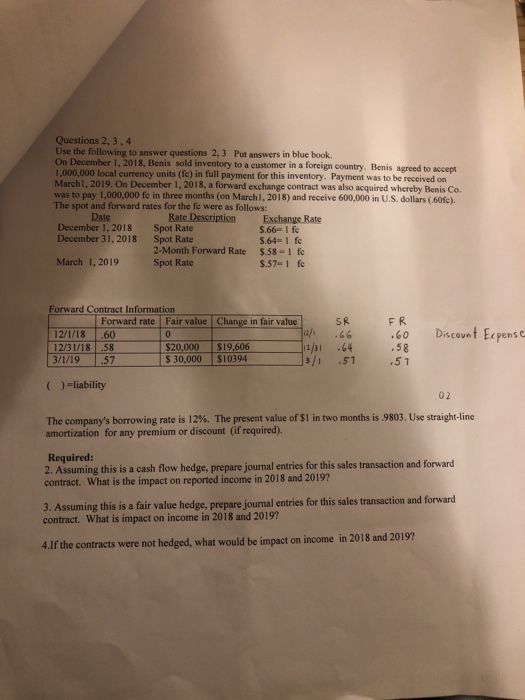

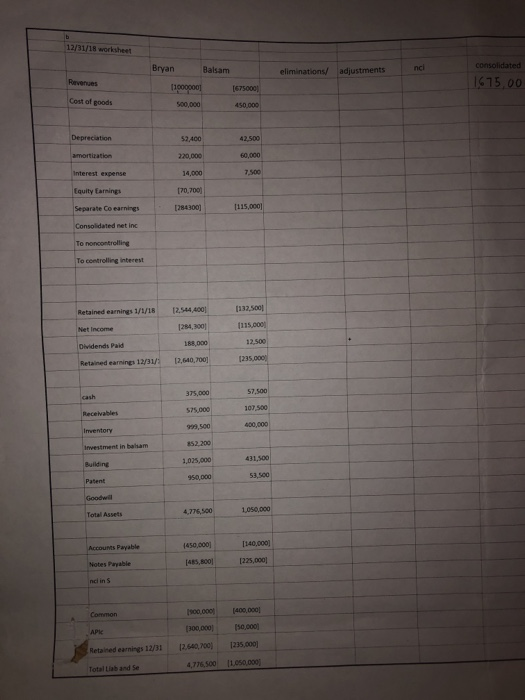

Questions 2, 3.4 Use the following to answer questions 2,3 Put answers in blue book. On December 1, 2018, Benis sold inventory to a customer in a foreign country. Benis agreed to accept 1,000,000 local currency units (fe) in full payment for this inventory. Payment was to be received on March 1, 2019. On December 1, 2018, a forward exchange contract was also acquired whereby Benis Co. was to pay 1,000,000 fe in three months (on March 1, 2018) and receive 600,000 in U.S. dollars (60fc). The spot and forward rates for the fe were as follows: Date Rate Description Exchange Rate December 1, 2018 Spot Rate 5.661 fc December 31, 2018 Spot Rate 5.6451 fc 2-Month Forward Rate S.58 -1 fc March 1, 2019 Spot Rate $.57-1 fc Change in fair value SR Forward Contract Information Forward rate Fair value 12/1/18 . 60 0 12/31/18 . 58 5 20.000 3/1/19 57 S 30,000 FR .60 .58 .57 Discount Expense $19,606 $10394 3/1 51 ( ) =liability 02 The company's borrowing rate is 12%. The present value of $1 in two months is .9803. Use straight-line amortization for any premium or discount (if required). Required: 2. Assuming this is a cash flow hedge, prepare journal entries for this sales transaction and forward contract. What is the impact on reported income in 2018 and 2019? 3. Assuming this is a fair value hedge, prepare journal entries for this sales transaction and forward contract. What is impact on income in 2018 and 2019? 4.If the contracts were not hedged, what would be impact on income in 2018 and 2019? 12/31/15 works Bryan Balsam (1000000 - ellation Revenues dustments consolidate lersoool 1675,0 Cost of goods 450.000 Depreciation 52.400 220.000 60.000 14.000 7500 Courtyaring 170,700 Separate Co earnings 0284300 115.000 Consolidated net inc To controlling interest Retained earning 1/1/18 2,544 400 132.500 1264,300 115 Dividends Paid 18.000 12.500 Retained earnings 12/31 2.640700 125.000 57.100 Receivables 107.500 575.000 tas 400.000 investment in baham Building 10.000 411.500 Patent 51.500 Goodwill Total Arts 500 100.000 1140.000 Notes Payable 1465,800 225.000 moins Common 100.000 400.000 APK 100.000 150.000 Retained earnings 12/31 2.640,700 235,000 Totaltaband se 47100 1.050.000 Questions 2, 3.4 Use the following to answer questions 2,3 Put answers in blue book. On December 1, 2018, Benis sold inventory to a customer in a foreign country. Benis agreed to accept 1,000,000 local currency units (fe) in full payment for this inventory. Payment was to be received on March 1, 2019. On December 1, 2018, a forward exchange contract was also acquired whereby Benis Co. was to pay 1,000,000 fe in three months (on March 1, 2018) and receive 600,000 in U.S. dollars (60fc). The spot and forward rates for the fe were as follows: Date Rate Description Exchange Rate December 1, 2018 Spot Rate 5.661 fc December 31, 2018 Spot Rate 5.6451 fc 2-Month Forward Rate S.58 -1 fc March 1, 2019 Spot Rate $.57-1 fc Change in fair value SR Forward Contract Information Forward rate Fair value 12/1/18 . 60 0 12/31/18 . 58 5 20.000 3/1/19 57 S 30,000 FR .60 .58 .57 Discount Expense $19,606 $10394 3/1 51 ( ) =liability 02 The company's borrowing rate is 12%. The present value of $1 in two months is .9803. Use straight-line amortization for any premium or discount (if required). Required: 2. Assuming this is a cash flow hedge, prepare journal entries for this sales transaction and forward contract. What is the impact on reported income in 2018 and 2019? 3. Assuming this is a fair value hedge, prepare journal entries for this sales transaction and forward contract. What is impact on income in 2018 and 2019? 4.If the contracts were not hedged, what would be impact on income in 2018 and 2019? 12/31/15 works Bryan Balsam (1000000 - ellation Revenues dustments consolidate lersoool 1675,0 Cost of goods 450.000 Depreciation 52.400 220.000 60.000 14.000 7500 Courtyaring 170,700 Separate Co earnings 0284300 115.000 Consolidated net inc To controlling interest Retained earning 1/1/18 2,544 400 132.500 1264,300 115 Dividends Paid 18.000 12.500 Retained earnings 12/31 2.640700 125.000 57.100 Receivables 107.500 575.000 tas 400.000 investment in baham Building 10.000 411.500 Patent 51.500 Goodwill Total Arts 500 100.000 1140.000 Notes Payable 1465,800 225.000 moins Common 100.000 400.000 APK 100.000 150.000 Retained earnings 12/31 2.640,700 235,000 Totaltaband se 47100 1.050.000