Questions 4&5, need you help ASAP prettttty please

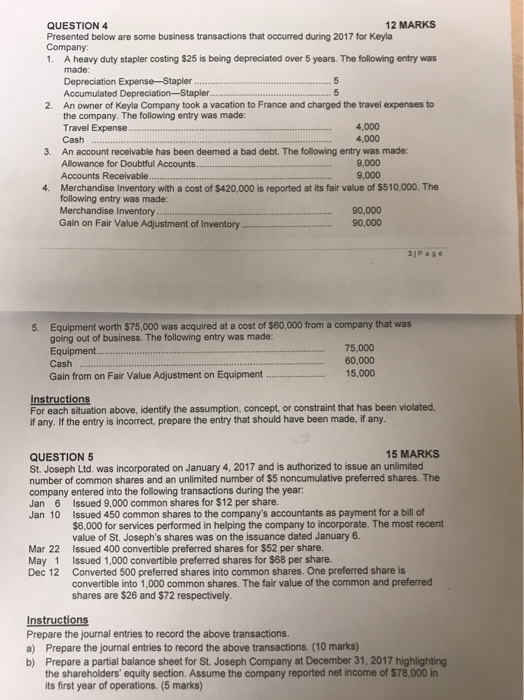

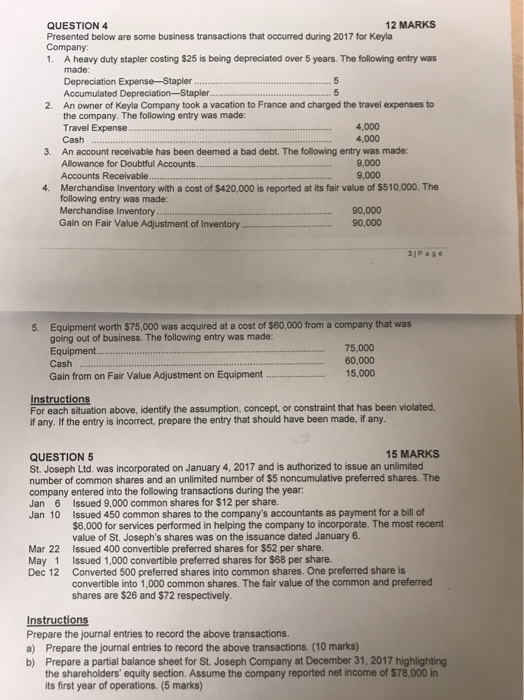

QUESTION4 12 MARKS Presented below are some business transactions that occurred during 2017 for Keyla Company: A heavy duty stapler costing $25 is being depreciated over 5 years. The following entry was made: 1. An owner of Keyla Company took a vacation to France and charged the travel expenses to the company. The following entry was made: 2. Travel Expense. 4,000 4,000 Cash An account receivable has been deemed a bad debt. The following entry was made Allowance for Doubtful Accounts 3. 9,000 9,000 Merchandise Inventory with a cost of $420,000 is reported at its fair value of $510,000. The following entry was made: Merchandise Inventory Gain on Fair Value Adjustment of Inventory.90,000 4. 90,000 31Page Equipment worth $75,000 was acquired at a cost of $60,000 from a company that was going out of business. The following entry was made Equipment Cash Gain from on Fair Value Adjustment on Equipment 5. 75,000 60,000 15,000 For each situation above, identify the assumption, concept, or constraint that has been violated, if any. If the entry is incorrect, prepare the entry that should have been made, if any. 15 MARKS QUESTION 5 St. Joseph Ltd. was incorporated on January 4, 2017 and is authorized to issue an unlimited number of common shares and an unlimited number of $5 noncumulative preferred shares. The company entered into the following transactions during the year Jan 6 Issued 9,000 common shares for $12 per share. Jan 10 Issued 450 common shares to the company's accountants as payment for a bill of $6,000 for services performed in helping the company to incorporate. The most recent value of St. Joseph's shares was on the issuance dated January 6. Mar 22 Issued 400 convertible preferred shares for $52 per share May 1 Issued 1,000 convertible preferred shares for $88 per share. Dec 12 Converted 500 preferred shares into common shares. One preferred share is convertible into 1,000 common shares. The fair value of the common and preferred shares are $26 and $72 respectively. Prepare the journal entries to record the above transactions. a) Prepare the journal entries to record the above transactions. (10 marks) b) Prepare a partial balance sheet for St. Joseph Company at December 31, 2017 highlighting the shareholders' equity section. Assume the company reported net income of $78,000 in its first year of operations

Questions 4&5, need you help ASAP prettttty please

Questions 4&5, need you help ASAP prettttty please