Answered step by step

Verified Expert Solution

Question

1 Approved Answer

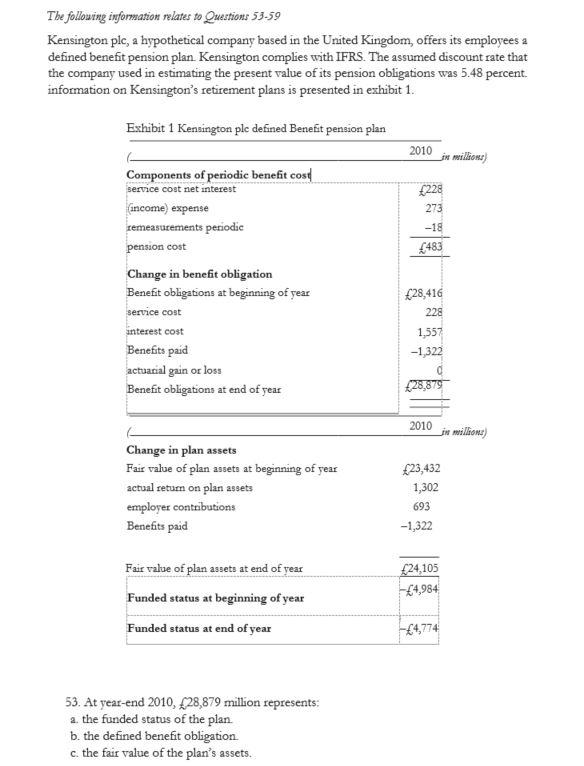

Questions 53-59 The following information relates to Questions 53-59 Kensington plc, a hypothetical company based in the United Kingdom, offers its employees a defined benefit

