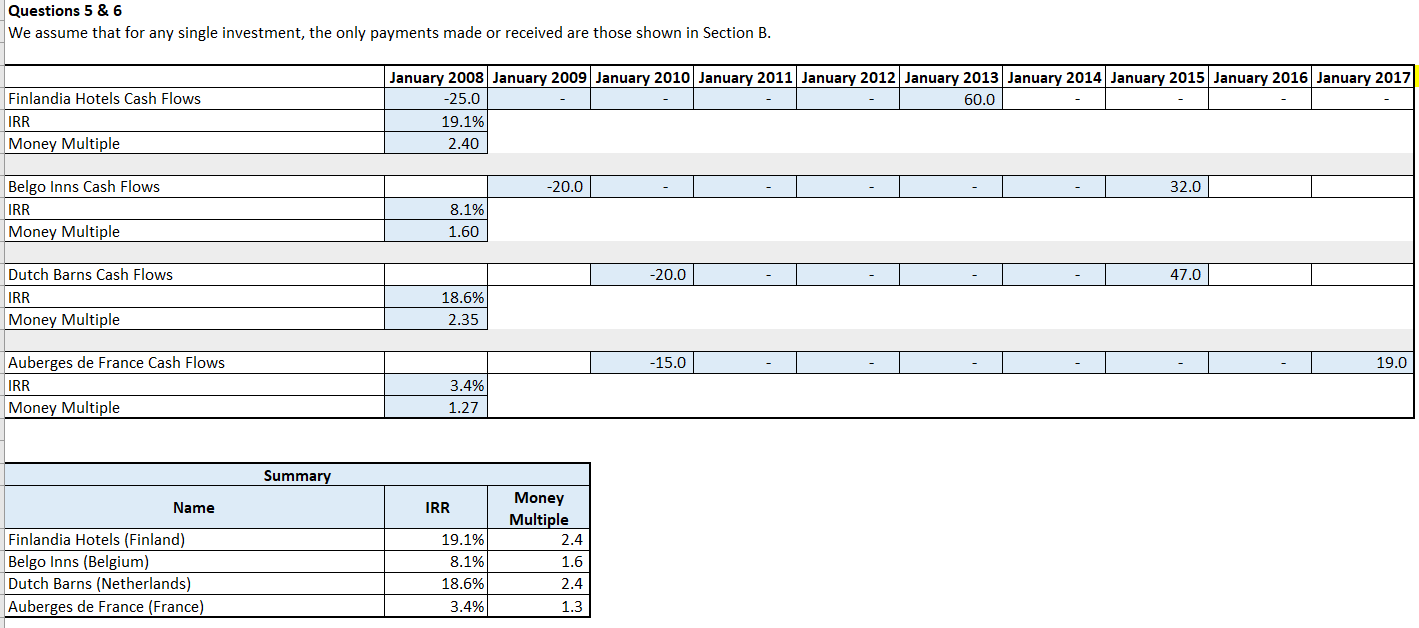

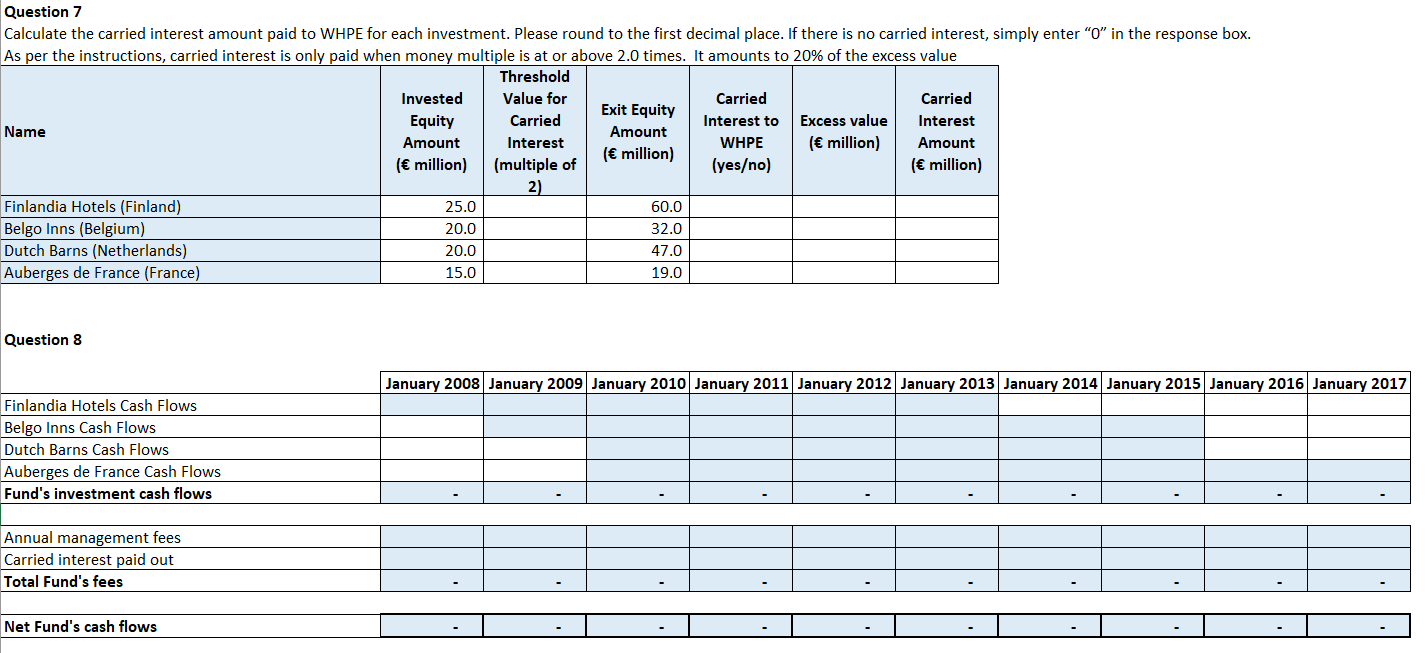

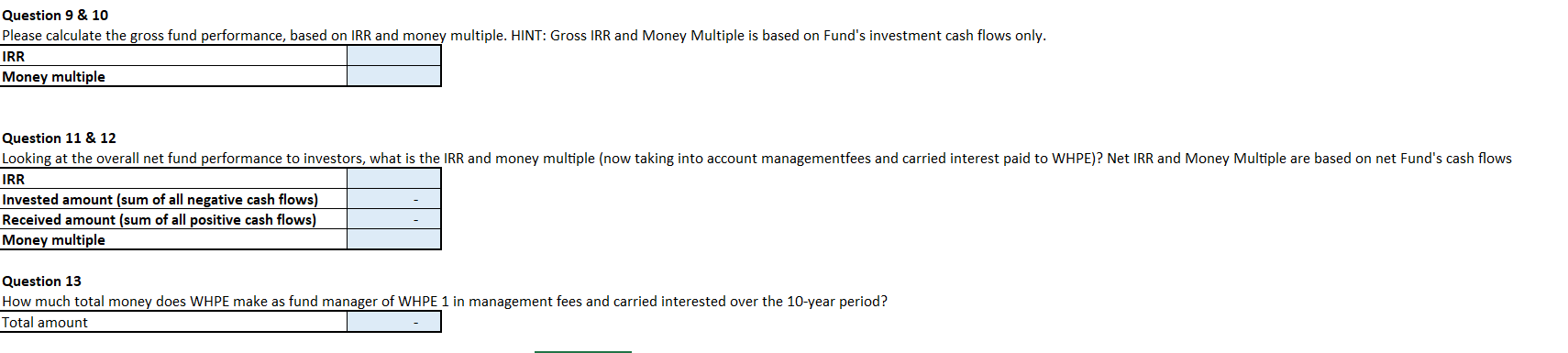

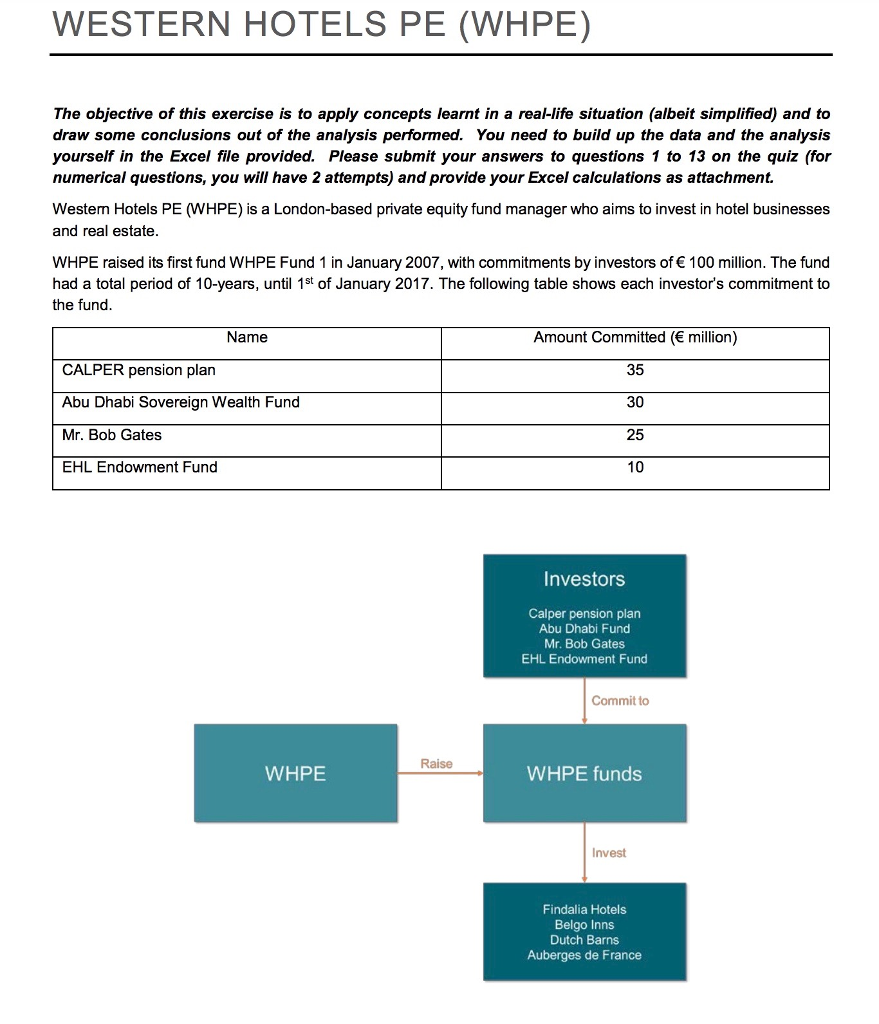

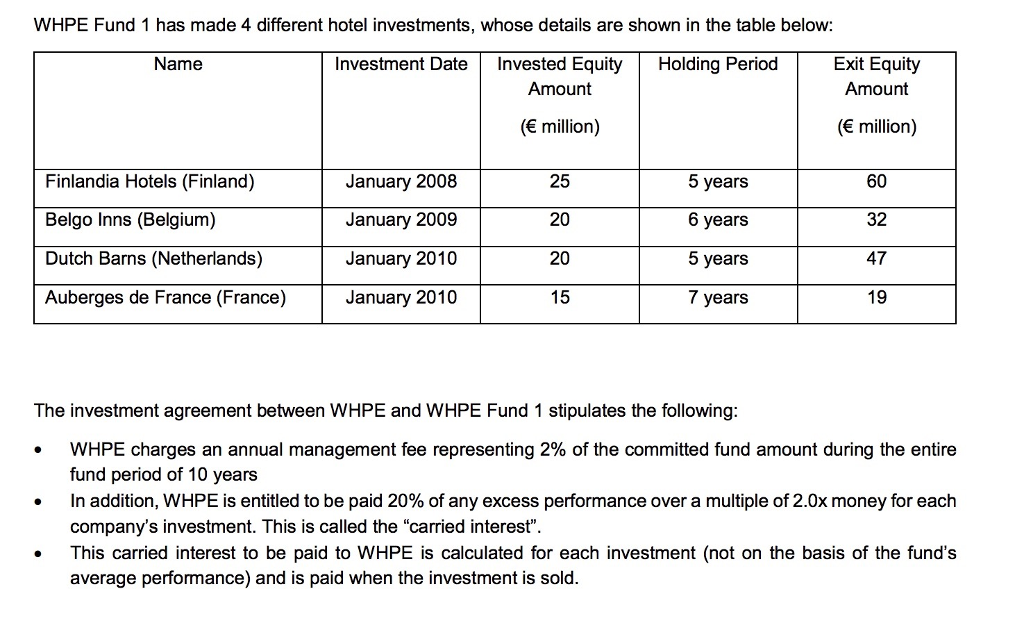

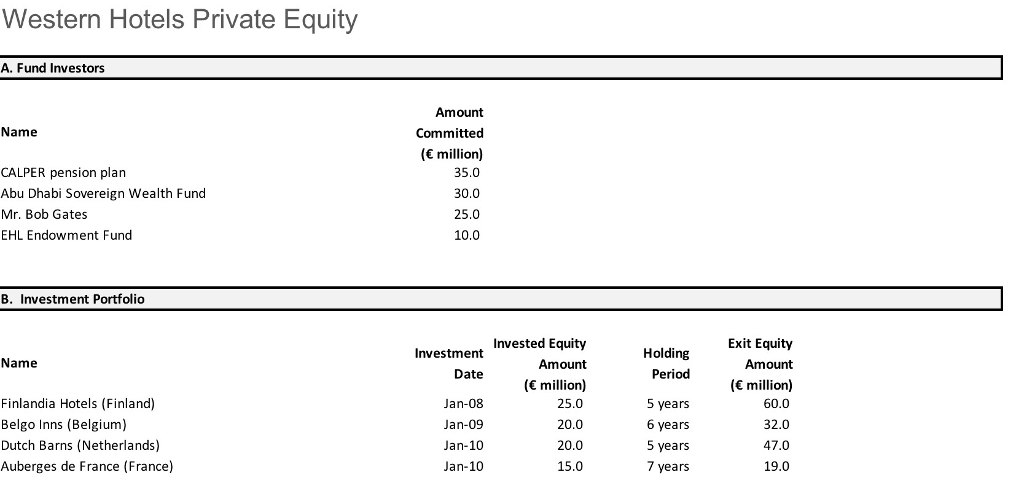

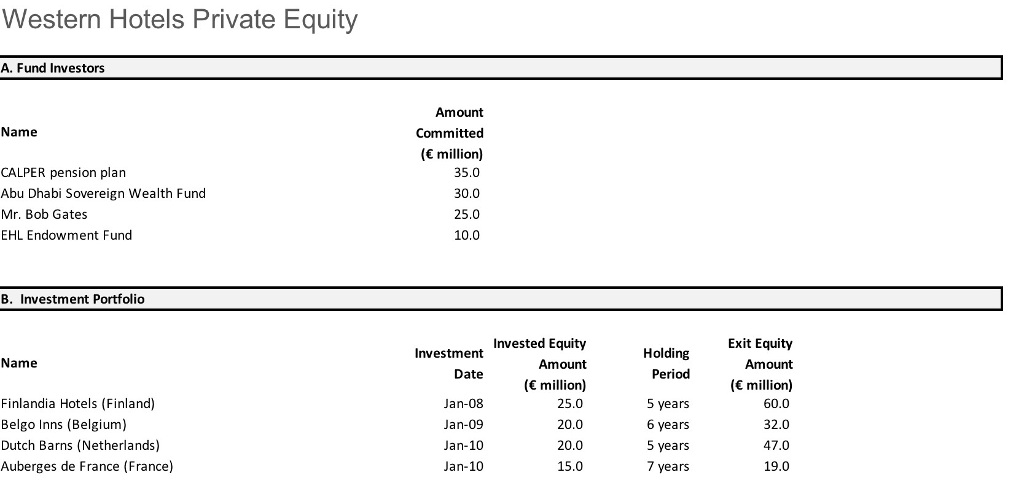

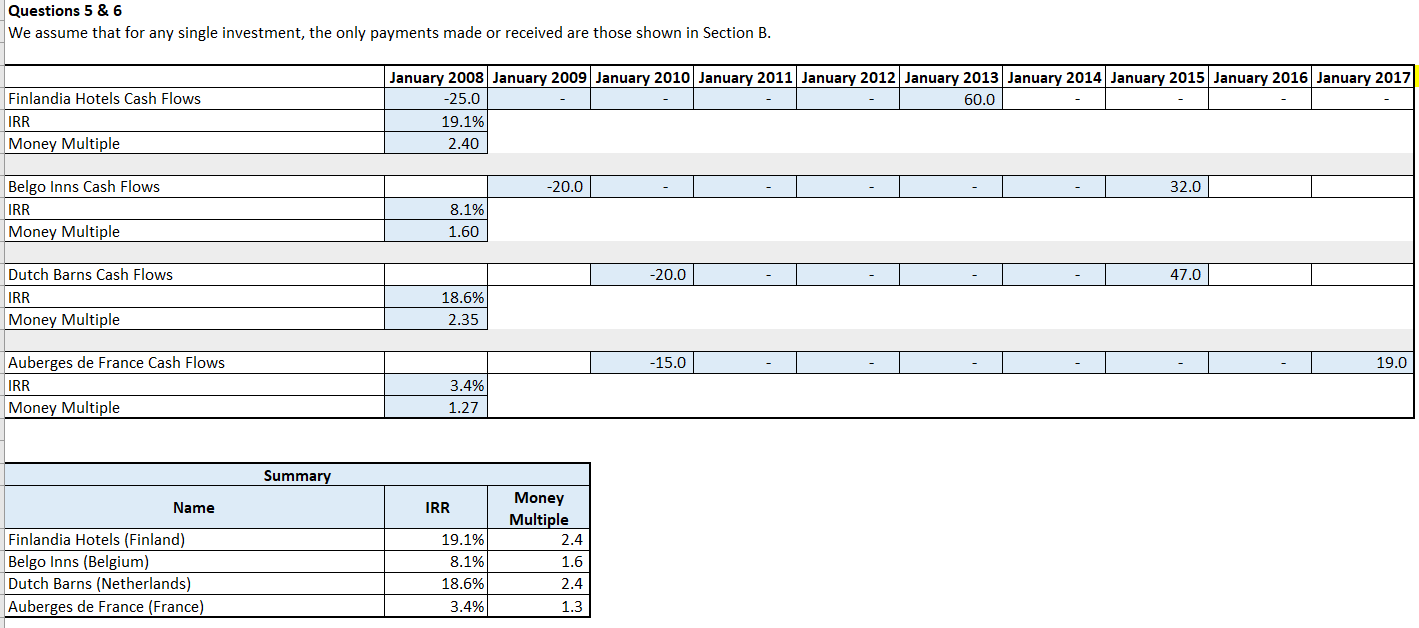

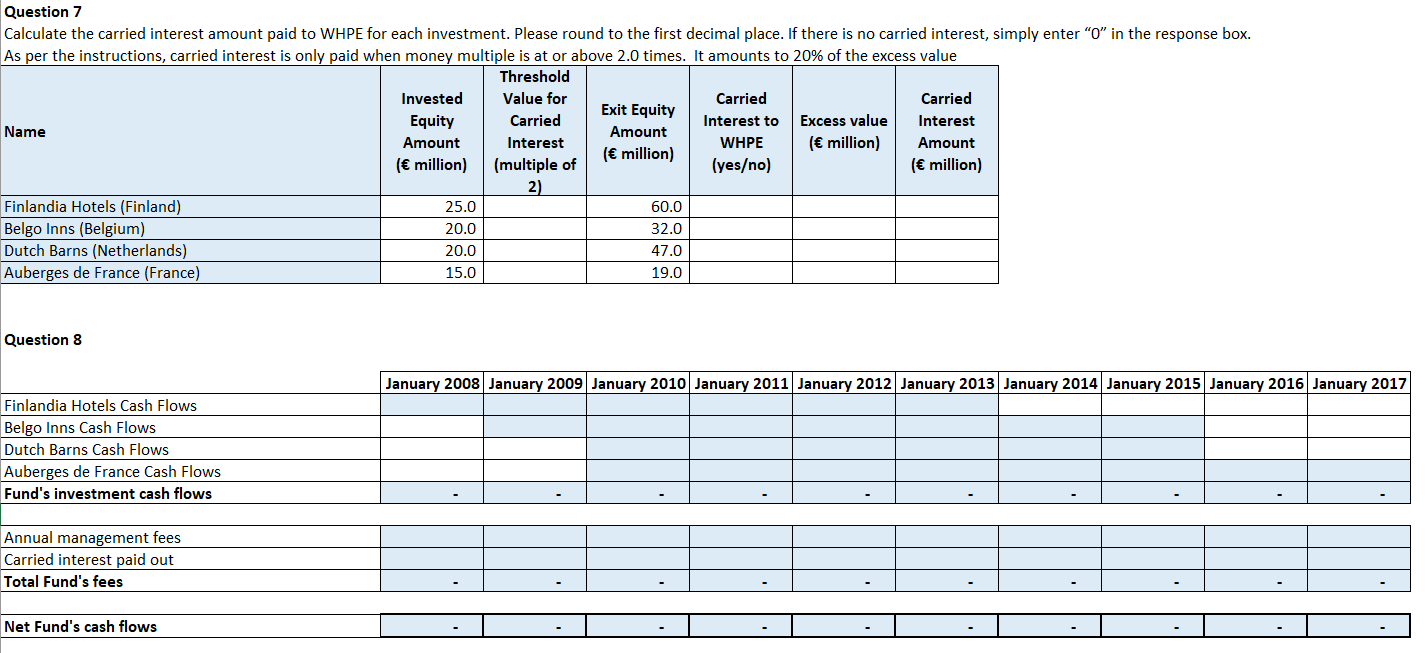

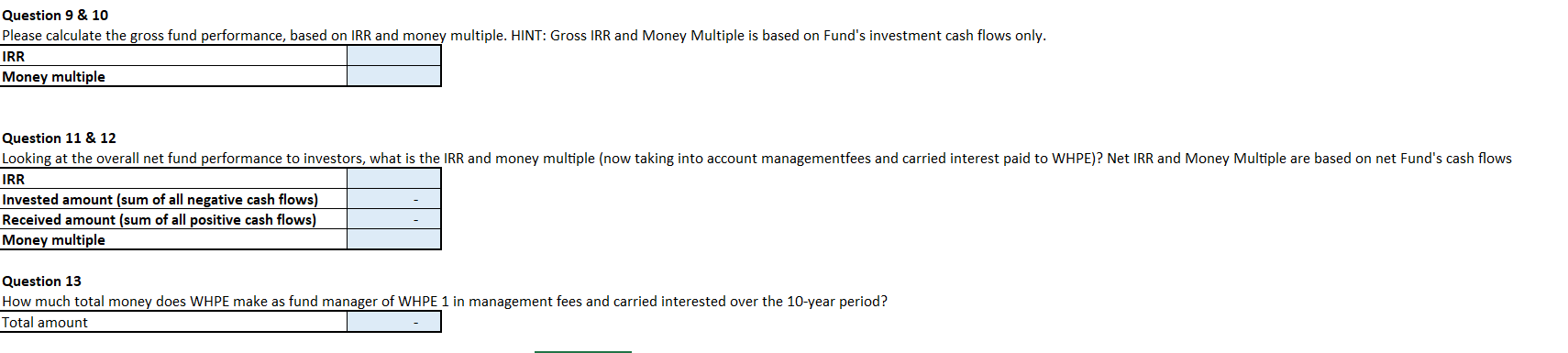

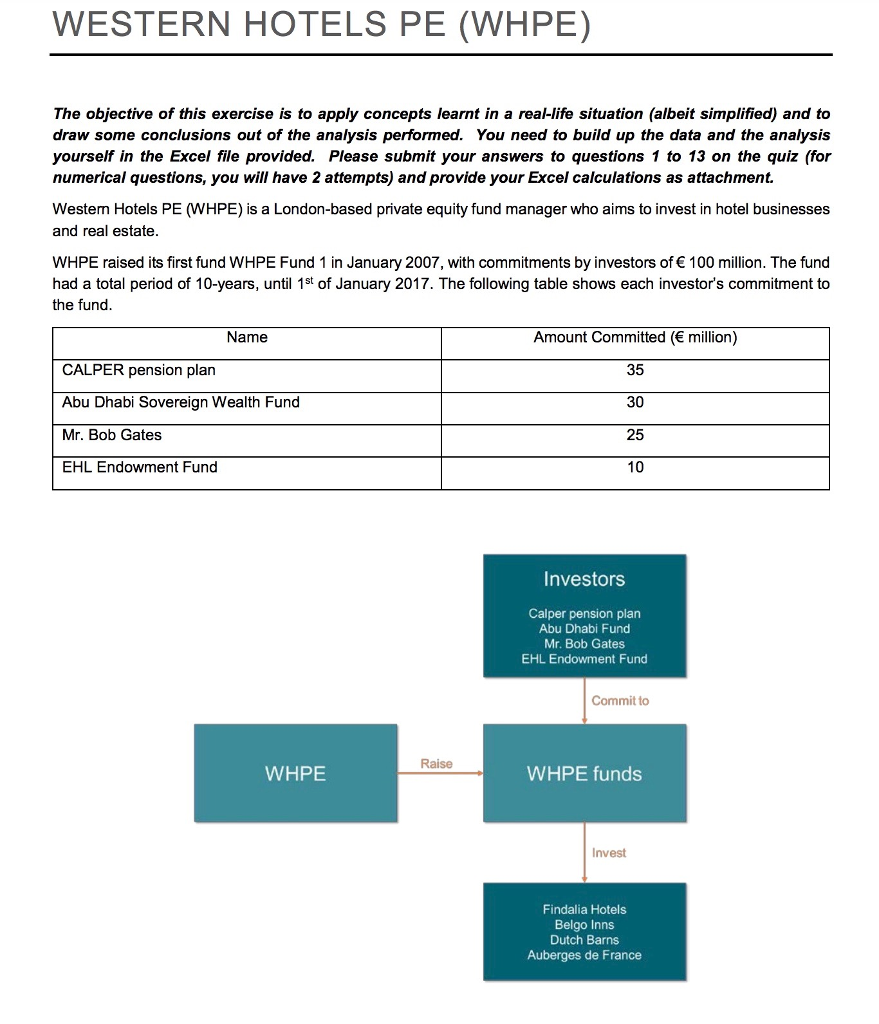

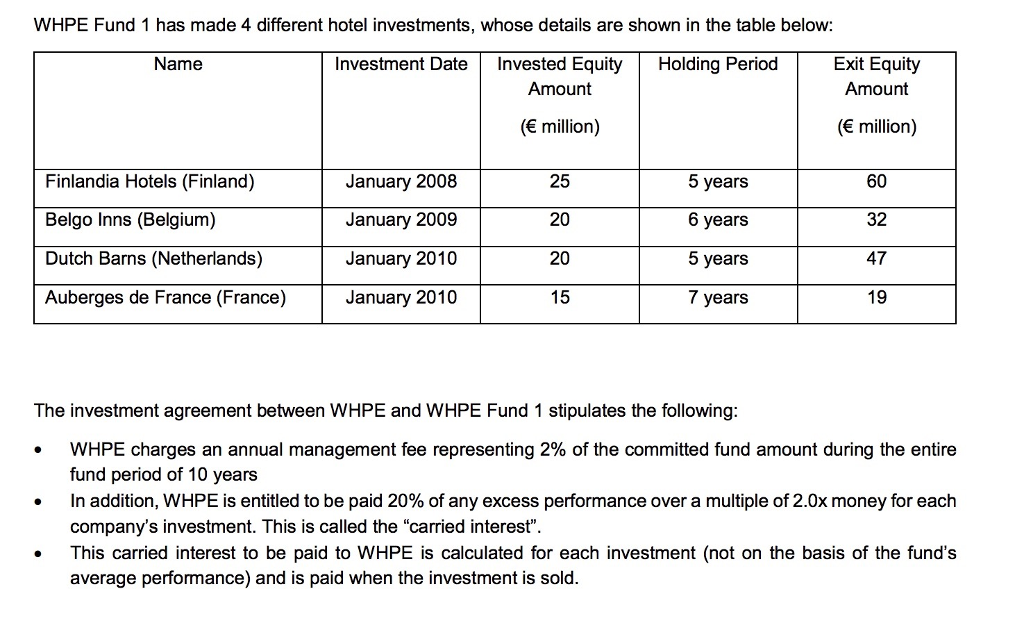

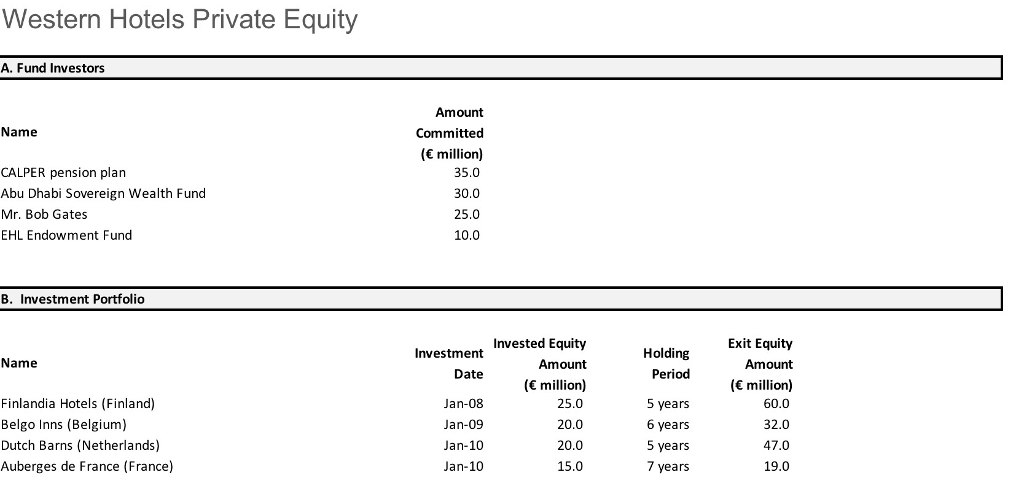

Questions 5&6 We assume that for any single investment, the only payments made or received are those shown in Section B. Finlandia Hotels Cash Flows IRR Money Multiple January 2008 January 2009 January 2010 January 