Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Questions 2 and 3 Smart Chart Add from Comment Link Baalmark Cross reference Links Header Footer Page Number Text Quick WordArt Box - Parts Text

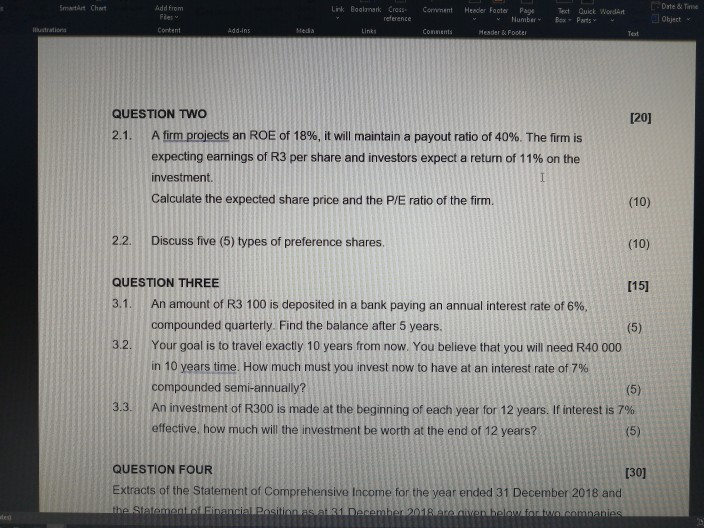

Questions 2 and 3

Smart Chart Add from Comment Link Baalmark Cross reference Links Header Footer Page Number Text Quick WordArt Box - Parts Text Date & Time Object Content Add-ins Media Comments Header & Footer QUESTION TWO [20] 2.1 A firm projects an ROE of 18%, it will maintain a payout ratio of 40%. The firm is expecting earnings of R3 per share and investors expect a return of 11% on the investment. Calculate the expected share price and the P/E ratio of the firm, I (10) 2.2. Discuss five (5) types of preference shares (10) QUESTION THREE [15] 3.1. An amount of R3 100 is deposited in a bank paying an annual interest rate of 6% compounded quarterly. Find the balance after 5 years. (5) 3.2. Your goal is to travel exactly 10 years from now. You believe that you will need R40 000 in 10 years time. How much must you invest now to have at an interest rate of 7% compounded semi-annually? (5) 3.3 An investment of R300 is made at the beginning of each year for 12 years. If interest is 7% effective, how much will the investment be worth at the end of 12 years? (5) QUESTION FOUR [30] Extracts of the Statement of Comprehensive Income for the year ended 31 December 2018 and the Statement of Financial Position as a 1. December 2018 von below for two comaniesStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started