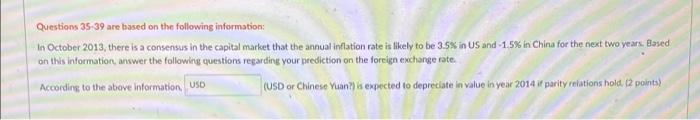

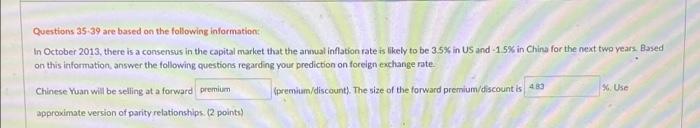

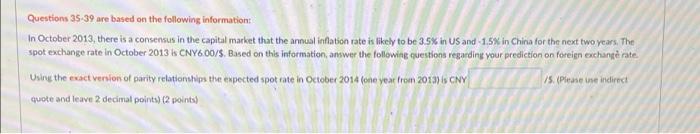

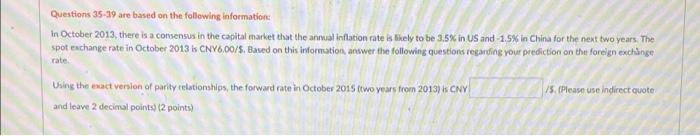

Questions 35-39 are based on the following information: In October 2013, there is a consensus in the capital market that the annual inflation rate is likely to be 3.5% in US and -1.5% in China for the next two years. Based on this information, answer the following questions regarding your prediction on the foreign exchange rate According to the above information USD (USD or Chinese Yuan?) is expected to depreciate in value in year 2014 if parity relations hold. (2 points) Questions 35 39 are based on the following information: In October 2013, there is a consensus in the capital market that the annual inflation rate is likely to be 3.5% in US and -15% in China for the next two years Based on this information answer the following questions regarding your prediction on foreign exchange rate. Chinese Yuan will be selling at a forward premium (premium/discount). The size of the forward premium/discount is 4.83 %. Use approximate version of parity relationships. (2 points) a Questions 35-39 are based on the following information In October 2013, there is a consensus in the capital market that the annual inflation rate is likely to be 3.5% in US and -1.5% in China for the next two years. Based on this information, answer the following questions regarding your prediction on the foreign exchange rate. You would expect |13 (US or China?) to have a higher interest rate according to parity relations (2 points) US Chine Questions 35-39 are based on the following information: In October 2013, there is a consensus in the capital market that the annual inflation rate is likely to be 3.5% in US and -1.5% in China for the next two years. The spot exchange rate in October 2013 ls CNY6.00/5. Based on this information, answer the following questions regarding your prediction on foreign exchange rate Using the exact version of parity relationships the expected spot rate in October 2014 (one year from 2019 CNY 15. Preine indirect quote and leave 2 decimal points) (2 points) Questions 35-39 are based on the following information In October 2013, there is a consensus in the capital market that the annual inflation rate is likely to be 3.5% in US and -1,5% in China for the next two years. The spot exchange rate in October 2013 is CNY6.00/5. Based on this information, answer the following questions regarding your prediction on the foreign exchange rate Ushing the exact version of parity relationships, the forward rate in October 2015 two years from 2013) KCN and leave 2 decimal points (2 points) 15. (Please use indirect quote 2