Answered step by step

Verified Expert Solution

Question

1 Approved Answer

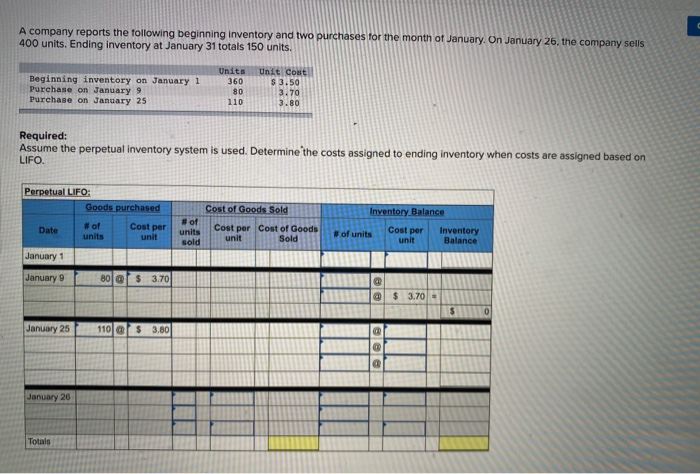

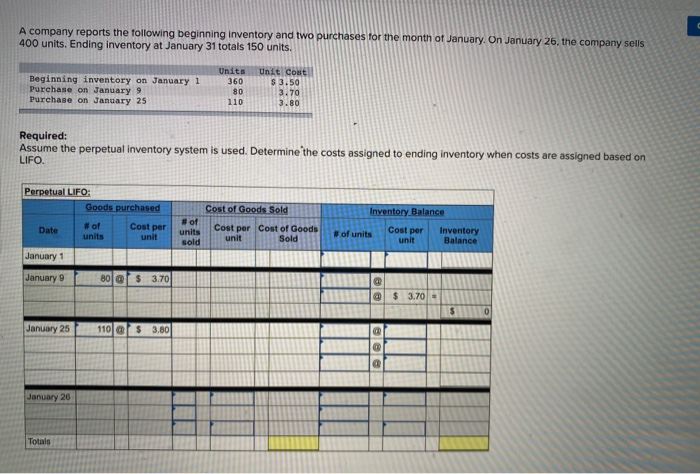

questions 2-10 and the parts questions 3 A company reports the following beginning inventory and two purchases for the month of January. On January 26.

