Questions 2-12 refer to Question 1. Please hell solve all

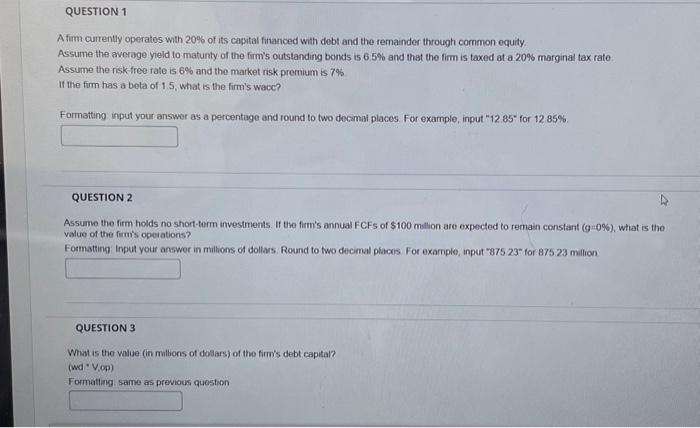

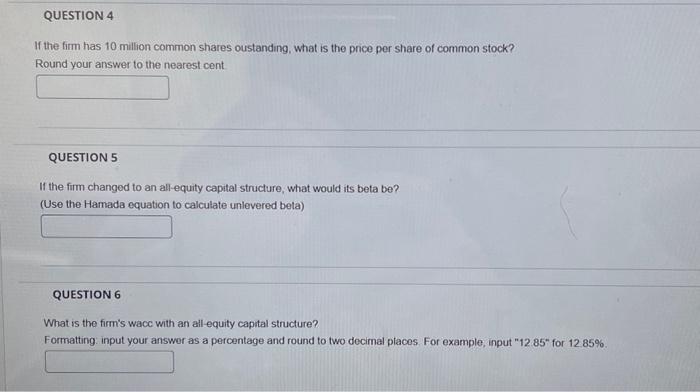

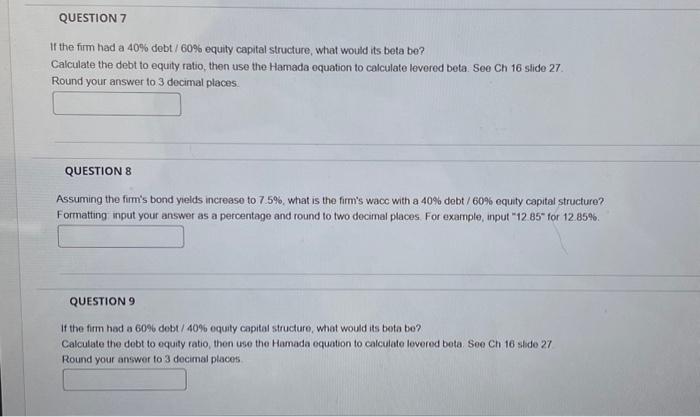

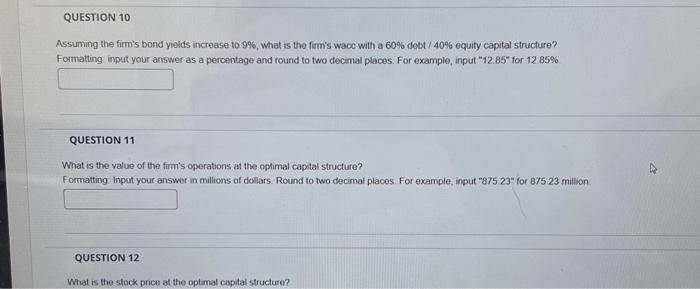

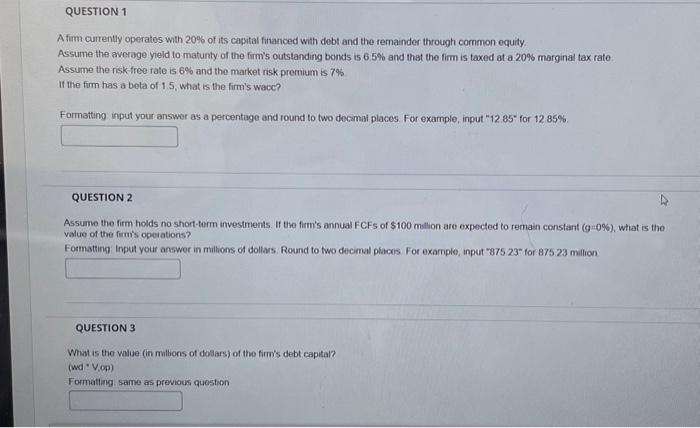

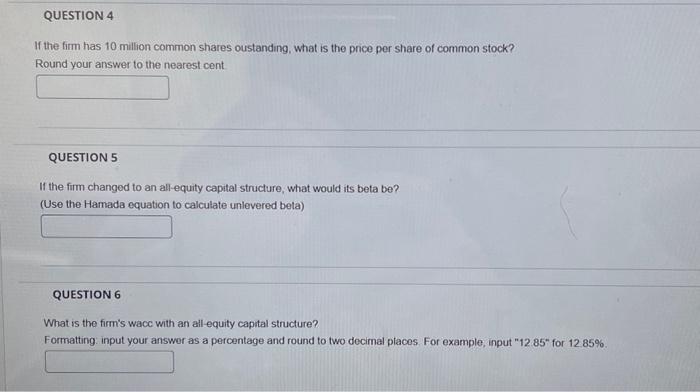

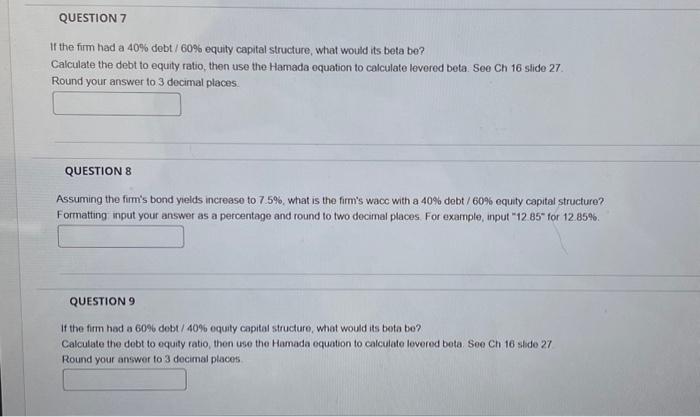

A firm currently operates with 20% of its capital financed with debt and the remainder through common equity. Assume the averoge yield to matunty of the firm's outstanding bonds is 6.5% and that the firm is taxed at a 20% marginal tax rate. Assume the risk-free rate is 6% and the market risk premium is 7% If the firm has a beta of 1.5 , what is the firm's wacc? Formatting input your answer as a percentage and round to two docimil places. For example, input " 12.85 for 1285%. QUESTION 2 Assume the firm holds no short-term investments. If the firm's annual F CFs of $100 mallion are expected to remain constant (g=0%), what is the value of the firmis operations? Formatting Input your answor in milions of dollass. Round to fwo decimal places For example, input "875 23" for 875.23 miltion QUESTION 3 What is the walue (in miltions of doliars) of the firm's debt capital? (nd*V,op) Formatting same as previous question If the firm has 10 million common shares oustanding, what is the price per share of common stock? Round your answer to the nearest cent QUESTION 5 If the firm changed to an all-equity capital structure, what would its beta