Answered step by step

Verified Expert Solution

Question

1 Approved Answer

QUESTIONS (30 Marks 5.1 The cost of capital is the rate that must be earned in order to satisfy the combined required rates of return

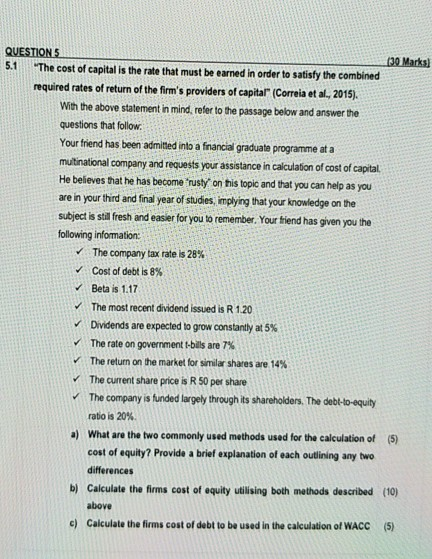

QUESTIONS (30 Marks 5.1 "The cost of capital is the rate that must be earned in order to satisfy the combined required rates of return of the firm's providers of capitar" (Correia et al., 2015). With the above statement in mind, refer to the passage below and answer the questions that follow. Your friend has been admitted into a financial graduate programme at a multinational company and requests your assistance in calculation of cost of capital He believes that he has become *rusty' on this topic and that you can help as you are in your third and final year of studies, implying that your knowledge on the subject is still fresh and easier for you to remember. Your friend has given you the following information: The company tax rate is 28% Cost of debt is 8% Beta is 1.17 The most recent dividend issued is R 1.20 Dividends are expected to grow constantly at 5% The rate on government t-bills are 7% The return on the market for similar shares are 14% The current share price is R50 per share The company is funded largely through its shareholders. The debt-to-equity ratio is 20% a) What are the two commonly used methods used for the calculation of (5) cost of equity? Provide a brief explanation of each outlining any two differences b) Calculate the firms cost of equity utilising both methods described (10) above c) Calculate the firms cost of debt to be used in the calculation of WACC

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started