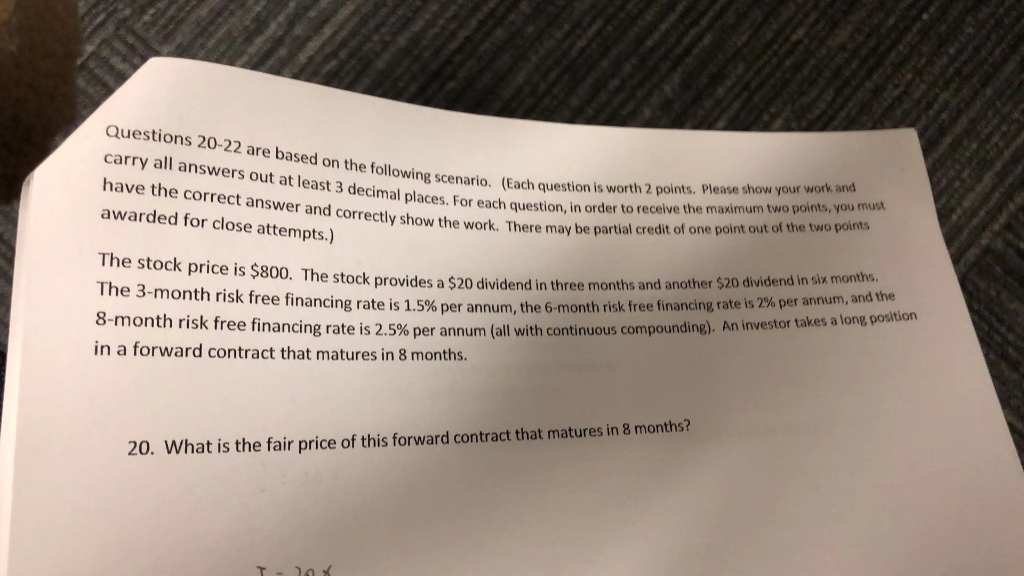

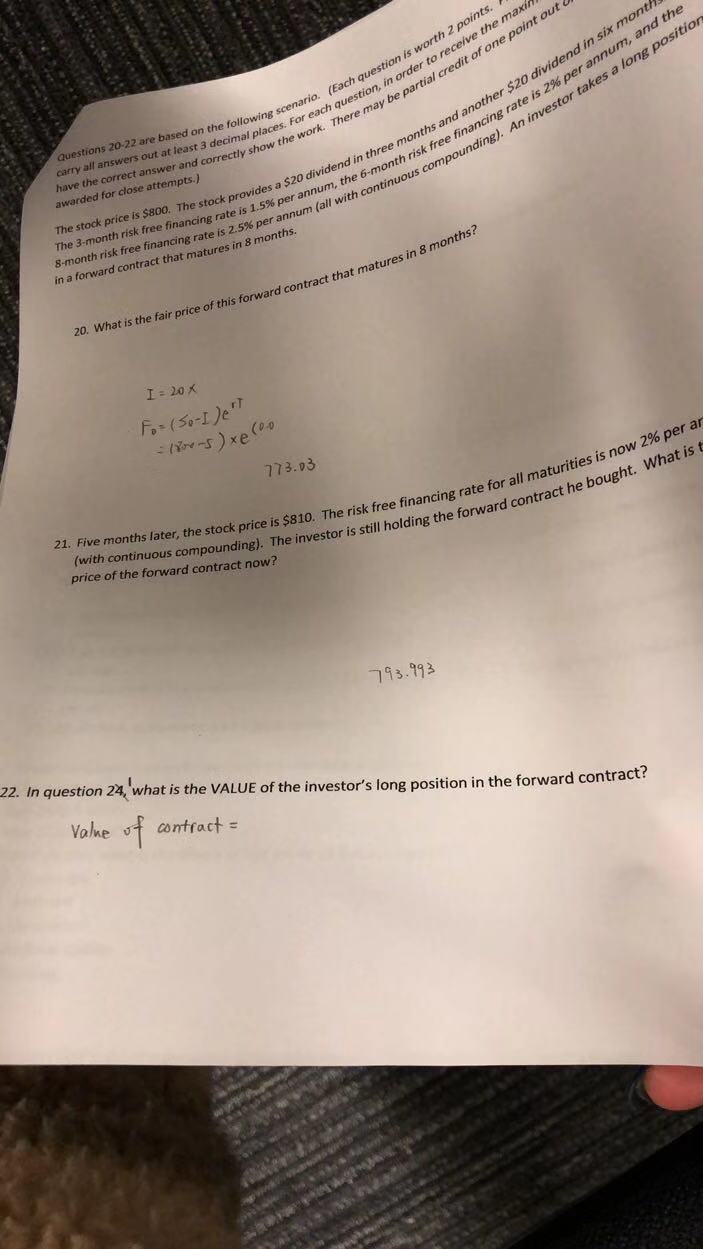

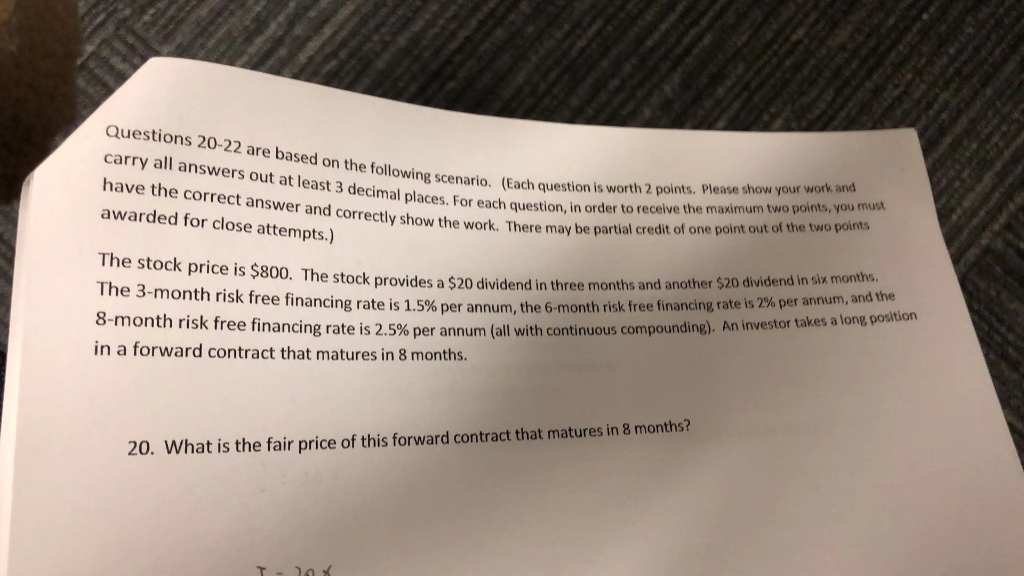

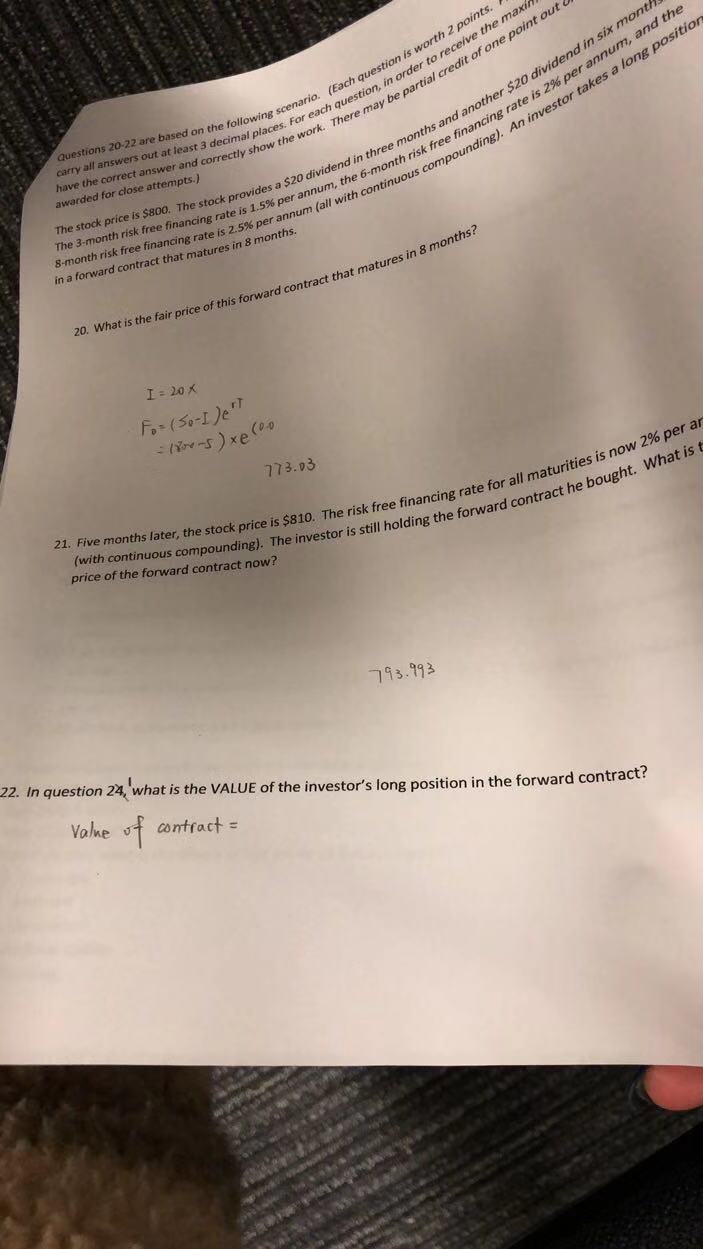

Questions 20-22 are based on the following scenario. (Each ques carry all answers out at least 3 decimal places. For each quer have the correct answer and correctly show the work. There awarded for close attempts.) 10. Each question is worth 2 points. Please show your work and ces. For each question, in order to receive the maximum two points, you must e work. There may be partial credit of one point out of the two points The stock price is $800. The stock provides a $20 dividend in three months The 3-month risk free financing rate is 1.5% per annum, the 6-m 8-month risk free financing rate is 2.5% per annum (all with continuous compound in a forward contract that matures in 8 months. end in three months and another $20 dividend in six months. um, the 6-month risk free financing rate is 2% per annum, and the with continuous compounding). An investor takes a long position 20. What is the fair price of this forward contract that matures in 8 months? T-7X scenario. (Each question is worth 2 points. ach question, in order to receive the maxin ere may be partial credit of one point out U and another $20 dividend in six month. nisk free financing rate is 2% per annum, and the ding). An investor takes a long position S20 dividend in three months and another per