Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Questions 3-5A and 3-7A Problem 3-5A Preparing adjusting and subsequent cash entries (annual)--accrued revenues LO4 In reviewing the accounts on March 31 for the year

Questions 3-5A and 3-7A

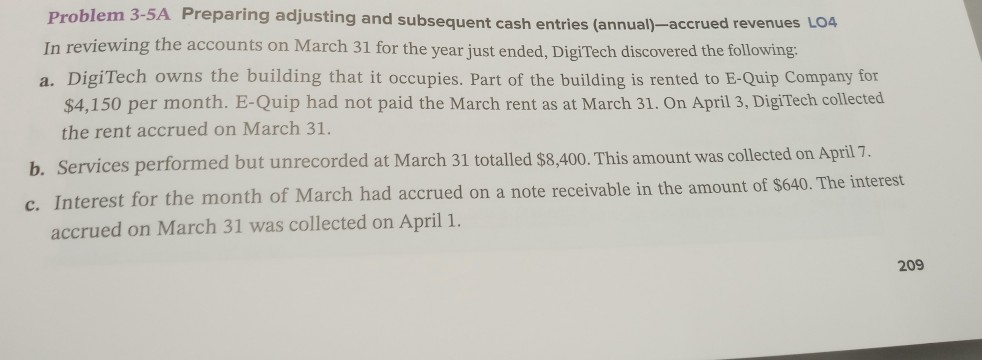

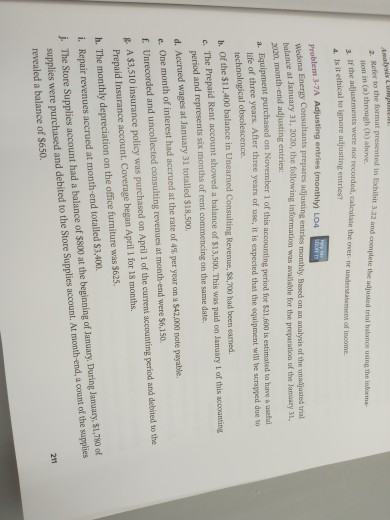

Problem 3-5A Preparing adjusting and subsequent cash entries (annual)--accrued revenues LO4 In reviewing the accounts on March 31 for the year just ended, DigiTech discovered the following: a. DigiTech owns the building that it occupies. Part of the building is rented to E-Quip Company for $4,150 per month. E-Quip had not paid the March rent as at March 31. On April 3, DigiTech collected the rent accrued on March 31. b. Services performed but unrecorded at March 31 totalled $8,400. This amount was collected on April 7. c. Interest for the month of March had accrued on a note receivable in the amount of $640. The interest accrued on March 31 was collected on April 1. 209 the to the format presented in thibit 3.22 and complete the w tion in (a) through a ll hange above she adjustments were not recorded, calculate the ever be understo of income 4. Is it ethical to lehore dun entries? problem 3-7A Adjusting entries (monthly L04 SORE aans Energy Consultants prepares adjusting entre monthly. Based on an analysis of the balance at January 31, 2020, the following information was wallble for the preparation of the January 31. adjusted tal 2000, month-end adjusting entries: Equipment purchased on november of this accounting period for $21.600 is estimated to have a useful life of three years. After three year of use, it is expected that the equipment will be scrapped due to technological obsolescence. b. of the $11.400 balance in Unearned Consulting Revenue, S8,700 had been camed. The Prepaid Rent account showed a balance of $13,500. This was paid on January 1 of this accounting period and represents six months of rent commencing on the same date. d. Accrued wages at January 31 totalled $18,500 c. One month of interest had accrued at the rate of 45 per year on a 542.000 note payable. f. Unrecorded and uncollected consulting revenues at month-end were 56,150. & A $3.510 insurance policy was purchased on April 1 of the current accounting period and debited to the Prepaid Insurance account. Coverage began April 1 for 18 months. h. The monthly depreciation on the office furniture was $625. i. Repair revenues accrued at month-end totalled $3,400 The Store Supplies account had a balance of $800 at the beginning of January. During January, 51,780 of supplies were purchased and debited to the Store Supplies account. At month-end, a count of the supplies revealed a balance of $650Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started