2011 January 2012 January 2013 January 2014 January 2015 January 2016 January 2017 -25.0 - 60.0 19.1% 2.40 Belgo Inns Cash Flows -20.0 - - - - - 32.0| IRR 8.1% 1.60 Money Multiple Dutch Barns Cash Flows IRR Money Multiple 18.6% 2.35 Auberges de France Cash Flows IRR Money Multiple T -150| -| I I I I .1 190 3.4% 11.27 Summary IRR Money Multiple 2.4 Name Finlandia Hotels (Finland) Belgo Inns (Belgium) Dutch Barns (Netherlands) Auberges de France (France) 1.6 19.1% 8.1% 18.6% 3.4% Question 7 Calculate the carried interest amount paid to WHPE for each investment. Please round to the first decimal place. If there is no carried interest, simply enter "O" in the response box. As per the instructions, carried interest is only paid when money multiple is at or above 2.0 times. It amounts to 20% of the excess value Threshold Invested Value for Carried Carried Exit Equity Equity Carried Interest to Excess value Interest Name Amount Amount Interest WHPE ( million) Amount ( million) ( million) (multiple of (yeso) ( million) 2) Finlandia Hotels (Finland) 25.0 60.0 Belgo Inns (Belgium) 20.0 32.0 Dutch Barns (Netherlands) 20.0 47.0 Auberges de France (France) 15.0 19.0 Question 8 January 2008 January 2009 January 2010 January 2011 January 2012 January 2013 January 2014 January 2015 January 2016 January 2017 Finlandia Hotels Cash Flows Belgo Inns Cash Flows Dutch Barns Cash Flows Auberges de France Cash Flows Fund's investment cash flows . . . . . . . . Annual management fees Carried interest paid out Total Fund's