Answered step by step

Verified Expert Solution

Question

1 Approved Answer

questions 20-24 WORKED out please!! Please answer the next 5 questions based on the following information. Please use the exact, not the approximate formula. Suppose

questions 20-24 WORKED out please!!

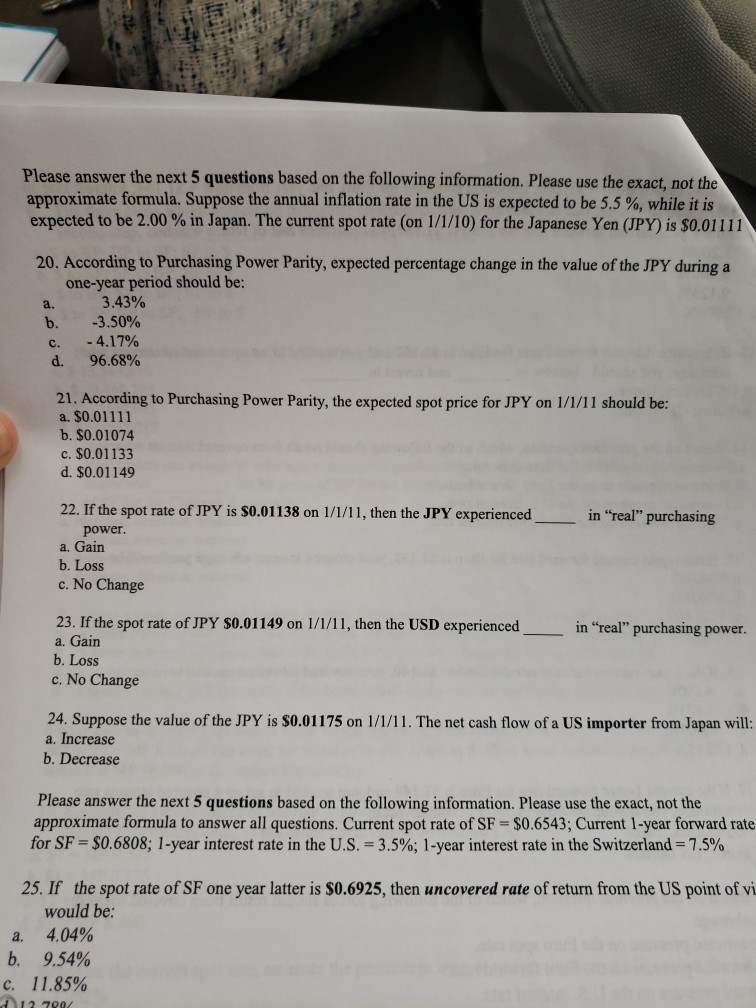

Please answer the next 5 questions based on the following information. Please use the exact, not the approximate formula. Suppose the annual inflation rate in the US is expected to be 5.5 %, while it is expected to be 2.00 % in Japan. The current spot rate (on 1/1/10) for the Japanese Yen (JPY) is $0.01 111 20. According to Purchasing Power Parity, expected percentage change in the value of the JPY during a one-year period should be: 3.43% -3.50% -4.17% 96.68% a. b. c. d. 21. According to Purchasing Power Parity, the expected spot price for JPY on 1/1/11 should be: a. $0.01111 b. $0.01074 c. $0.01133 d. $0.01149 22. If the spot rate of JPY is s0.01138 on 1/1/11, then the JPY experienced in "real" purchasing power. a. Gain b. Loss c. No Change 23. If the spot rate of JPY $0.01 149 on l/1/11, then the USD experienced in "real" purchasing power. a. Gain b. Loss c. No Change 24. Suppose the value of the JPY is S0.01175 on 1/1/11. The net cash flow of a US importer from Japan will: a. Increase b. Decrease Please answer the next 5 questions based on the following information. Please use the exact, not the approximate formula to answer all questions. Current spot rate of SF $0.6543; Current 1-year forward rate for SF-30 6808; 1-year interest rate in the US.-3.5%; 1-year interest rate in the Switzerland 75% 25. If the spot rate of SF one year latter is S0.6925, then uncovered rate of return from the US point of vi a. 4.04% C. 11.85% would be: 9.54% 13 790Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started