Questions 53-59

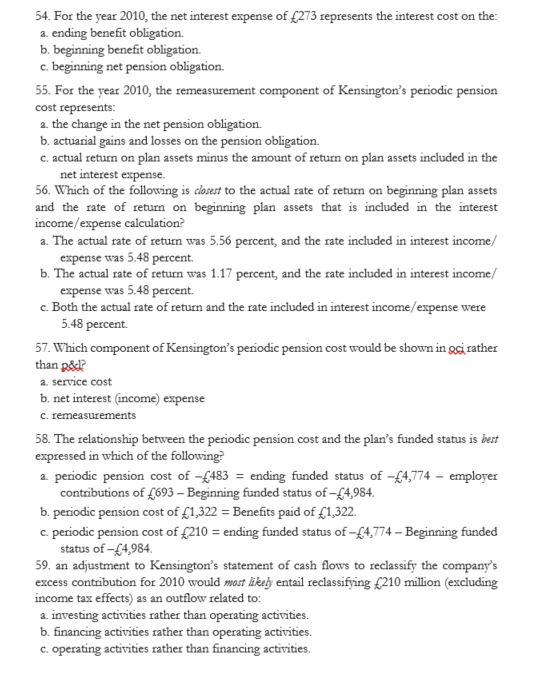

The following information relates to Questions 53-59 Kensington plc, a hypothetical company based in the United Kingdom, offers its employees a defined benefit pension plan Kensington complies with IFRS. The assumed discount rate that the company used in estimating the present value of its pension obligations was 5.48 percent. information on Kensington's retirement plans is presented in exhibit 1. Exhibit 1 Kensington ple defined Benefit pension plan 2010 fix million) 228 273 07121 -18 483 Components of periodic benefit cose service cost net interest income) expense remeasurements periodic pension cost Change in benefit obligation Benefit obligations at beginning of year service cost interest cost Benefits paid actuarial gain or loss Benefit obligations at end of year 28,416 228 1,557 -1,322 28,879 2010 je millione) Change in plan assets Fair value of plan assets at beginning of year actual return on plan assets employer contributions Benefits paid 23,432 1,302 693 -1,322 Fair value of plan assets at end of year 24,105 -4,984 Funded status at beginning of year Funded status at end of year -4,774 53. At year-end 2010, 28,879 million represents: a. the funded status of the plan. b. the defined benefit obligation c. the fair value of the plan's assets. 54. For the year 2010, the net interest expense of 273 represents the interest cost on the a. ending benefit obligation b. beginning benefit obligation. c. beginning net pension obligation. 55. For the year 2010, the remeasurement component of Kensington's periodic pension cost represents: 2. the change in the net pension obligation b. actuarial gains and losses on the pension obligation c. actual return on plan assets minus the amount of return on plan assets included in the net interest expense 56. Which of the following is closest to the actual rate of return on beginning plan assets and the rate of retum on beginning plan assets that is included in the interest income/expense calculation a. The actual rate of return was 5.56 percent, and the rate included in interest income! expense was 5.48 percent b. The actual rate of return was 1.17 percent, and the rate included in interest income/ expense was 5.48 percent. c. Both the actual rate of return and the rate included in interest income /expense were 5.48 percent 57. Which component of Kensington's periodic pension cost would be shown in gsi rather than & a service cost b. net interest (income) expense c. remeasurements 58. The relationship between the periodic pension cost and the plan's funded status is best expressed in which of the following 2. periodic pension cost of - 483 = ending funded status of -4,774 - employer contributions of 693 - Beginning funded status of - 4,984. b. periodic pension cost of 1,322 = Benefits paid of 1,322. c. periodic pension cost of 210 = ending funded status of -4,774 - Beginning funded status of - 4,984 59, an adjustment to Kensington's statement of cash flows to reclassify the company's excess contribution for 2010 would most likeh entail reclassifying 210 million (excluding income tax effects) as an outflow related to: 2. investing activities rather than operating activities. b. financing activities rather than operating activities. c. operating activities rather than financing activities. The following information relates to Questions 53-59 Kensington plc, a hypothetical company based in the United Kingdom, offers its employees a defined benefit pension plan Kensington complies with IFRS. The assumed discount rate that the company used in estimating the present value of its pension obligations was 5.48 percent. information on Kensington's retirement plans is presented in exhibit 1. Exhibit 1 Kensington ple defined Benefit pension plan 2010 fix million) 228 273 07121 -18 483 Components of periodic benefit cose service cost net interest income) expense remeasurements periodic pension cost Change in benefit obligation Benefit obligations at beginning of year service cost interest cost Benefits paid actuarial gain or loss Benefit obligations at end of year 28,416 228 1,557 -1,322 28,879 2010 je millione) Change in plan assets Fair value of plan assets at beginning of year actual return on plan assets employer contributions Benefits paid 23,432 1,302 693 -1,322 Fair value of plan assets at end of year 24,105 -4,984 Funded status at beginning of year Funded status at end of year -4,774 53. At year-end 2010, 28,879 million represents: a. the funded status of the plan. b. the defined benefit obligation c. the fair value of the plan's assets. 54. For the year 2010, the net interest expense of 273 represents the interest cost on the a. ending benefit obligation b. beginning benefit obligation. c. beginning net pension obligation. 55. For the year 2010, the remeasurement component of Kensington's periodic pension cost represents: 2. the change in the net pension obligation b. actuarial gains and losses on the pension obligation c. actual return on plan assets minus the amount of return on plan assets included in the net interest expense 56. Which of the following is closest to the actual rate of return on beginning plan assets and the rate of retum on beginning plan assets that is included in the interest income/expense calculation a. The actual rate of return was 5.56 percent, and the rate included in interest income! expense was 5.48 percent b. The actual rate of return was 1.17 percent, and the rate included in interest income/ expense was 5.48 percent. c. Both the actual rate of return and the rate included in interest income /expense were 5.48 percent 57. Which component of Kensington's periodic pension cost would be shown in gsi rather than & a service cost b. net interest (income) expense c. remeasurements 58. The relationship between the periodic pension cost and the plan's funded status is best expressed in which of the following 2. periodic pension cost of - 483 = ending funded status of -4,774 - employer contributions of 693 - Beginning funded status of - 4,984. b. periodic pension cost of 1,322 = Benefits paid of 1,322. c. periodic pension cost of 210 = ending funded status of -4,774 - Beginning funded status of - 4,984 59, an adjustment to Kensington's statement of cash flows to reclassify the company's excess contribution for 2010 would most likeh entail reclassifying 210 million (excluding income tax effects) as an outflow related to: 2. investing activities rather than operating activities. b. financing activities rather than operating activities. c. operating activities rather than financing activitiesStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started