fees Net Fund's cash flows Question 9 & 10 Please calculate the gross fund performance, based on IRR and money multiple. HINT: Gross IRR and Money Multiple is based on Fund's investment cash flows only. IRR Money multiple Question 11 & 12 Looking at the overall net fund performance to investors, what is the IRR and money multiple (now taking into account managementfees and carried interest paid to WHPE)? Net IRR and Money Multiple are based on net Fund's cash flows IRR Invested amount (sum of all negative cash flows) Received amount (sum of all positive cash flows) Money multiple Question 13 How much total money does WHPE make as fund manager of WHPE 1 in management fees and carried interested over the 10-year period? Total amount WESTERN HOTELS PE (WHPE) The objective of this exercise is to apply concepts learnt in a real-life situation (albeit simplified) and to draw some conclusions out of the analysis performed. You need to build up the data and the analysis yourself in the Excel file provided. Please submit your answers to questions 1 to 13 on the quiz (for numerical questions, you will have 2 attempts) and provide your Excel calculations as attachment. Western Hotels PE (WHPE) is a London-based private equity fund manager who aims to invest in hotel businesses and real estate. WHPE raised its first fund WHPE Fund 1 in January 2007, with commitments by investors of 100 million. The fund had a total period of 10-years, until 1st of January 2017. The following table shows each investor's commitment