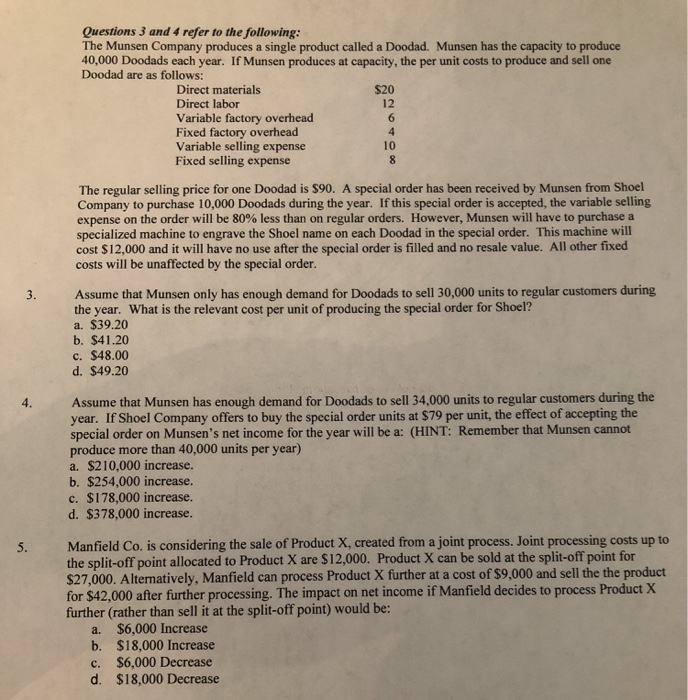

Questions 3 and 4 refer to the following: The Munsen Company produces a single product called a Doodad. Munsen has the capacity to produce 40,000 Doodads each year. If Munsen produces at capacity, the per unit costs to produce and sell one Doodad are as follows: Direct materials $20 Direct labor Variable factory overhead Fixed factory overhead Variable selling expense Fixed selling expense The regular selling price for one Doodad is $90. A special order has been received by Munsen from Shoel Company to purchase 10,000 Doodads during the year. If this special order is accepted, the variable selling expense on the order will be 80% less than on regular orders. However, Munsen will have to purchase a specialized machine to engrave the Shoel name on each Doodad in the special order. This machine will cost $12,000 and it will have no use after the special order is filled and no resale value. All other fixed costs will be unaffected by the special order. Assume that Munsen only has enough demand for Doodads to sell 30,000 units to regular customers during the year. What is the relevant cost per unit of producing the special order for Shoel? a. $39.20 b. $41.20 c. $48.00 d. $49.20 Assume that Munsen has enough demand for Doodads to sell 34,000 units to regular customers during the year. If Shoel Company offers to buy the special order units at $79 per unit, the effect of accepting the special order on Munsen's net income for the year will be a: (HINT: Remember that Munsen cannot produce more than 40,000 units per year) a. $210,000 increase. b. $254,000 increase. c. $178,000 increase. d. $378,000 increase. Manfield Co. is considering the sale of Product X, created from a joint process. Joint processing costs up to the split-off point allocated to Product X are $12,000. Product X can be sold at the split-off point for $27,000. Alternatively, Manfield can process Product X further at a cost of $9,000 and sell the the product for $42.000 after further processing. The impact on net income if Manfield decides to process Product X further (rather than sell it at the split-off point) would be: a. $6,000 Increase b. $18,000 Increase c. $6,000 Decrease d. $18,000 Decrease