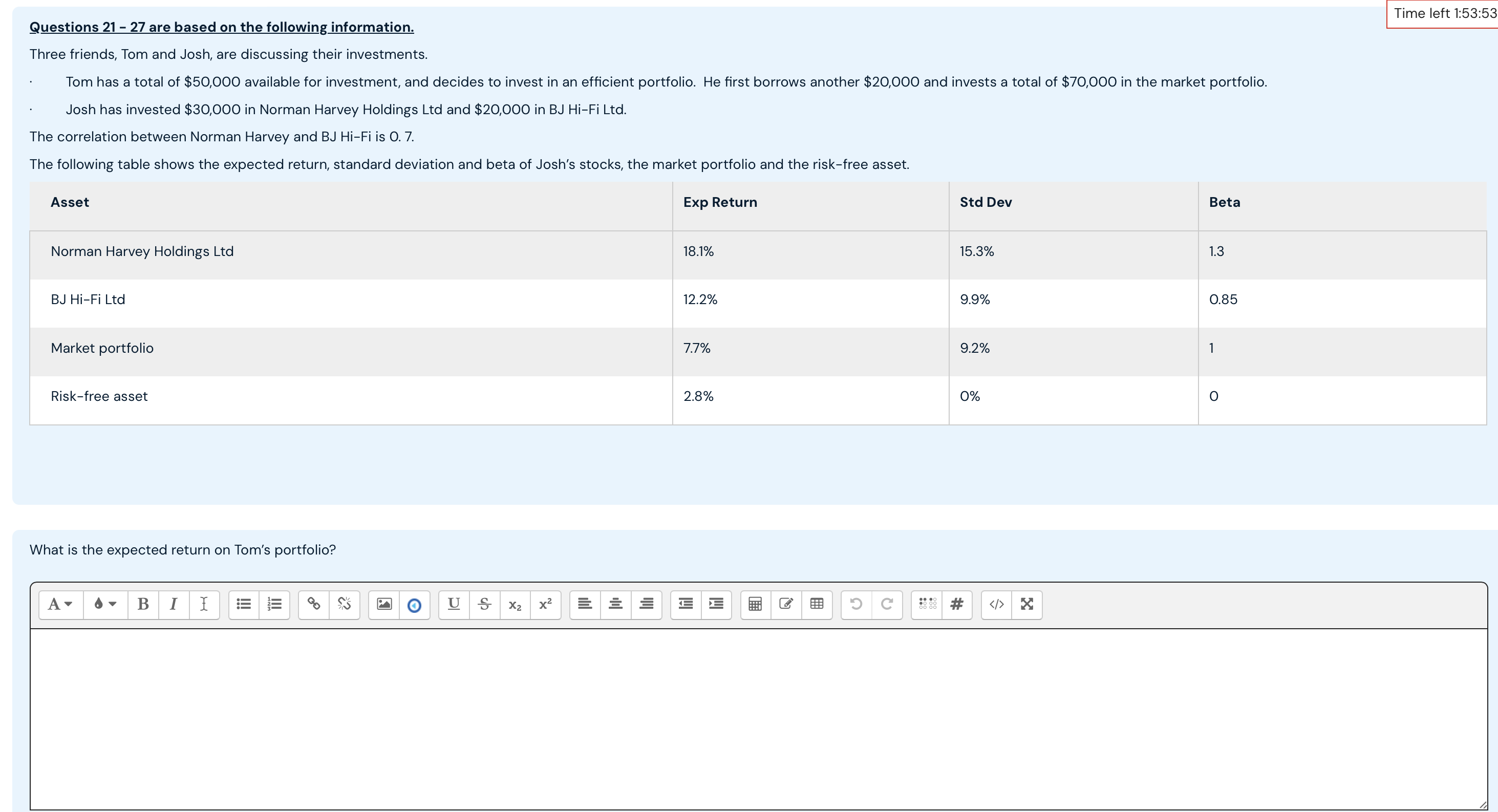

Three friends, Tom and Josh, are discussing their investments.

Tom has a total of $ available for investment, and decides to invest in an efficient portfolio. He first borrows another $ and invests a total of $ in the market portfolio.

Josh has invested $ in Norman Harvey Holdings Ltd and $ in BJ HiFi Ltd

The correlation between Norman Harvey and BJ HiFi is O

The following table shows the expected return, standard deviation and beta of Josh's stocks, the market portfolio and the riskfree asset.

tableAssetExp Return,Std Dev,BetaNorman Harvey Holdings LtdBJ HiFi LtdMarket portfolio,Riskfree asset,O

What is the expected return on Tom's portfolio?

A

B

I

I

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started