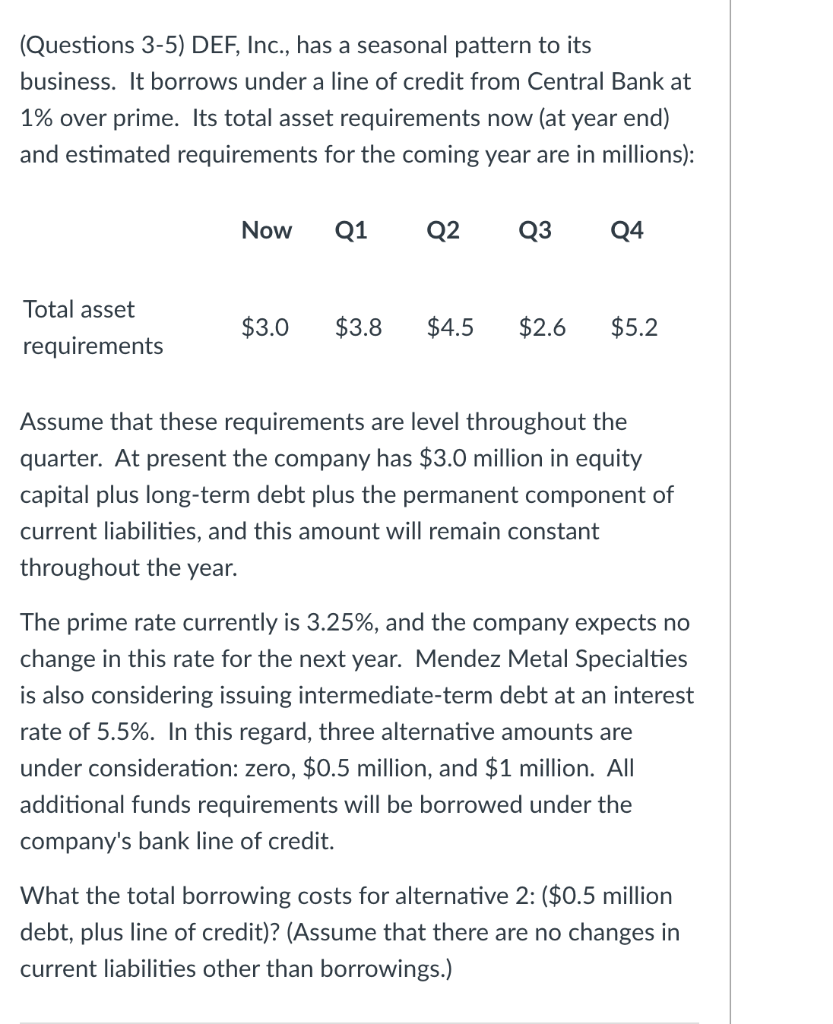

(Questions 3-5) DEF, Inc., has a seasonal pattern to its business. It borrows under a line of credit from Central Bank at 1% over prime. Its total asset requirements now (at year end) and estimated requirements for the coming year are in millions): Now Q1 Q2 Q3 24 Total asset requirements $3.0 $3.8 $4.5 $2.6 $5.2 Assume that these requirements are level throughout the quarter. At present the company has $3.0 million in equity capital plus long-term debt plus the permanent component of current liabilities, and this amount will remain constant throughout the year. The prime rate currently is 3.25%, and the company expects no change in this rate for the next year. Mendez Metal Specialties is also considering issuing intermediate-term debt at an interest rate of 5.5%. In this regard, three alternative amounts are under consideration: zero, $0.5 million, and $1 million. All additional funds requirements will be borrowed under the company's bank line of credit. What the total borrowing costs for alternative 2: ($0.5 million debt, plus line of credit)? (Assume that there are no changes in current liabilities other than borrowings.) O $59,375.00 O $54,062.50 O $57,250.00 $216,250.00 O $148,250.00 O $27,500.00 None of them O $37,062.50 (Questions 3-5) DEF, Inc., has a seasonal pattern to its business. It borrows under a line of credit from Central Bank at 1% over prime. Its total asset requirements now (at year end) and estimated requirements for the coming year are in millions): Now Q1 Q2 Q3 24 Total asset requirements $3.0 $3.8 $4.5 $2.6 $5.2 Assume that these requirements are level throughout the quarter. At present the company has $3.0 million in equity capital plus long-term debt plus the permanent component of current liabilities, and this amount will remain constant throughout the year. The prime rate currently is 3.25%, and the company expects no change in this rate for the next year. Mendez Metal Specialties is also considering issuing intermediate-term debt at an interest rate of 5.5%. In this regard, three alternative amounts are under consideration: zero, $0.5 million, and $1 million. All additional funds requirements will be borrowed under the company's bank line of credit. What the total borrowing costs for alternative 2: ($0.5 million debt, plus line of credit)? (Assume that there are no changes in current liabilities other than borrowings.) O $59,375.00 O $54,062.50 O $57,250.00 $216,250.00 O $148,250.00 O $27,500.00 None of them O $37,062.50