Answered step by step

Verified Expert Solution

Question

1 Approved Answer

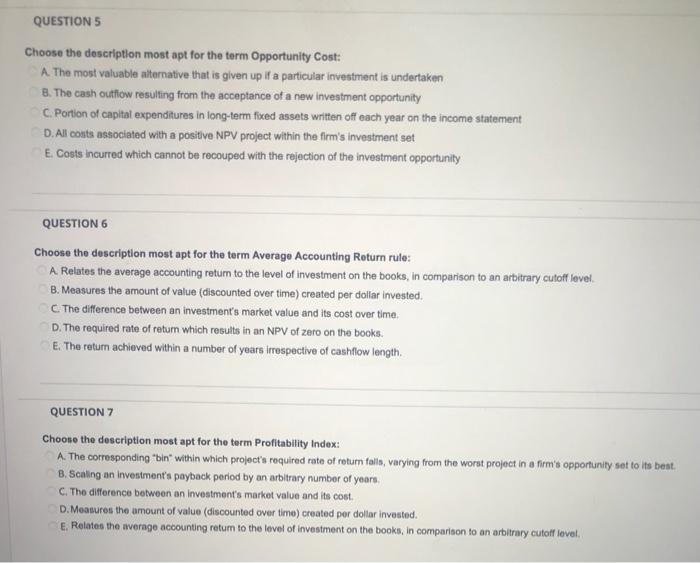

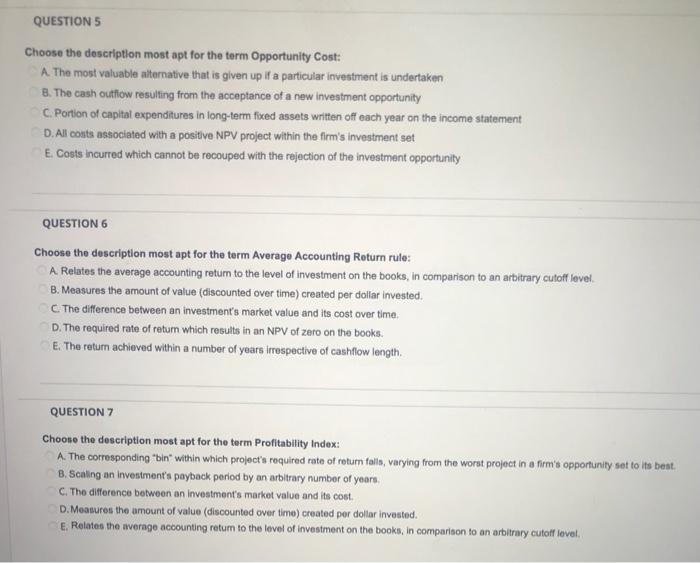

questions (5-7) QUESTION 5 Choose the description most apt for the term Opportunity Cost: A The most valuable alternative that is given up if a

questions (5-7)

QUESTION 5 Choose the description most apt for the term Opportunity Cost: A The most valuable alternative that is given up if a particular investment is undertaken 8. The cash outlow resulting from the acceptance of a new investment opportunity C. Portion of capital expenditures in long-term fixed assets written off each year on the income statement D. All costs associated with a positive NPV project within the firm's investment set E. Costs incurred which cannot be recouped with the rejection of the investment opportunity QUESTION 6 Choose the description most apt for the term Average Accounting Return rule: A Relates the average accounting return to the level of investment on the books, in comparison to an arbitrary cutoff level. B. Measures the amount of value (discounted over time) created per dollar invested. C. The difference between an investment's market value and its cost over time, D. The required rate of retum which results in an NPV of zero on the books. E. The retum achieved within a number of years irrespective of cashflow length QUESTION 7 Choose the description most apt for the term Profitability Index: A. The corresponding bin" within which project's required rate of return falls, varying from the worst project in a firm's opportunity set to its best. B. Scaling an investment's payback period by an arbitrary number of years, C. The difference between an investment's market value and its cost D. Measures the amount of value (discounted over time) created per dollar invested. E. Relates the average accounting return to the level of investment on the books, in comparison to an arbitrary cutoff level

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started