Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Questions 3&4 QUESTION 3 Monita Hussain has a business in which she's invested $260000 of his own money, which is the firm's only capital. (There

Questions 3&4

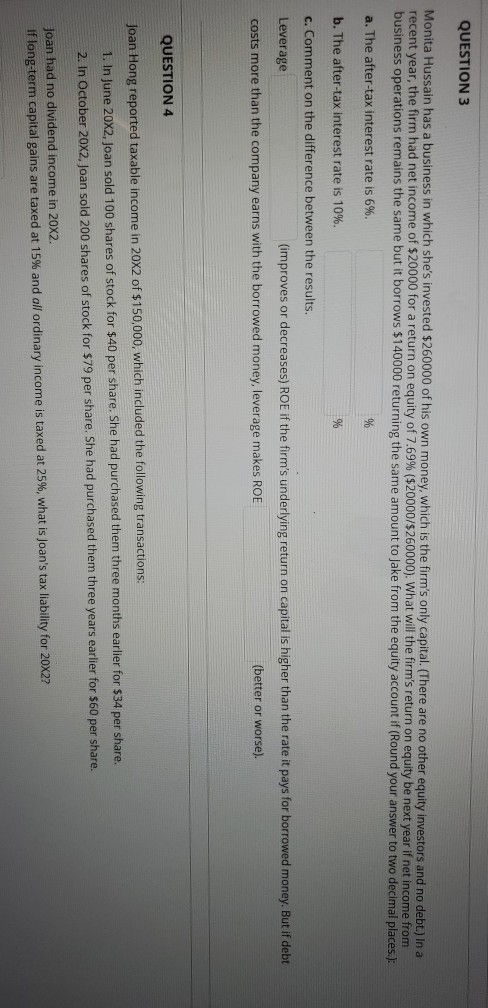

QUESTION 3 Monita Hussain has a business in which she's invested $260000 of his own money, which is the firm's only capital. (There are no other equity investors and no debt.) In a recent year, the firm had net income of $20000 for a return on equity of 7.69% ($20000/$260000). What will the firm's return on equity be next year if net income from business operations remains the same but it borrows $140000 returning the same amount to Jake from the equity account if (Round your answer to two decimal places.): a. The after-tax interest rate is 6%. b. The after-tax interest rate is 10%. % c. Comment on the difference between the results, Leverage (improves or decreases) ROE if the firm's underlying return on capital is higher than the rate it pays for borrowed money. But if debt costs more than the company earns with the borrowed money, leverage makes ROE (better or worse). QUESTION 4 Joan Hong reported taxable income in 20x2 of $150,000, which included the following transactions: 1. In June 20x2, Joan sold 100 shares of stock for $40 per share. She had purchased them three months earlier for $34 per share. 2. In October 20X2, Joan sold 200 shares of stock for $79 per share. She had purchased them three years earlier for $60 per share. Joan had no dividend income in 20x2. If long-term capital gains are taxed at 15% and all ordinary income is taxed at 25%, what is Joan's tax liability for 20x2Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started