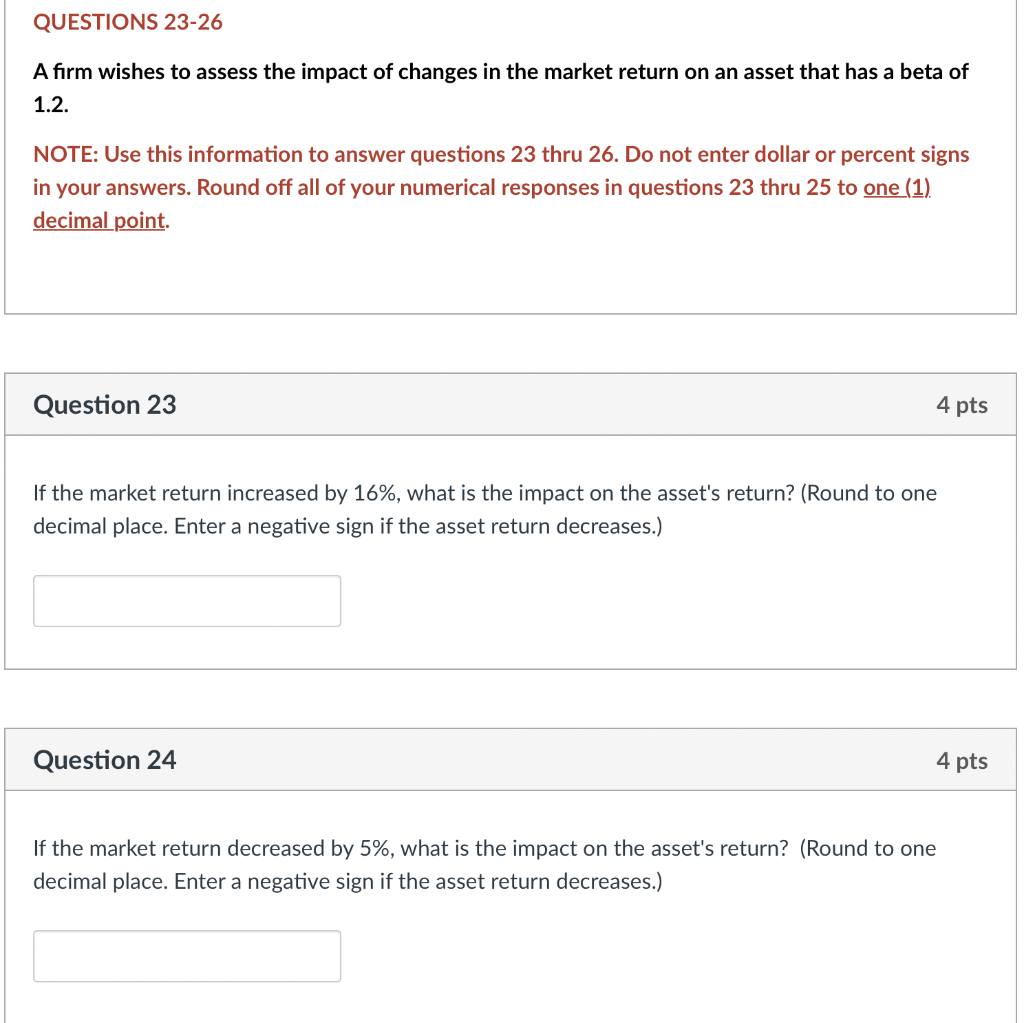

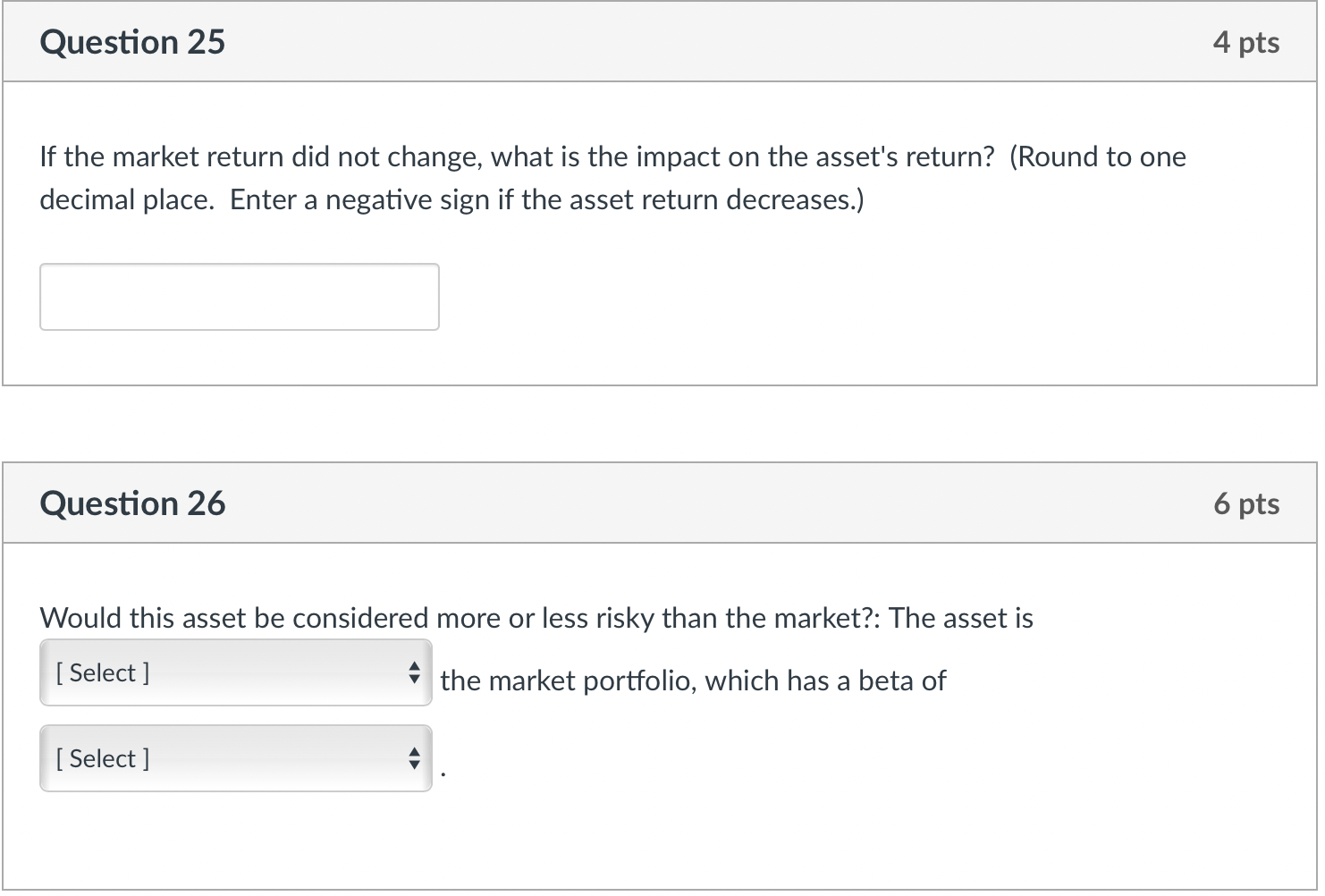

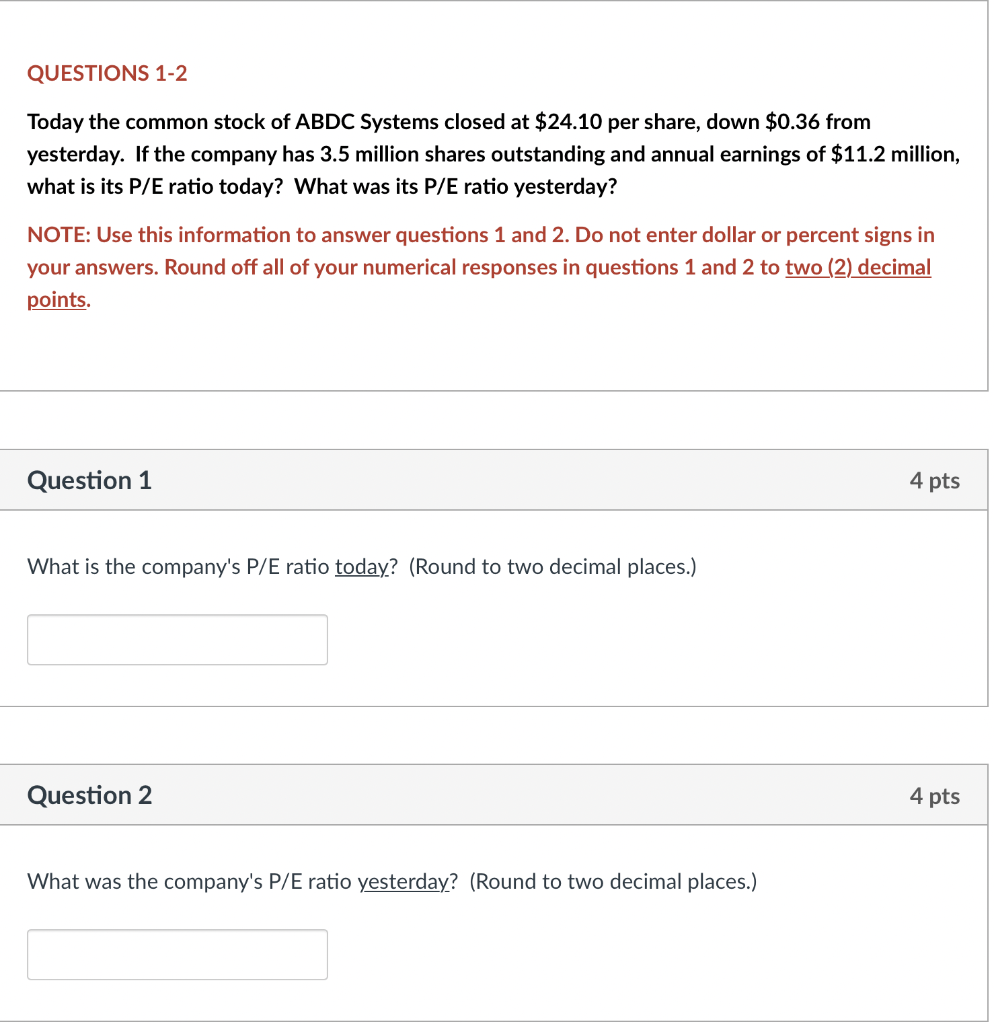

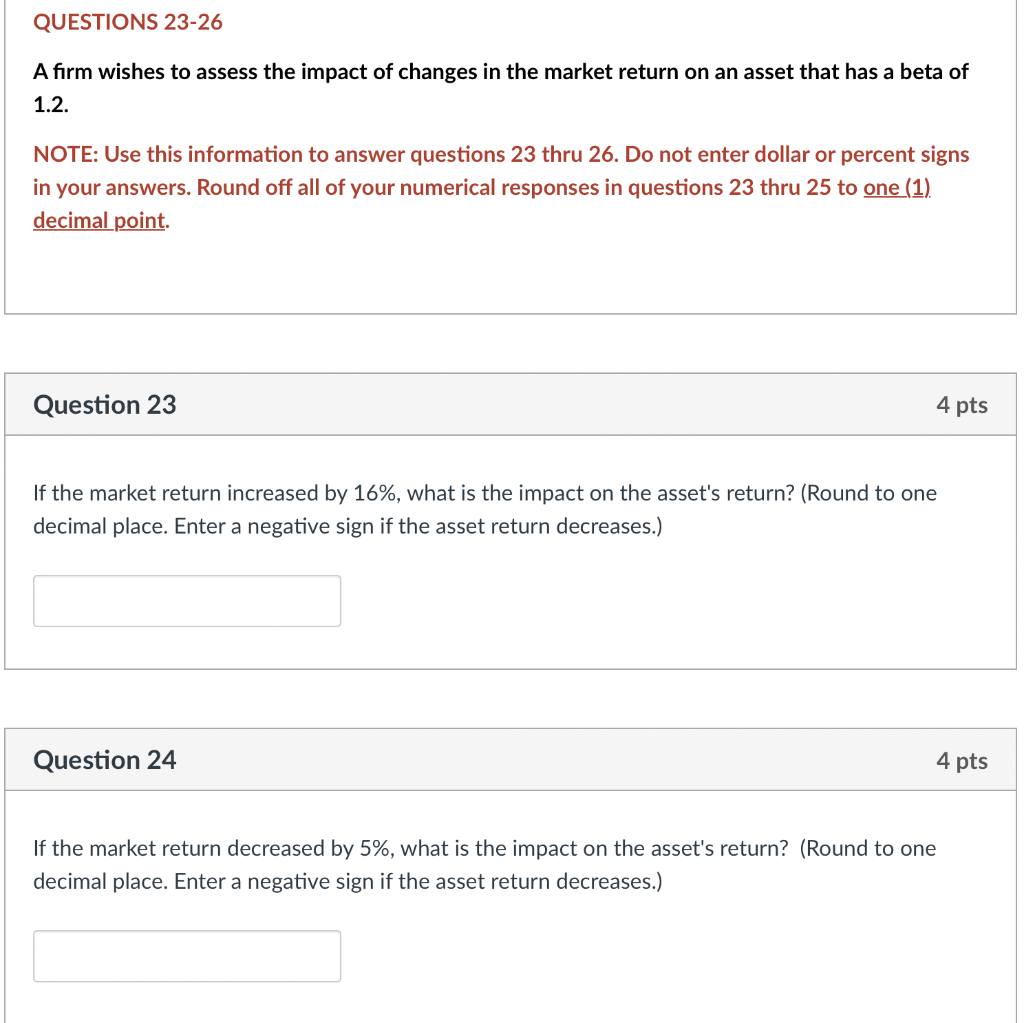

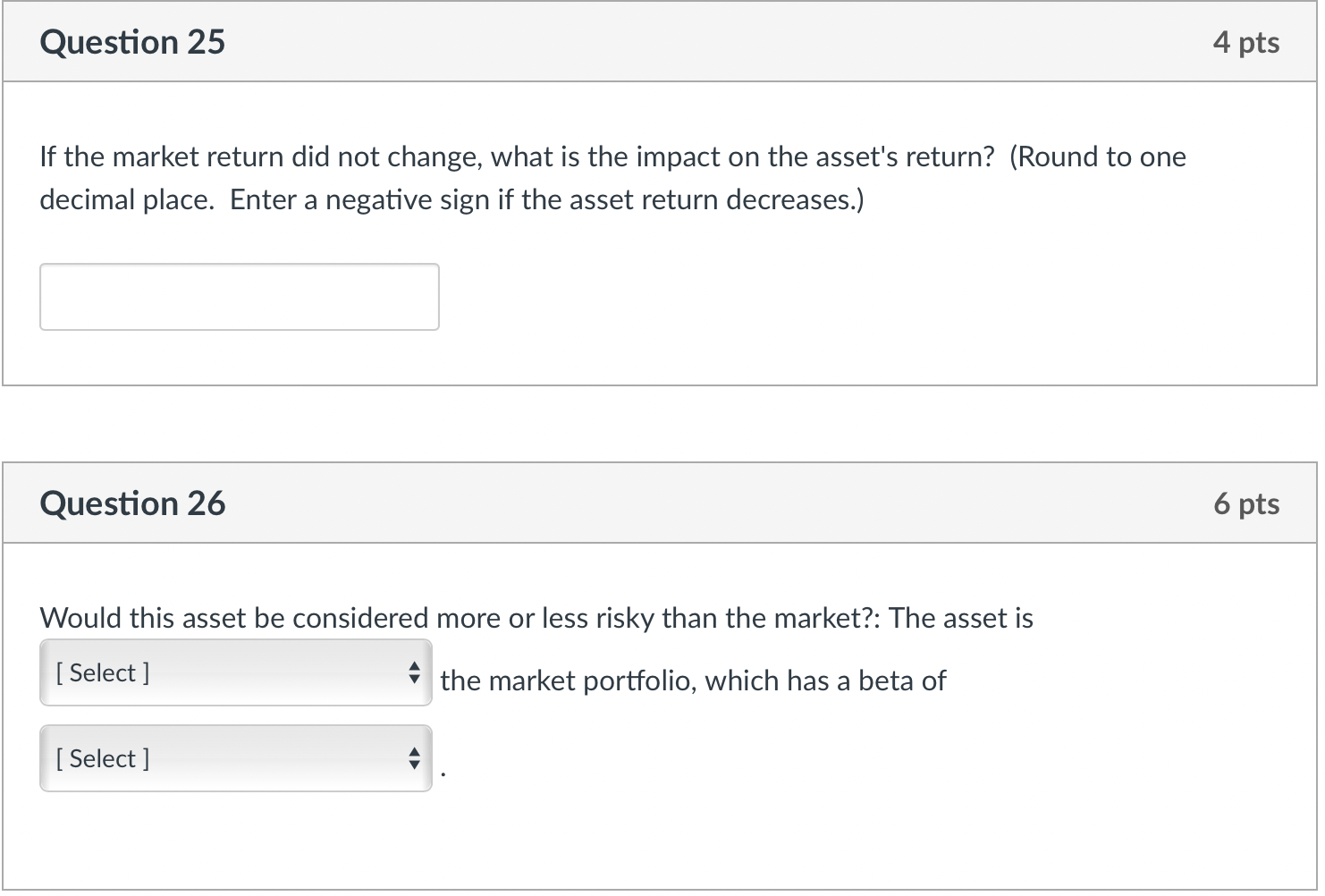

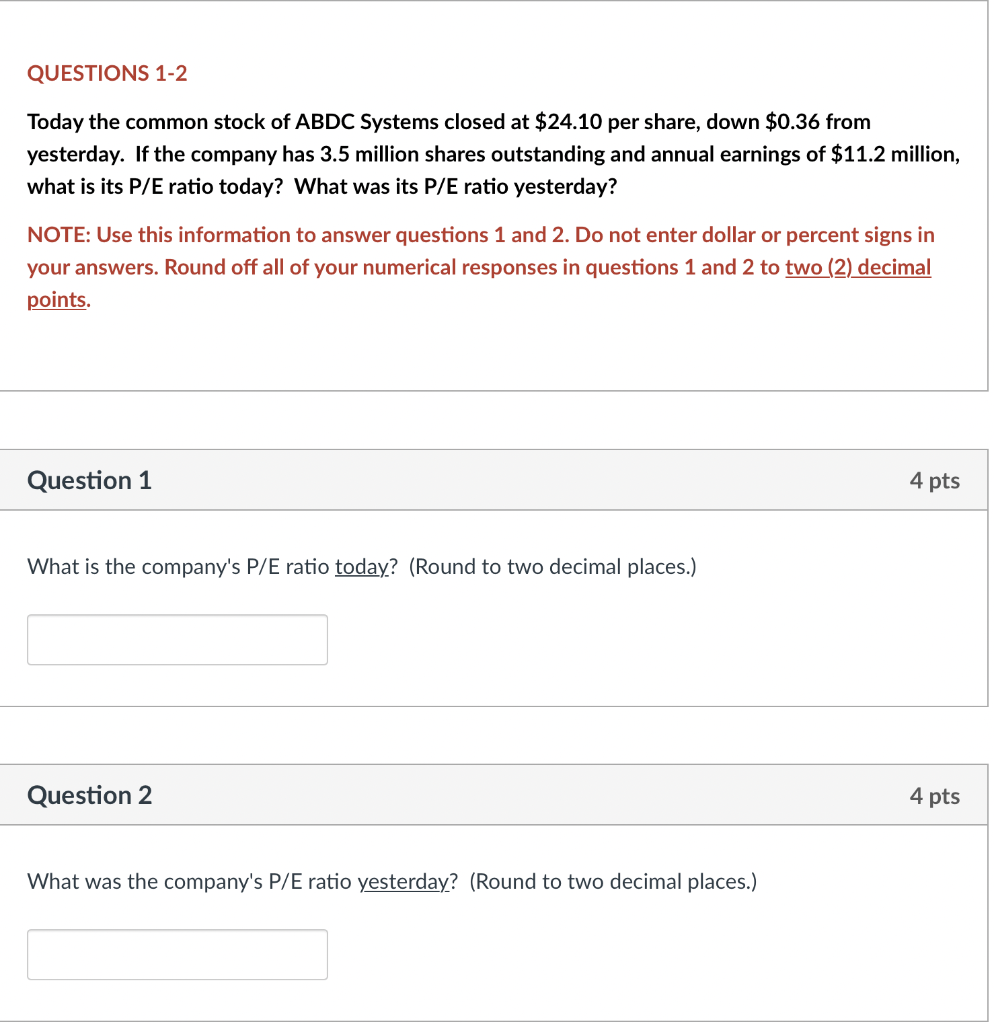

QUESTIONS 23-26 A firm wishes to assess the impact of changes in the market return on an asset that has a beta of 1.2. NOTE: Use this information to answer questions 23 thru 26. Do not enter dollar or percent signs in your answers. Round off all of your numerical responses in questions 23 thru 25 to one (1). decimal point. Question 