Questions 5 through 7 please. This is for 2018 tax year.

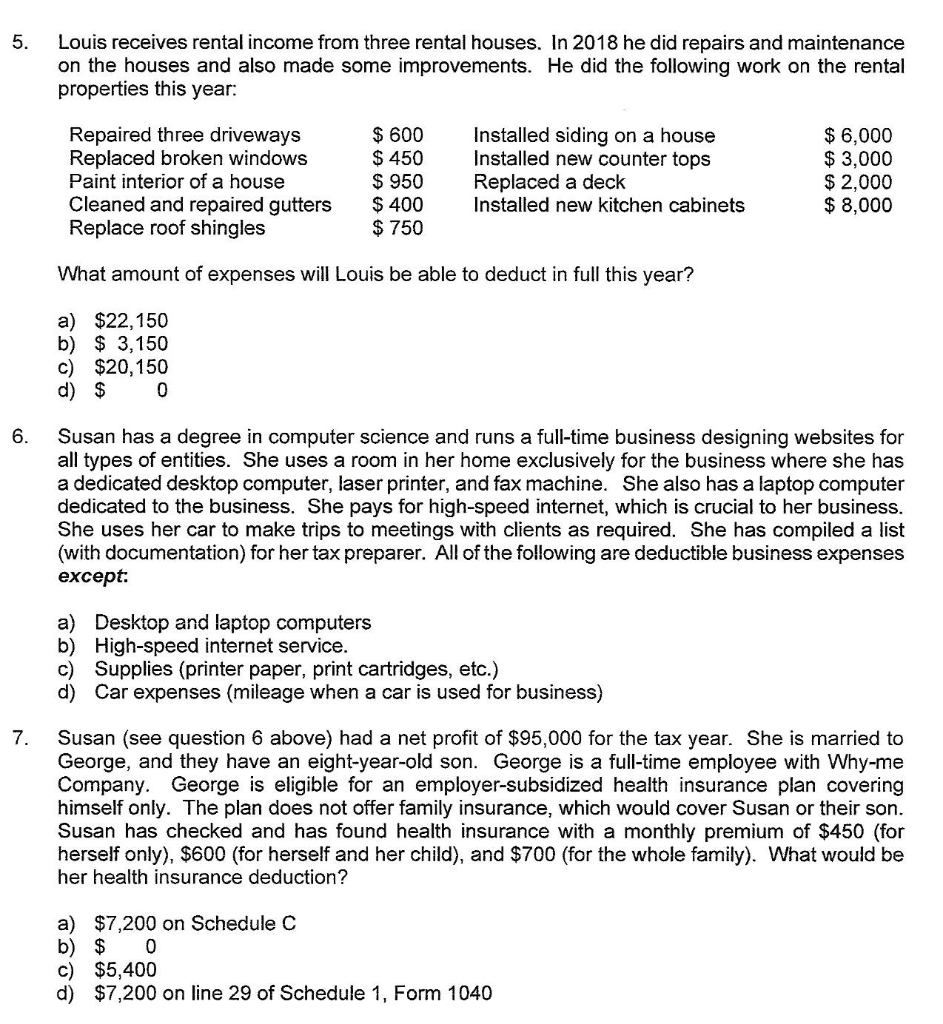

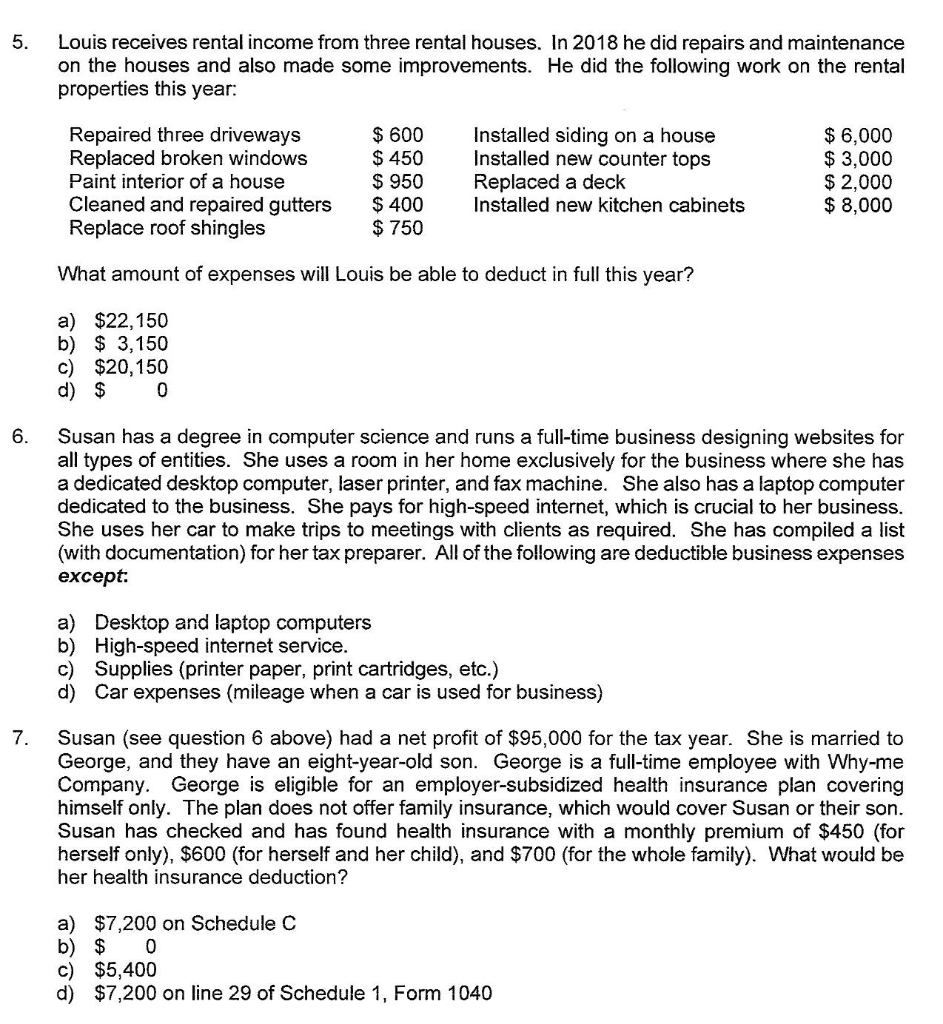

5. Louis receives rental income from three rental houses. In 2018 he did repairs and maintenance on the houses and also made some improvements. He did the following work on the rental properties this year: Repaired three driveways Replaced broken windows Paint interior of a house Cleaned and repaired gutters Replace roof shingles $ 600 $ 450 $ 950 $ 400 $ 750 Installed siding on a house Installed new counter tops Replaced a deck Installed new kitchen cabinets $ 6,000 $ 3,000 $ 2,000 $ 8,000 What amount of expenses will Louis be able to deduct in full this year? a) $22,150 b) $ 3,150 c) $20,150 d) $ 0 6. Susan has a degree in computer science and runs a full-time business designing websites for all types of entities. She uses a room in her home exclusively for the business where she has a dedicated desktop computer, laser printer, and fax machine. She also has a laptop computer dedicated to the business. She pays for high-speed internet, which is crucial to her business. She uses her car to make trips to meetings with clients as required. She has compiled a list (with documentation) for her tax preparer. All of the following are deductible business expenses except: a) Desktop and laptop computers b) High-speed internet service. c) Supplies (printer paper, print cartridges, etc.) d) Car expenses (mileage when a car is used for business) 7. Susan (see question 6 above) had a net profit of $95,000 for the tax year. She is married to George, and they have an eight-year-old son. George is a full-time employee with Why-me Company. George is eligible for an employer-subsidized health insurance plan covering himself only. The plan does not offer family insurance, which would cover Susan or their son. Susan has checked and has found health insurance with a monthly premium of $450 (for herself only), $600 (for herself and her child), and $700 (for the whole family). What would be her health insurance deduction? a) $7,200 on