annum, the 6-month risk free fina Questions 20-22 are based on the following sce carry all answers out at least 3 decimal places." have the correct answer and correctly show the awarded for close attempts.) The stock price is $800. The stock provides a $200 The 3-month risk free financing rate is 1.5% per annum, 8-month risk free financing rate is 2.5% per annum (all in a forward contract that matures in 8 months. nat matures in 8 months? 20. What is the fair price of this forward contract that matures in 8 I = 20 For (50-1 et xe - ( - 773.03 cing rate for all maturities is now 2% per ar contract he bought. What is t The investor is still holding the forward contract he boug Hive months later, the stock price is $810. The risk free financing rate (with continuous compounding). The investor is still price of the forward contract now? 793.993 22. In question 24, what is the VALUE of the investor's long position in the forward contract? value of contract = Questions 20-22 are based on the following scenario. (Each ques carry all answers out at least 3 decimal places. For each quer have the correct answer and correctly show the work. There awarded for close attempts.) 10. Each question is worth 2 points. Please show your work and ces. For each question, in order to receive the maximum two points, you must e work. There may be partial credit of one point out of the two points The stock price is $800. The stock provides a $20 dividend in three months The 3-month risk free financing rate is 1.5% per annum, the 6-m 8-month risk free financing rate is 2.5% per annum (all with continuous compound in a forward contract that matures in 8 months. end in three months and another $20 dividend in six months. um, the 6-month risk free financing rate is 2% per annum, and the with continuous compounding). An investor takes a long position 20. What is the fair price of this forward contract that matures in 8 months? T-7X Questions 20-22 are based on the following scenario. (Each ques carry all answers out at least 3 decimal places. For each quer have the correct answer and correctly show the work. There awarded for close attempts.) 10. Each question is worth 2 points. Please show your work and ces. For each question, in order to receive the maximum two points, you must e work. There may be partial credit of one point out of the two points The stock price is $800. The stock provides a $20 dividend in three months The 3-month risk free financing rate is 1.5% per annum, the 6-m 8-month risk free financing rate is 2.5% per annum (all with continuous compound in a forward contract that matures in 8 months. end in three months and another $20 dividend in six months. um, the 6-month risk free financing rate is 2% per annum, and the with continuous compounding). An investor takes a long position 20. What is the fair price of this forward contract that matures in 8 months? T-7X