questions 2 and 3

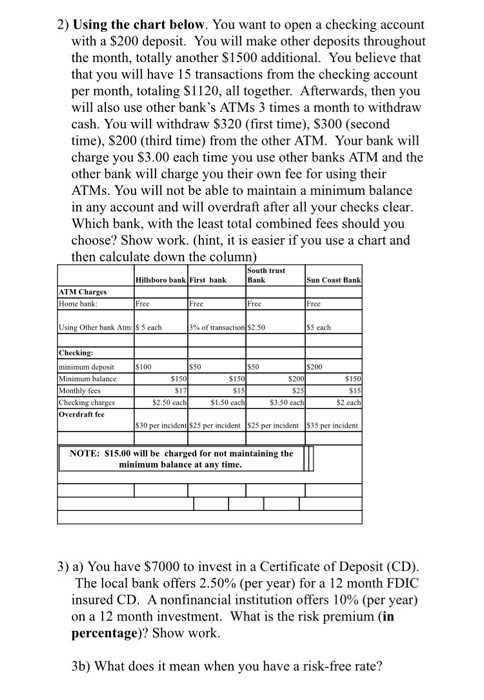

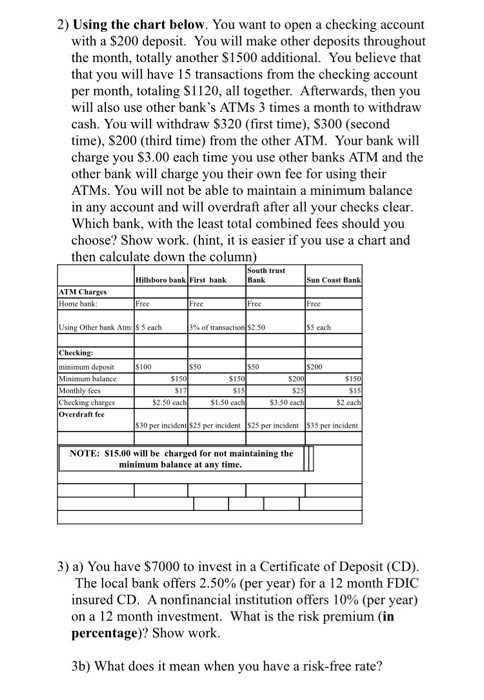

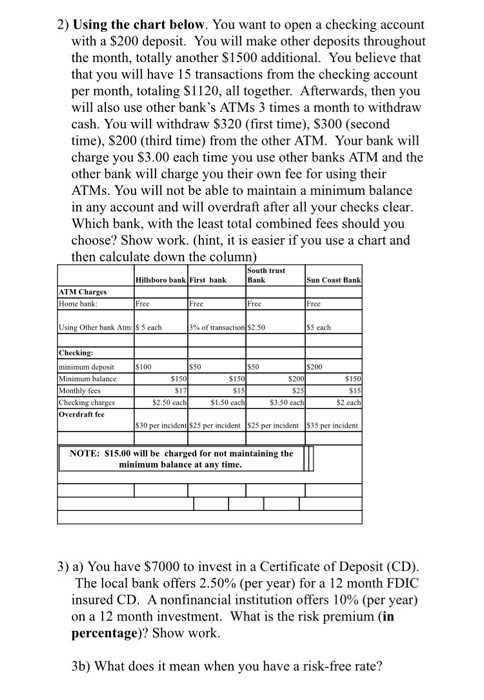

2) Using the chart below. You want to open a checking account with a $200 deposit. You will make other deposits throughout the month, totally another $1500 additional. You believe that that you will have 15 transactions from the checking account per month, totaling S1120, all together. Afterwards, then you will also use other bank's ATMs 3 times a month to withdraw cash. You will withdraw $320 (first time), S300 (second time), S200 (third time) from the other ATM. Your bank will charge you $3.00 each time you use other banks ATM and the other bank will charge you their own fee for using their ATMs. You will not be able to maintain a minimum balance in any account and will overdraft after all your checks clear. Which bank, with the least total combined fees should you choose? Show work. (hint, it is easier if you use a chart and then calculate down the column) South trust Hillsbore bank First bank Bank Sun Coulant ATM Charges Home bank: Free Free Free Free Using Other bank Atmes cach 3% of transaction $2.50 s cach Checkine 200 minimum deposit Minimum balance Monthly fees T Checking charges Overdraft fee $100 Isso SiSC S17 $2.50 cach Isso S IS S200 SISS25 $1.50 each S J. Seach S 150 SIS S 2 each s 30 per incideni 25 incidents per incident 15 per incident NOTE: S15.00 will be charged for not maintaining the minimum balance at any time. 3) a) You have $7000 to invest in a Certificate of Deposit (CD). The local bank offers 2.50% (per year) for a 12 month FDIC insured CD. A nonfinancial institution offers 10% (per year) on a 12 month investment. What is the risk premium in percentage)? Show work. 3b) What does it mean when you have a risk-free rate? 2) Using the chart below. You want to open a checking account with a $200 deposit. You will make other deposits throughout the month, totally another $1500 additional. You believe that that you will have 15 transactions from the checking account per month, totaling S1120, all together. Afterwards, then you will also use other bank's ATMs 3 times a month to withdraw cash. You will withdraw $320 (first time), S300 (second time), S200 (third time) from the other ATM. Your bank will charge you $3.00 each time you use other banks ATM and the other bank will charge you their own fee for using their ATMs. You will not be able to maintain a minimum balance in any account and will overdraft after all your checks clear. Which bank, with the least total combined fees should you choose? Show work. (hint, it is easier if you use a chart and then calculate down the column) South trust Hillsbore bank First bank Bank Sun Coulant ATM Charges Home bank: Free Free Free Free Using Other bank Atmes cach 3% of transaction $2.50 s cach Checkine 200 minimum deposit Minimum balance Monthly fees T Checking charges Overdraft fee $100 Isso SiSC S17 $2.50 cach Isso S IS S200 SISS25 $1.50 each S J. Seach S 150 SIS S 2 each s 30 per incideni 25 incidents per incident 15 per incident NOTE: S15.00 will be charged for not maintaining the minimum balance at any time. 3) a) You have $7000 to invest in a Certificate of Deposit (CD). The local bank offers 2.50% (per year) for a 12 month FDIC insured CD. A nonfinancial institution offers 10% (per year) on a 12 month investment. What is the risk premium in percentage)? Show work. 3b) What does it mean when you have a risk-free rate