questions 2-10 and the parts

questions 3

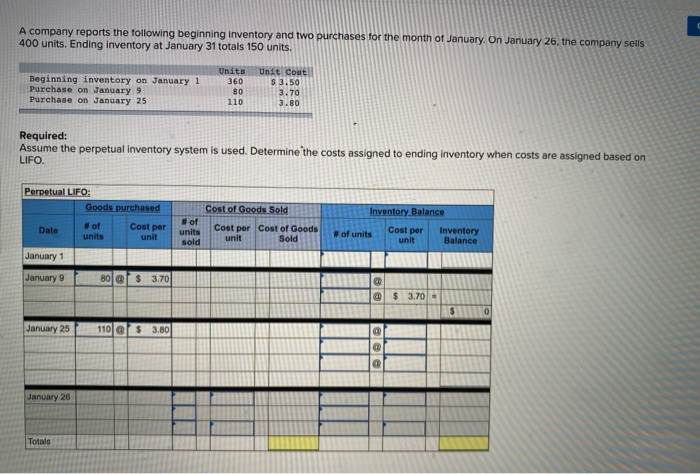

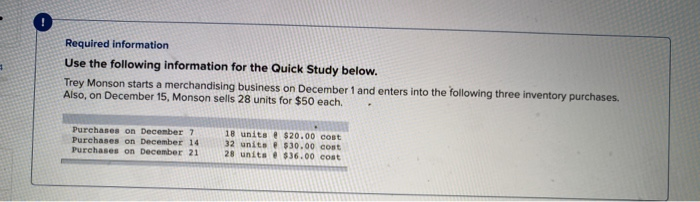

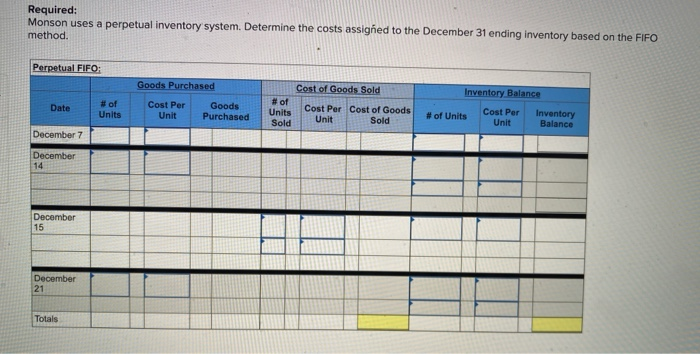

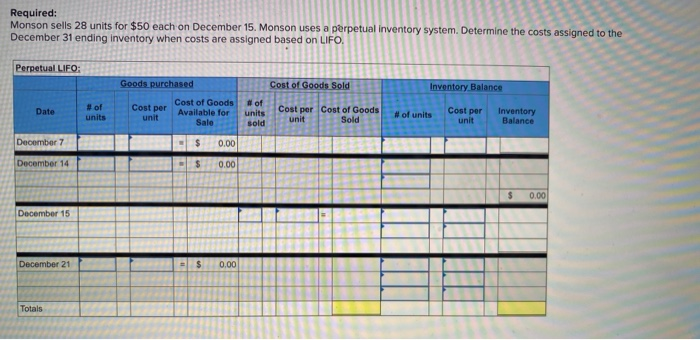

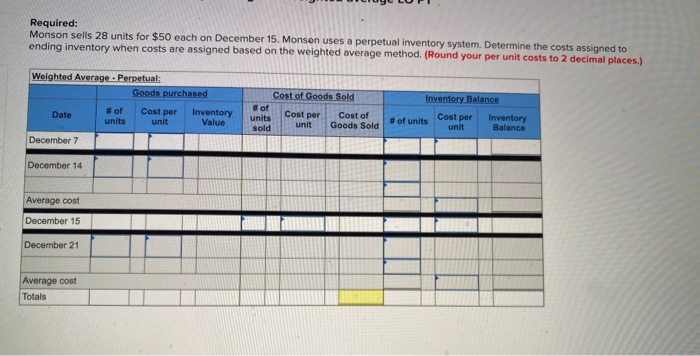

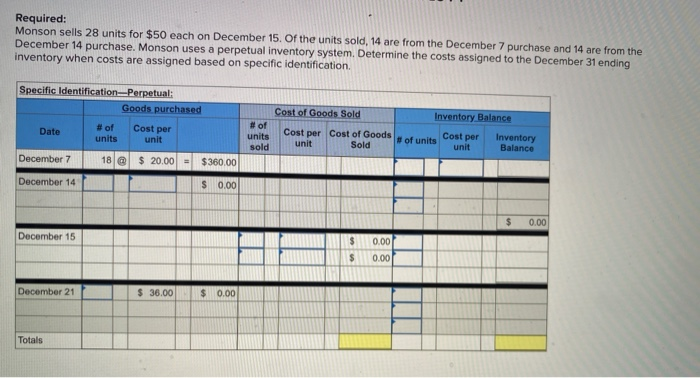

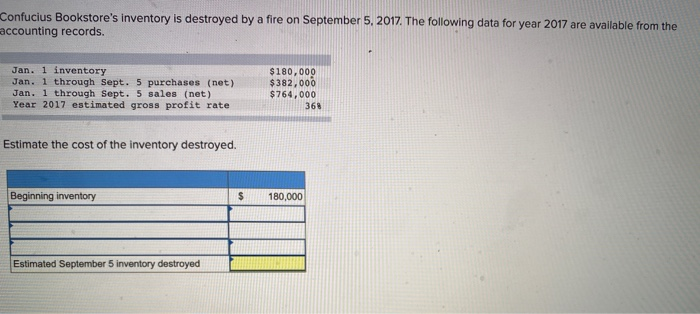

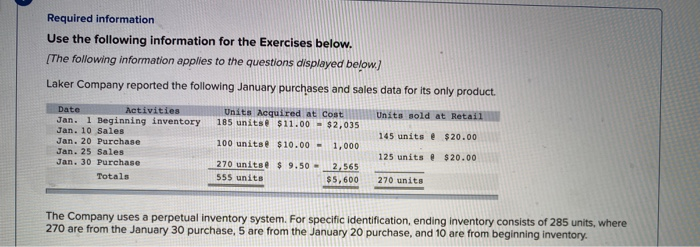

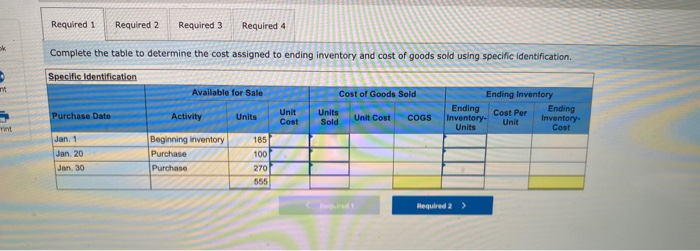

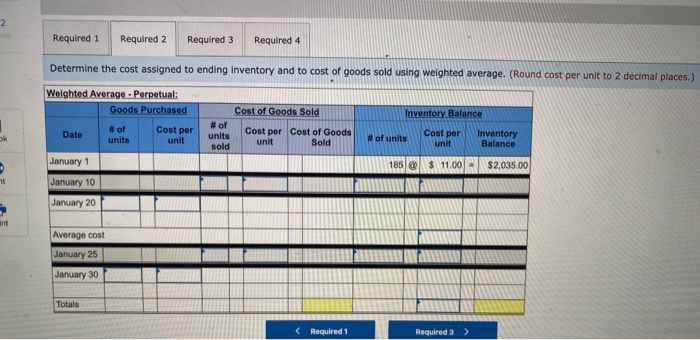

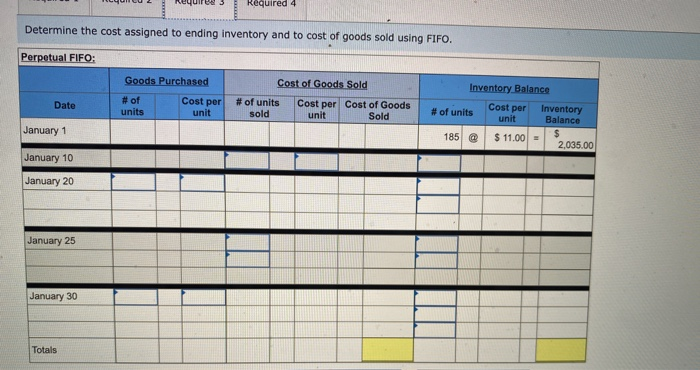

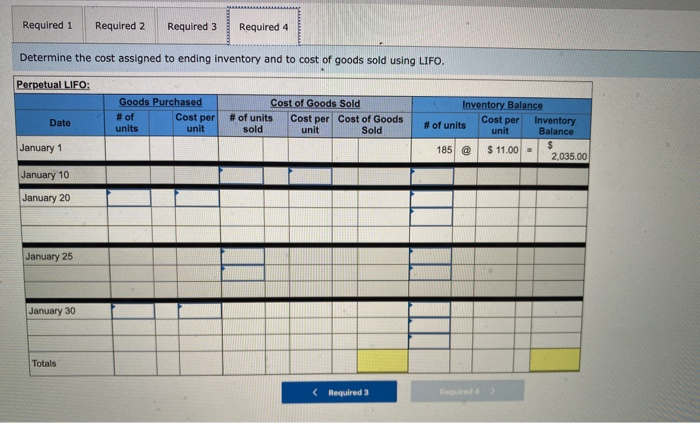

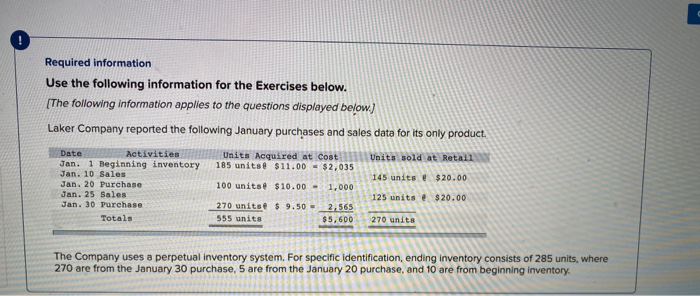

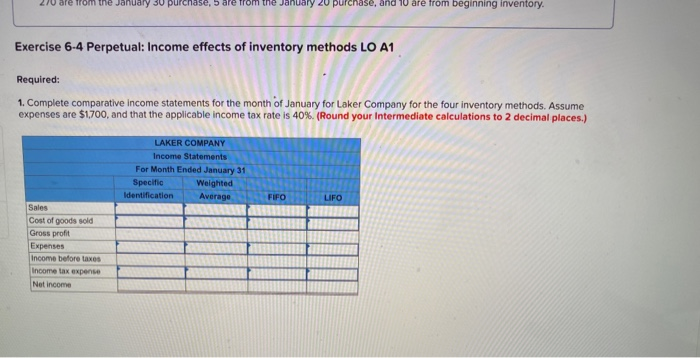

A company reports the following beginning inventory and two purchases for the month of January. On January 26. the company sells 400 units. Ending inventory at January 31 totals 150 units. Beginning inventory on January 1 Purchase on January 9 Purchase on January 25 Unit 360 80 110 Unit Cout $3.50 3.70 Required: Assume the perpetual inventory system is used. Determine the costs assigned to ending inventory when costs are assigned based on LIFO. Perpetual LIFO: Goods purchased Cost of Goods Sold Inventory Balance Cost per Inventory of Date of Cost per cost of goods Cost per unit units sold unit of units Sold unit Balance January 1 January 9 | 80 @ $ 3.70 January 25 1 10 @ 3.80 January 26 Totals Required information Use the following information for the Quick Study below. Trey Monson starts a merchandising business on December 1 and enters into the following three inventory purchases. Also, on December 15, Monson sells 28 units for $50 each Purchases on December 7 Purchases on December 14 Purchases on December 21 18 units @ $20.00 cont 3 2 units $30.00 cost 