Answered step by step

Verified Expert Solution

Question

1 Approved Answer

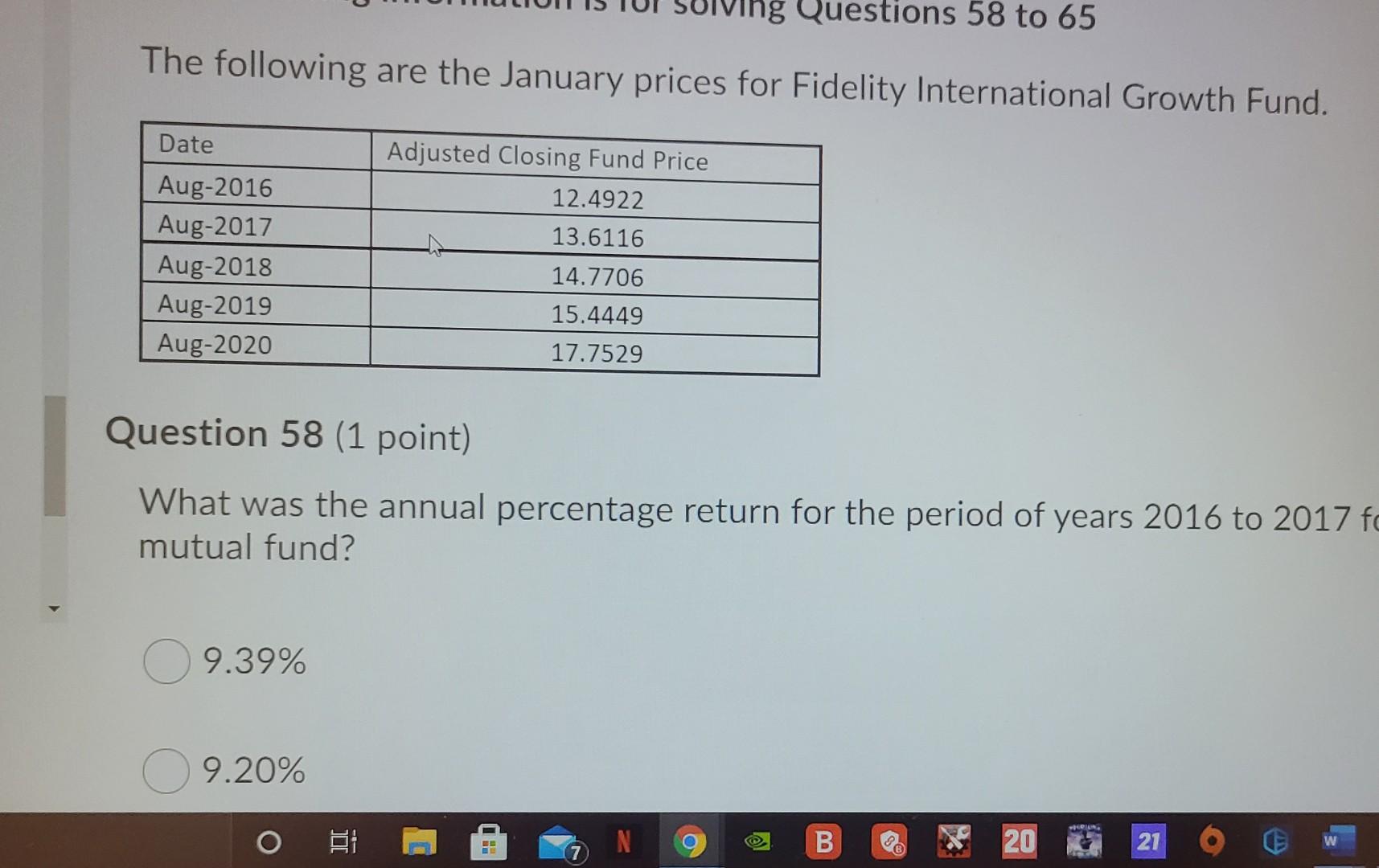

Questions 58 to 65 The following are the January prices for Fidelity International Growth Fund. Date Adjusted Closing Fund Price 12.4922 13.6116 Aug-2016 Aug-2017 Aug-2018