Schedule C b) $ 0 c) $5,400 d) $7,200 on line 29 of Schedule 1, Form 1040 5. Louis receives rental income from three rental houses. In 2018 he did repairs and maintenance on the houses and also made some improvements. He did the following work on the rental properties this year: Repaired three driveways Replaced broken windows Paint interior of a house Cleaned and repaired gutters Replace roof shingles $ 600 $ 450 $ 950 $ 400 $ 750 Installed siding on a house Installed new counter tops Replaced a deck Installed new kitchen cabinets $ 6,000 $ 3,000 $ 2,000 $ 8,000 What amount of expenses will Louis be able to deduct in full this year? a) $22,150 b) $ 3,150 c) $20,150 d) $ 0 6. Susan has a degree in computer science and runs a full-time business designing websites for all types of entities. She uses a room in her home exclusively for the business where she has a dedicated desktop computer, laser printer, and fax machine. She also has a laptop computer dedicated to the business. She pays for high-speed internet, which is crucial to her business. She uses her car to make trips to meetings with clients as required. She has compiled a list (with documentation) for her tax preparer. All of the following are deductible business expenses except: a) Desktop and laptop computers b) High-speed internet service. c) Supplies (printer paper, print cartridges, etc.) d) Car expenses (mileage when a car is used for business) 7. Susan (see question 6 above) had a net profit of $95,000 for the tax year. She is married to George, and they have an eight-year-old son. George is a full-time employee with Why-me Company. George is eligible for an employer-subsidized health insurance plan covering himself only. The plan does not offer family insurance, which would cover Susan or their son. Susan has checked and has found health insurance with a monthly premium of $450 (for herself only), $600 (for herself and her child), and $700 (for the whole family). What would be her health insurance deduction? a) $7,200 on Schedule C b) $ 0 c) $5,400 d) $7,200 on line 29 of Schedule 1, Form 1040