28 units $36.00 cost Required: Monson uses a perpetual inventory system. Determine the costs assigned to the December 31 ending inventory based on the FIFO method. Perpetual FIFO: Goods Purchased Inventory Balance # of Units Date Cost Per Unit Cost of Goods Sold of Toit Cost Per Cost of Goods Unit Sold Goods Purchased a ltCost Per Unit Inventory Balance December 7 December December December Totals Required: Monson sells 28 units for $50 each on December 15. Monson uses a perpetual inventory system. Determine the costs assigned to the December 31 ending inventory when costs are assigned based on LIFO. Perpetual LIFO: Goods purchased Cost of Goods Sold Inventory Balance Date of Cost per e Cost of Goods Available for #of units Cost per Cost of Goods Unit Sold units #of units Cost per unit Inventory Balance Sale sold December 7 - $ 0.00 0.00 December 14 $ $ 0.00 December 15 TTTTTTTT TUTTI TIL December 21 Totals Required: Monson sells 28 units for $50 each on December 15. Monson uses a perpetual inventory system. Determine the costs assigned to ending inventory when costs are assigned based on the weighted average method. (Round your per unit costs to 2 decimal places.) Weighted Average - Perpetual: Goods purchased # of Cost per Date Inventory y units unit Value Cost of Goods Sold of unit Cost per Cost of sold unit Goods Sold Inventory Balance #of units cost per Inventory unit Balance December 7 December 14 Average cost December 15 December 21 Average cost Totals Required: Monson sells 28 units for $50 each on December 15. Of the units sold, 14 are from the December 7 purchase and 14 are from the December 14 purchase. Monson uses a perpetual inventory system. Determine the costs