to the fund. Name Amount Committed ( million) CALPER pension plan 35 Abu Dhabi Sovereign Wealth Fund Mr. Bob Gates EHL Endowment Fund Investors Calper pension plan Abu Dhabi Fund Mr. Bob Gates EHL Endowment Fund Commit to WHPE Raise robow HPE funds WHPE funds Invest Findalia Hotels Belgo Inns Dutch Barns Auberges de France WHPE Fund 1 has made 4 different hotel investments, whose details are shown in the table below: Name Investment Date Holding Period Invested Equity Amount Exit Equity Amount ( million) ( million) Finlandia Hotels (Finland) January 2008 25 5 years Belgo Inns (Belgium) January 2009 20 6 years Dutch Barns (Netherlands) January 2010 5 years Auberges de France (France) January 2010 15 7 years The investment agreement between WHPE and WHPE Fund 1 stipulates the following: WHPE charges an annual management fee representing 2% of the committed fund amount during the entire fund period of 10 years In addition, WHPE is entitled to be paid 20% of any excess performance over a multiple of 2.0x money for each company's investment. This is called the "carried interest". This carried interest to be paid to WHPE is calculated for each investment (not on the basis of the fund's average performance) and is paid when the investment is sold. Western Hotels Private Equity A. Fund Investors Name CALPER pension plan Abu Dhabi Sovereign Wealth Fund Mr. Bob Gates EHL Endowment Fund Amount Committed ( million) 35.0 30.0 25.0 10.0 B. Investment Portfolio Name Holding Period Invested Equity Investment Amount Date ( million) Jan-08 25.0 Jan-09 20.0 Jan-10 20.0 Jan-10 15.0 Exit Equity Amount ( million) 60.0 Finlandia Hotels (Finland) Belgo Inns (Belgium) Dutch Barns (Netherlands) Auberges de France (France) 32.0 5 years 6 years 5 years 7 years 47.0 19.0 Western Hotels Private Equity A. Fund Investors Name CALPER pension plan Abu Dhabi Sovereign Wealth Fund Mr. Bob Gates EHL Endowment Fund Amount Committed ( million) 35.0 30.0 25.0 10.0 B. Investment Portfolio Name Holding Period Invested Equity Investment Amount Date ( million) Jan-08 25.0 Jan-09 20.0 Jan-10 20.0 Jan-10 15.0 Exit Equity Amount ( million) 60.0 Finlandia Hotels (Finland) Belgo Inns (Belgium) Dutch Barns (Netherlands) Auberges de France (France) 32.0 5 years 6 years 5 years 7 years 47.0 19.0