23 4 pts If the market return increased by 16%, what is the impact on the asset's return? (Round to one decimal place. Enter a negative sign if the asset return decreases.) Question 24 4 pts If the market return decreased by 5%, what is the impact on the asset's return? (Round to one decimal place. Enter a negative sign if the asset return decreases.) If the market return did not change, what is the impact on the asset's return? (Round to one decimal place. Enter a negative sign if the asset return decreases.) Question 26 Would this asset be considered more or less risky than the market?: The asset is the market portfolio, which has a beta of QUESTIONS 1-2 Today the common stock of ABDC Systems closed at $24.10 per share, down $0.36 from yesterday. If the company has 3.5 million shares outstanding and annual earnings of $11.2 million, what is its P/E ratio today? What was its P/E ratio yesterday? NOTE: Use this information to answer questions 1 and 2. Do not enter dollar or percent signs in your answers. Round off all of your numerical responses in questions 1 and 2 to two (2) decimal points. Question 1 4 pts What is the company's P/E ratio today? (Round to two decimal places.) Question 2 4 pts What was the company's P/E ratio yesterday? (Round to two decimal places.) QUESTIONS 23-26 A firm wishes to assess the impact of changes in the market return on an asset that has a beta of 1.2. NOTE: Use this information to answer questions 23 thru 26. Do not enter dollar or percent signs in your answers. Round off all of your numerical responses in questions 23 thru 25 to one (1). decimal point. Question 23 4 pts If the market return increased by 16%, what is the impact on the asset's return? (Round to one decimal place. Enter a negative sign if the asset return decreases.) Question 24 4 pts If the market return decreased by 5%, what is the impact on the asset's return? (Round to one decimal place. Enter a negative sign if the asset return decreases.) If the market return did not change, what is the impact on the asset's return? (Round to one decimal place. Enter a negative sign if the asset return decreases.) Question 26 Would this asset be considered more or less risky than the market?: The asset is the market portfolio, which has a beta of QUESTIONS 1-2 Today the common stock of ABDC Systems closed at $24.10 per share, down $0.36 from yesterday. If the company has 3.5 million shares outstanding and annual earnings of $11.2 million, what is its P/E ratio today? What was its P/E ratio yesterday? NOTE: Use this information to answer questions 1 and 2. Do not enter dollar or percent signs in your answers. Round off all of your numerical responses in questions 1 and 2 to two (2) decimal points. Question 1 4 pts What is the company's P/E ratio today? (Round to two decimal places.) Question 2 4 pts What was the company's P/E ratio yesterday? (Round to two decimal places.)