assigned to the December 31 ending inventory when costs are assigned based on specific identification. Cost of Goods Sold Specific Identification Perpetual: Goods purchased Date # of Cost per units unit December 7 18 @ $ 20.00 = $360,00 # of units sold Cost per Cost of Goods unit Sold Inventory Balance of unite Cost per Inventory unit Balance December 14 $ 0.00 December 15 0.001 0.001 December 21 $ 36.00 $ 0.00 Totals Confucius Bookstore's Inventory is destroyed by a fire on September 5, 2017. The following data for year 2017 are available from the accounting records. Jan. 1 inventory Jan. 1 through Sept. 5 purchases (net) Jan. 1 through Sept. 5 sales (net) Year 2017 estimated gross profit rate $180,000 $382,000 $764,000 368 Estimate the cost of the inventory destroyed Beginning inventory 180,000 Estimated September 5 inventory destroyed Required information Use the following information for the Exercises below. (The following information applies to the questions displayed below) Laker Company reported the following January purchases and sales data for its only product. Units sold at Retail Units Aequired at Cost 185 unitse $11.00 - $2,035 145 units $20.00 Date Activities Jan. 1 Beginning inventory Jan. 10 Sales Jan. 20 Purchase Jan. 25 Sales Jan. 30 Purchase Totals 100 unitse $10.00 - 1,000 125 units $20.00 270 unitse $ 9.50 - 555 units 2,565 $5,600 270 units The Company uses a perpetual inventory system. For specific identification, ending Inventory consists of 285 units, where 270 are from the January 30 purchase, 5 are from the January 20 purchase, and 10 are from beginning inventory. Required 1 Required 2 Required 3 Required 4 Complete the table to determine the cost assigned