Answered step by step

Verified Expert Solution

Question

1 Approved Answer

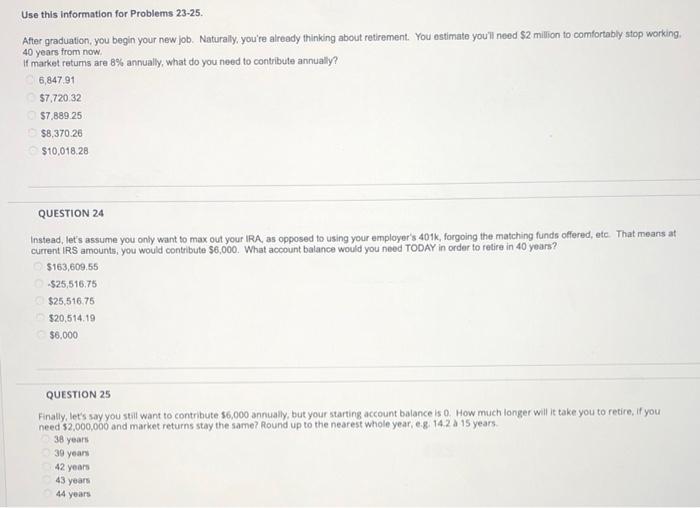

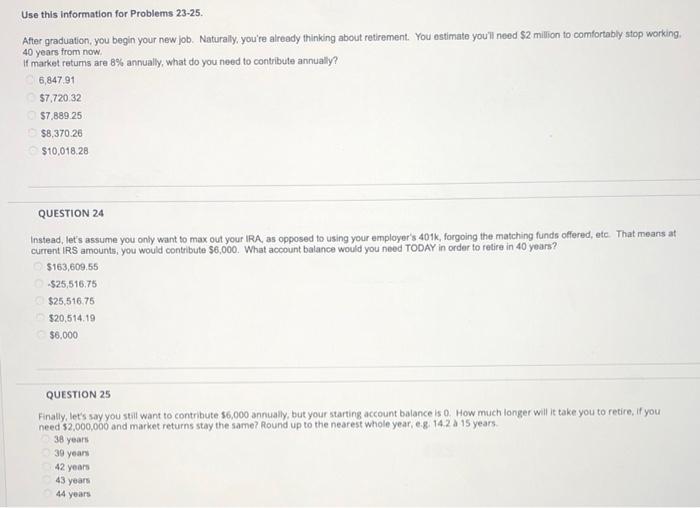

questions 23-25 (market returns, IRA etc) Use this information for Problems 23-25. After graduation, you begin your new job. Naturally, you're already thinking about retirement.

questions 23-25 (market returns, IRA etc)

Use this information for Problems 23-25. After graduation, you begin your new job. Naturally, you're already thinking about retirement. You estimate you'll need $2 million to comfortably stop working, 40 years from now If market returns are 8% annually, what do you need to contribute annually? 6,84791 $7.720.32 $7.889.25 $8,370.26 $10,018,28 QUESTION 24 Instead, let's assume you only want to max out your IRA, as opposed to using your employer's 4016, forgoing the matching funds offered, etc. That means at Current IRS amounts, you would contribute $6,000. What account balance would you need TODAY in order to retire in 40 years? $163,609,55 $25,516.75 $25,516.75 $20,514.19 $6,000 QUESTION 25 Finally, let's say you still want to contribute $6,000 annually, but your starting account balance is 0. How much longer will it take you to retire, if you need $2,000,066 and market returns stay the same? Round up to the nearest whole year, c.8. 14.22 15 years 38 years 39 years 42 years 43 years 44 years

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started