be? (Use the Hamada equation to calculate unlevered beta) QUESTION 6 What is the firm's wacc with an all equity capital structure? Formatting. input your answer as a percentage and round to two decirnal places. For example, input "12 85" for 12.85%. If the firm had a 40% dobt /60% equity capital structure, what would its beta be? Calculate the debt to equity ratio, then use the Hamada oquation to calculate levered beta. See Ch 16 slide 27. Round your answer to 3 docimal places. QUESTION 8 Assuming the firm's bond yelds increase to 7.5%, what is the firm's wacc with a 40% debt / 60% equity capital structure? Formatting input your answer as a percentage and round to two decimal places. For example, input "12.85" for 12.85%. QUESTION 9 If the firm had a 60% debt / 40% equity capital structure, what would its beta be? Calculate the debt to equity ratio, then use the Hamada equation to calculate levered beta: See Ch 16 stide 27 Round your answer to 3 decirnal places Assuming the firm's bond yields increase to 9%, what is tho firm's wacc with a 60% debt / 40% equity capital structure? Formatting input your answer as a percentage and round to two decimal places. For example, input "12.85" for 12.85%. QUESTION 11 What is the value of the firm's operations at the optimal captal structure? Formatting Inpout your answer in millions of dollars. Round to two decimal places For example, input "875 23" for 875 23 million QUESTION 12 What is the stock price at the optimal capital structure