to ending inventory and cost of goods sold using specific identification. Specific Identification Available for Sale Cost of Goods Sold Ending Inventory Ending Cost Per Ending Inventory. Wale Inventory Units Cost Purchase Date Activity Unit Cost Units Units Sold Cost COGS on Jan. 1 Jan 20 Beginning inventory Purchase Purchase 185 1001 270 Jan. 30 566 Required 1 Required 2 Required 3 Required 4 Determine the cost assigned to ending inventory and to cost of goods sold using weighted average. (Round cost per unit to 2 decimal places.) Weighted Average - Perpetual: Goods Purchased # of Date Cost per units unit Inventory Balance w of units sold Cost of Goods Sold com Cost per Cost of Goods unit Sold # of units cost per unit Inventory Balance January 1 185 @ $ 11.00 - $2,035.00 January 10 January 20 Average cost January 25 January 30 Totals reyr kequired 4 Determine the cost assigned to ending inventory and to cost of goods sold using FIFO. Perpetual FIFO: Cost of Goods Sold Goods Purchased # of Cost per units unit Date # of units sold Cost per Cost of Goods unit Sold Inventory Balance of units Cost per cost per Inventory unit Balance 185 @ $11.00 - 12.035.00 January 1 January 10 January 20 January 25 January 30 Totals Required 1 Required 2 Required 3 Required 4 Determine the cost assigned to ending inventory and to cost of goods sold using LIFO. Perpetual LIFO: Goods Purchased # of Cost per units unit Cost of Goods Sold # of units Cost per Cost of Goods sold unit Sold Date Inventory Balance Cost per Inventory # of units unit Balance 185 @ $ 11.00 - 2,035.00 January 1 January 10 January 20 January 25 January 30 Totals

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started