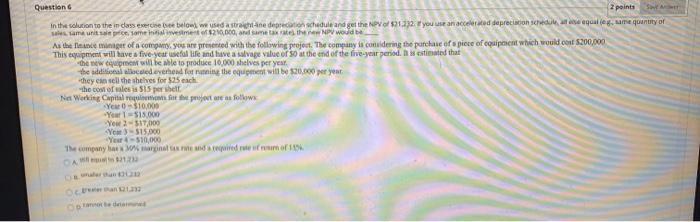

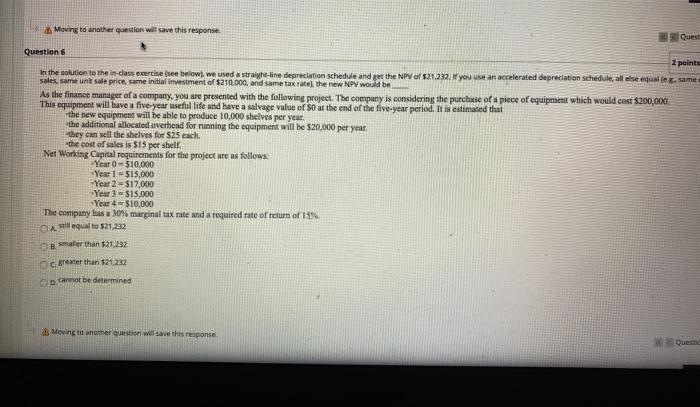

Questions 2 points in the solution to the incasserell we used a strane depreciation schedule and get the NPV1.132. you use an accelerated depreciation schedule, e quantity of sam unitamente 20,000 ansamerate the NPV would As the inte mingit of a commity, you are presented with the following project. The company is considering the purchase of a piece of equipment which would cost $200,000 This will have a five-year flife and have a salvage value of so at the end of the five-year period estimated that the new equipment will be able to produce 10,000 shelves per year. the additional sceled extrhood for putting the equatent will be $20.000 per year they can sell the shelves for 525 each the cost of sales is 515 per helt Ne Working Capital of the follow You $10,000 -You 115.000 You 2-517.000 Y-315.000 - 510,000 The company at Marina divendres of A be Moving to another question will save this response Ques Question 6 2 points In the solution to the in-class exercise (see below, we used a straight-line depreciation schedule and get the NPV of $21.232. you use an accelerated depreciation schedule, allelse equalle, same sales, same unt sale price, same initial investment of $210.000, and same tax rate the new NPV would be As the finance manager of a company, you are presented with the following project. The company is considering the purchase of a piece of equipment which would cost $200,000 This equipment will have a five-year useful life and have a salvage value of so at the end of the five-year period. It is estimated that the new equipment will be able to produce 10,000 shelves per year. the additional allocated overhead for running the equipment will be $20,000 per year. they can sell the shelves for 525 each. the cost of sales is 315 per shell Net Working Capital requirements for the project are as follows: -Year 0 - $10,000 Year 1-$15,000 Year 2-$17,000 Year 3-S15,000 *Year 4510,000 The company has a 30% marginal tax rate and a required rate of return of 15% A Mill equal to $21.232 mater than 521232 greater than 121222 Carnot be determined Moving to another question will save this response. Quest Questions 2 points in the solution to the incasserell we used a strane depreciation schedule and get the NPV1.132. you use an accelerated depreciation schedule, e quantity of sam unitamente 20,000 ansamerate the NPV would As the inte mingit of a commity, you are presented with the following project. The company is considering the purchase of a piece of equipment which would cost $200,000 This will have a five-year flife and have a salvage value of so at the end of the five-year period estimated that the new equipment will be able to produce 10,000 shelves per year. the additional sceled extrhood for putting the equatent will be $20.000 per year they can sell the shelves for 525 each the cost of sales is 515 per helt Ne Working Capital of the follow You $10,000 -You 115.000 You 2-517.000 Y-315.000 - 510,000 The company at Marina divendres of A be Moving to another question will save this response Ques Question 6 2 points In the solution to the in-class exercise (see below, we used a straight-line depreciation schedule and get the NPV of $21.232. you use an accelerated depreciation schedule, allelse equalle, same sales, same unt sale price, same initial investment of $210.000, and same tax rate the new NPV would be As the finance manager of a company, you are presented with the following project. The company is considering the purchase of a piece of equipment which would cost $200,000 This equipment will have a five-year useful life and have a salvage value of so at the end of the five-year period. It is estimated that the new equipment will be able to produce 10,000 shelves per year. the additional allocated overhead for running the equipment will be $20,000 per year. they can sell the shelves for 525 each. the cost of sales is 315 per shell Net Working Capital requirements for the project are as follows: -Year 0 - $10,000 Year 1-$15,000 Year 2-$17,000 Year 3-S15,000 *Year 4510,000 The company has a 30% marginal tax rate and a required rate of return of 15% A Mill equal to $21.232 mater than 521232 greater than 121222 Carnot be determined Moving to another question will save this response. Quest