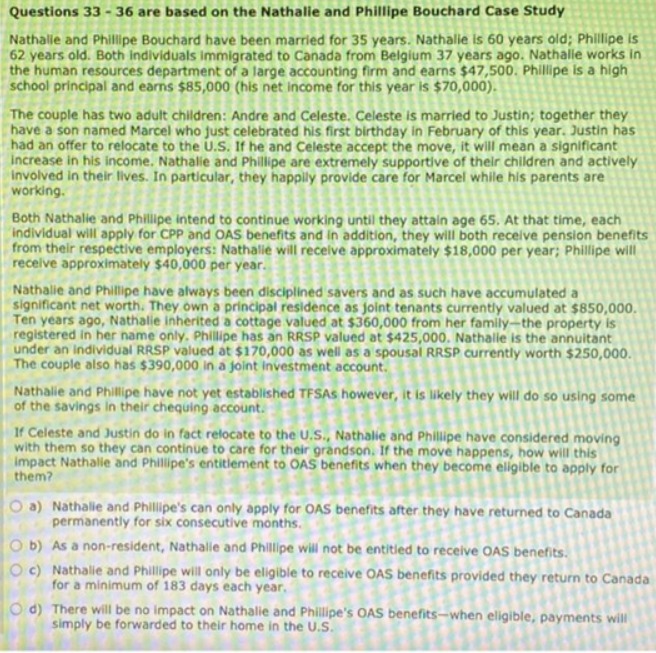

Questions 33 - 36 are based on the Nathalie and Phillipe Bouchard Case Study Nathalie and Phillipe Bouchard have been married for 35 years. Nathalie is 60 years old; Phillipe Is 62 years old. Both individuals immigrated to Canada from Belgium 37 years ago. Nathalie works in the human resources department of a large accounting firm and earns $47,500. Phillipe is a high school principal and earns $85,000 (his net income for this year is $70,000). The couple has two adult children: Andre and Celeste. Celeste is married to Justin; together they have a son named Marcel who just celebrated his first birthday in February of this year. Justin has had an offer to relocate to the U.S. If he and Celeste accept the move, it will mean a significant Increase in his income. Nathalie and Phillipe are extremely supportive of their children and actively involved in their lives. In particular, they happily provide care for Marcel while his parents are working. Both Nathalie and Phillipe intend to continue working until they attain age 65. At that time, each individual will apply for CPP and OAS benefits and In addition, they will both receive pension benefits from their respective employers: Nathalie will receive approximately $18,000 per year; Phillipe will receive approximately $40,000 per year. Nathalie and Phillipe have always been disciplined savers and as such have accumulated a significant net worth. They own a principal residence as joint tenants currently valued at $850,000 Ten years ago, Nathalie inherited a cottage valued at $360,000 from her family-the property is registered in her name only. Phillipe has an RRSP valued at $425,000. Nathalie is the annuitant under an Individual RRSP valued at $170,000 as well as a spousal RRSP currently worth $250,000. The couple also has $390,000 in a joint investment account. Nathalie and Phillipe have not yet established TFSAs however, it is likely they will do so using some of the savings In their chequing account. If Celeste and Justin do in fact relocate to the U.S., Nathalie and Phillipe have considered moving with them so they can continue to care for their grandson. If the move happens, how will this Impact Nathalie and Phillipe's entitlement to OAS benefits when they become eligible to apply for them? ( a) Nathalie and Phillipe's can only apply for OAS benefits after they have returned to Canada permanently for six consecutive months. ( b) As a non-resident, Nathalie and Phillipe will not be entitled to receive OAS benefits. ( c) Nathalie and Phillipe will only be eligible to receive OAS benefits provided they return to Canada for a minimum of 183 days each year. Od) There will be no impact on Nathalie and Phillipe's OAS benefits-when eligible, payments will simply be forwarded to their home in the U.S