Answered step by step

Verified Expert Solution

Question

1 Approved Answer

questions 29-32 please 29. Why might mutual fund turnover affect an investor's tax liability? A. The more purchases and sales the fund makes the greater

questions 29-32 please

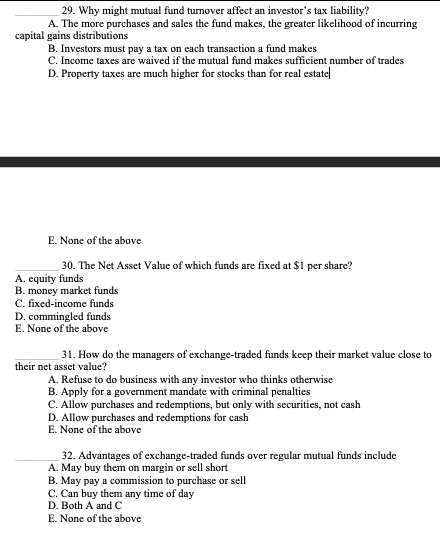

29. Why might mutual fund turnover affect an investor's tax liability? A. The more purchases and sales the fund makes the greater likelihood of incurring capital gains distributions B. Investors must pay a tax on each transaction a fund makes C. Income taxes are waived if the mutual fund makes sufficient number of trades D. Property taxes are much higher for stocks than for real estatel E. None of the above 30. The Net Asset Value of which funds are fixed at $1 per share? A. equity funds B. money market funds C. fixed-income funds D. commingled funds E. None of the above 31. How do the managers of exchange-traded funds keep their market value close to their net asset value? A. Refuse to do business with any investor who thinks otherwise B. Apply for a government mandate with criminal penalties C. Allow purchases and redemptions, but only with securities, not cash D. Allow purchases and redemptions for cash E. None of the above 32. Advantages of exchange-traded funds over regular mutual funds include A. May buy them on margin or sell short B. May pay a commission to purchase or sell C. Can buy them any time of day D. Both A and C E. None of the aboveStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started