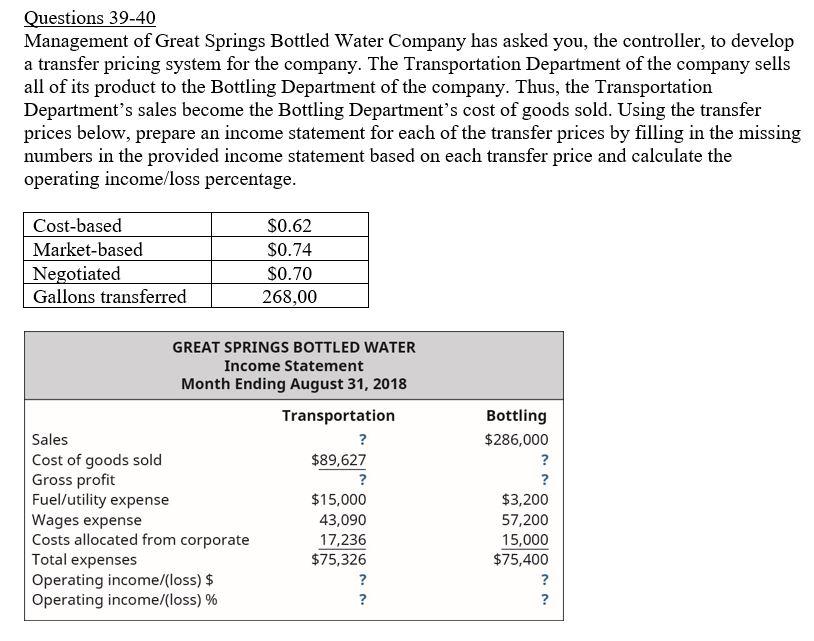

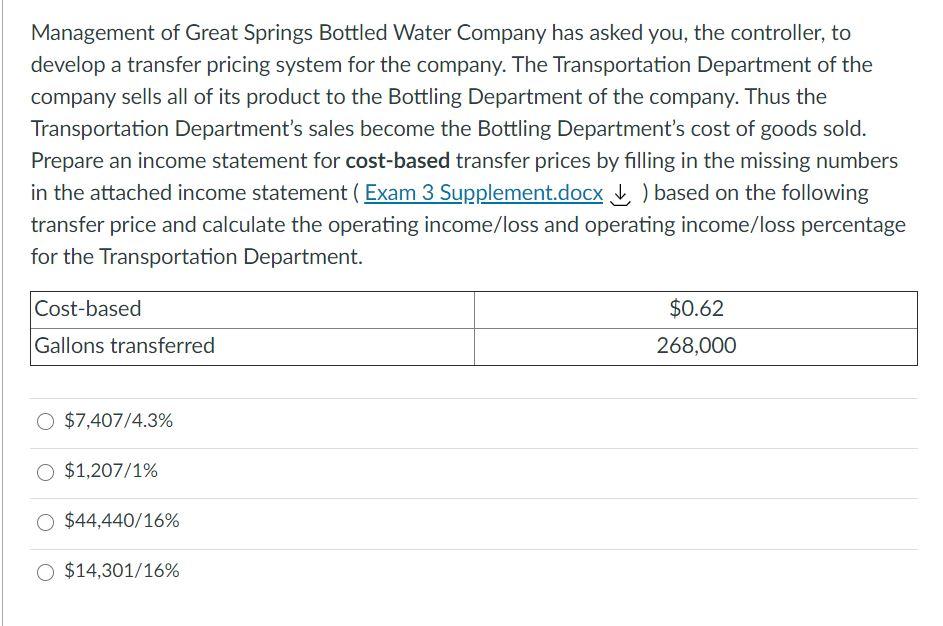

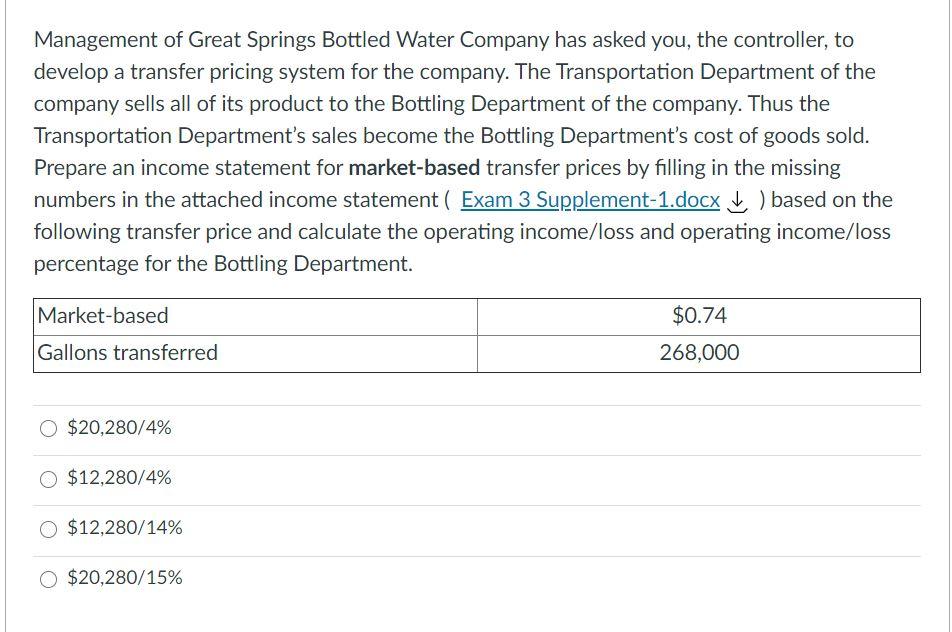

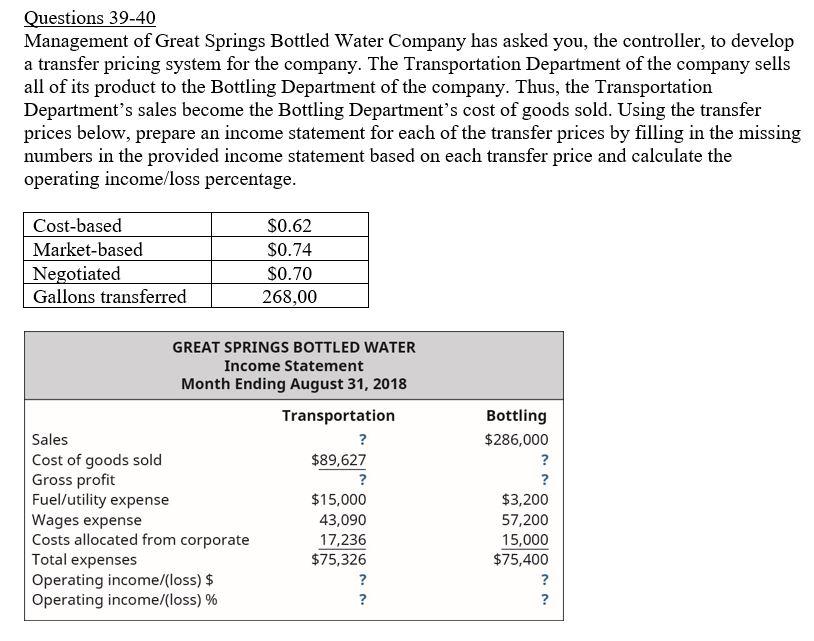

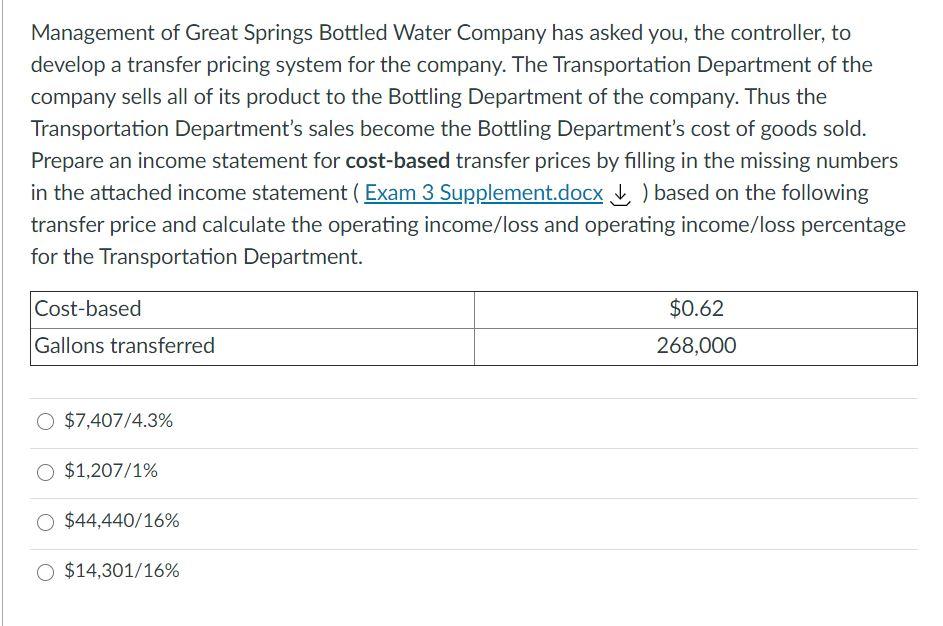

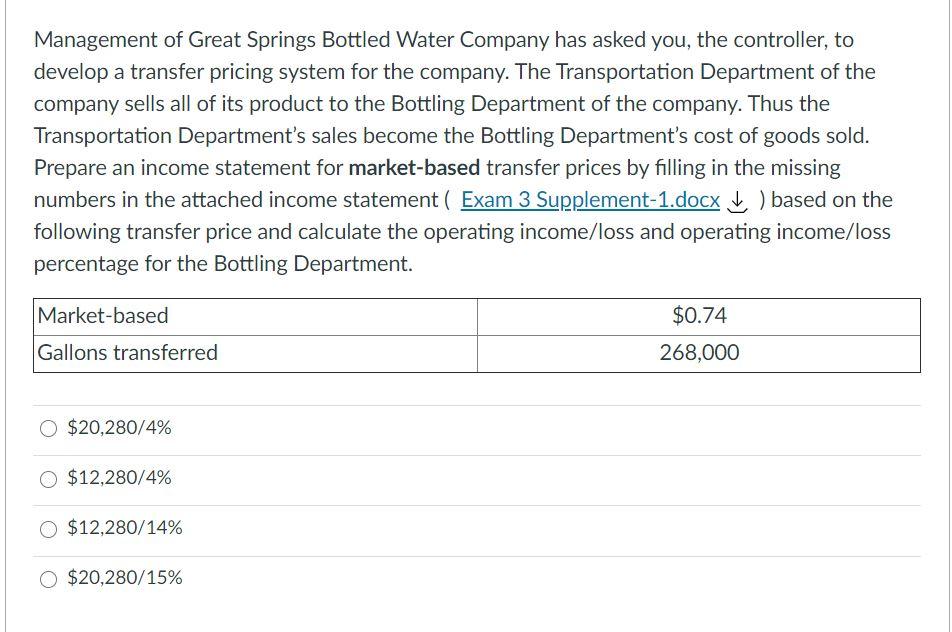

Questions 39-40 Management of Great Springs Bottled Water Company has asked you, the controller, to develop a transfer pricing system for the company. The Transportation Department of the company sells all of its product to the Bottling Department of the company. Thus, the Transportation Department's sales become the Bottling Department's cost of goods sold. Using the transfer prices below, prepare an income statement for each of the transfer prices by filling in the missing numbers in the provided income statement based on each transfer price and calculate the operating income/loss percentage. Cost-based Market-based Negotiated Gallons transferred $0.62 $0.74 $0.70 268,00 GREAT SPRINGS BOTTLED WATER Income Statement Month Ending August 31, 2018 Transportation Sales ? Cost of goods sold $89,627 Gross profit ? Fuel/utility expense $15,000 Wages expense 43,090 Costs allocated from corporate 17,236 Total expenses $75,326 Operating income/(loss) $ ? Operating income/loss) % Bottling $286,000 ? ? $3,200 57,200 15,000 $75,400 ? ? ? Management of Great Springs Bottled Water Company has asked you, the controller, to develop a transfer pricing system for the company. The Transportation Department of the company sells all of its product to the Bottling Department of the company. Thus the Transportation Department's sales become the Bottling Department's cost of goods sold. Prepare an income statement for cost-based transfer prices by filling in the missing numbers in the attached income statement ( Exam 3 Supplement.docx ) based on the following transfer price and calculate the operating income/loss and operating income/loss percentage for the Transportation Department. Cost-based $0.62 Gallons transferred 268,000 O $7,407/4.3% $1,207/1% $44,440/16% $14,301/16% Management of Great Springs Bottled Water Company has asked you, the controller, to develop a transfer pricing system for the company. The Transportation Department of the company sells all of its product to the Bottling Department of the company. Thus the Transportation Department's sales become the Bottling Department's cost of goods sold. Prepare an income statement for market-based transfer prices by filling in the missing numbers in the attached income statement ( Exam 3 Supplement-1.docx ) based on the following transfer price and calculate the operating income/loss and operating income/loss percentage for the Bottling Department. Market-based $0.74 268,000 Gallons transferred $20,280/4% $12,280/4% $12,280/14% $20,280/15%