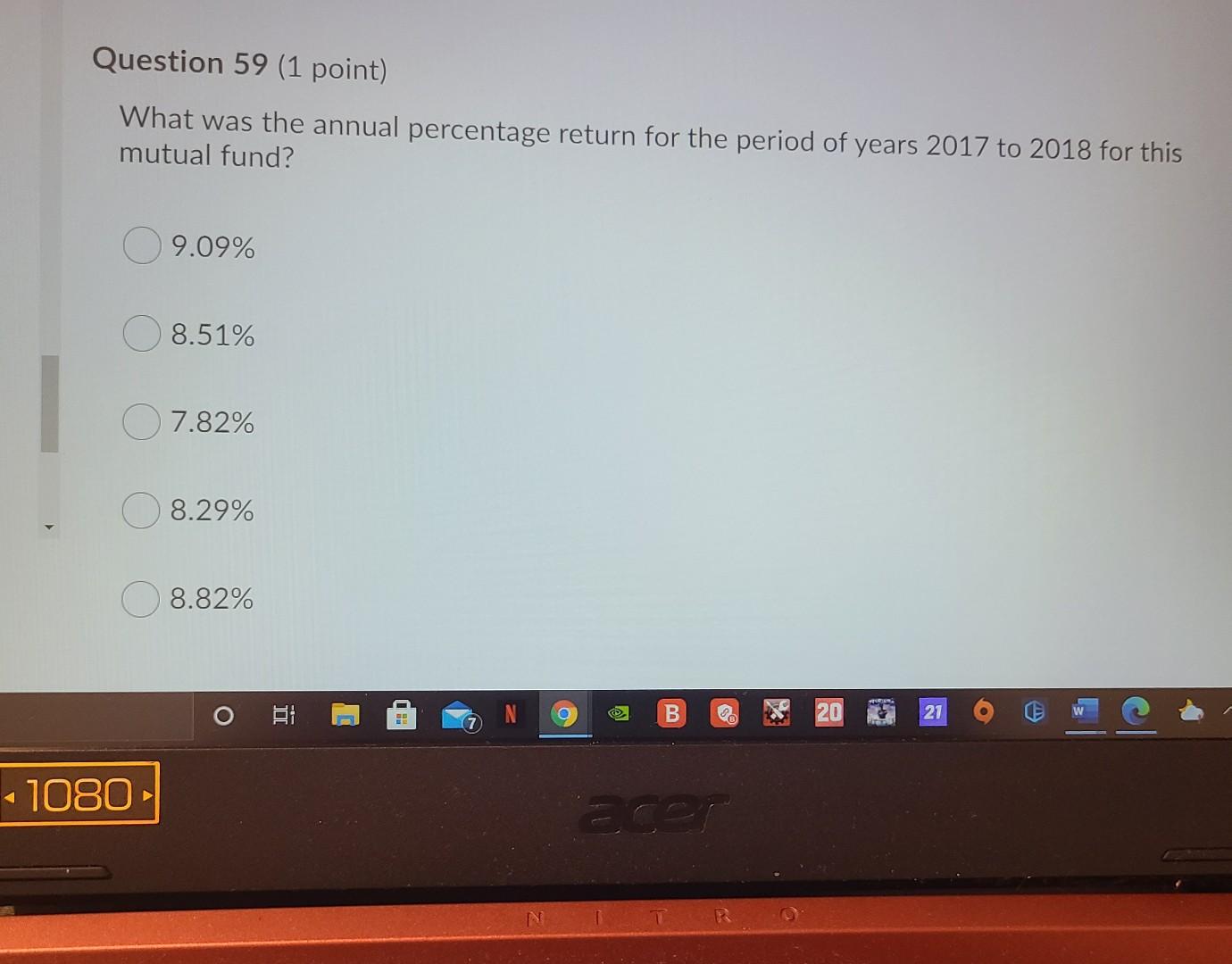

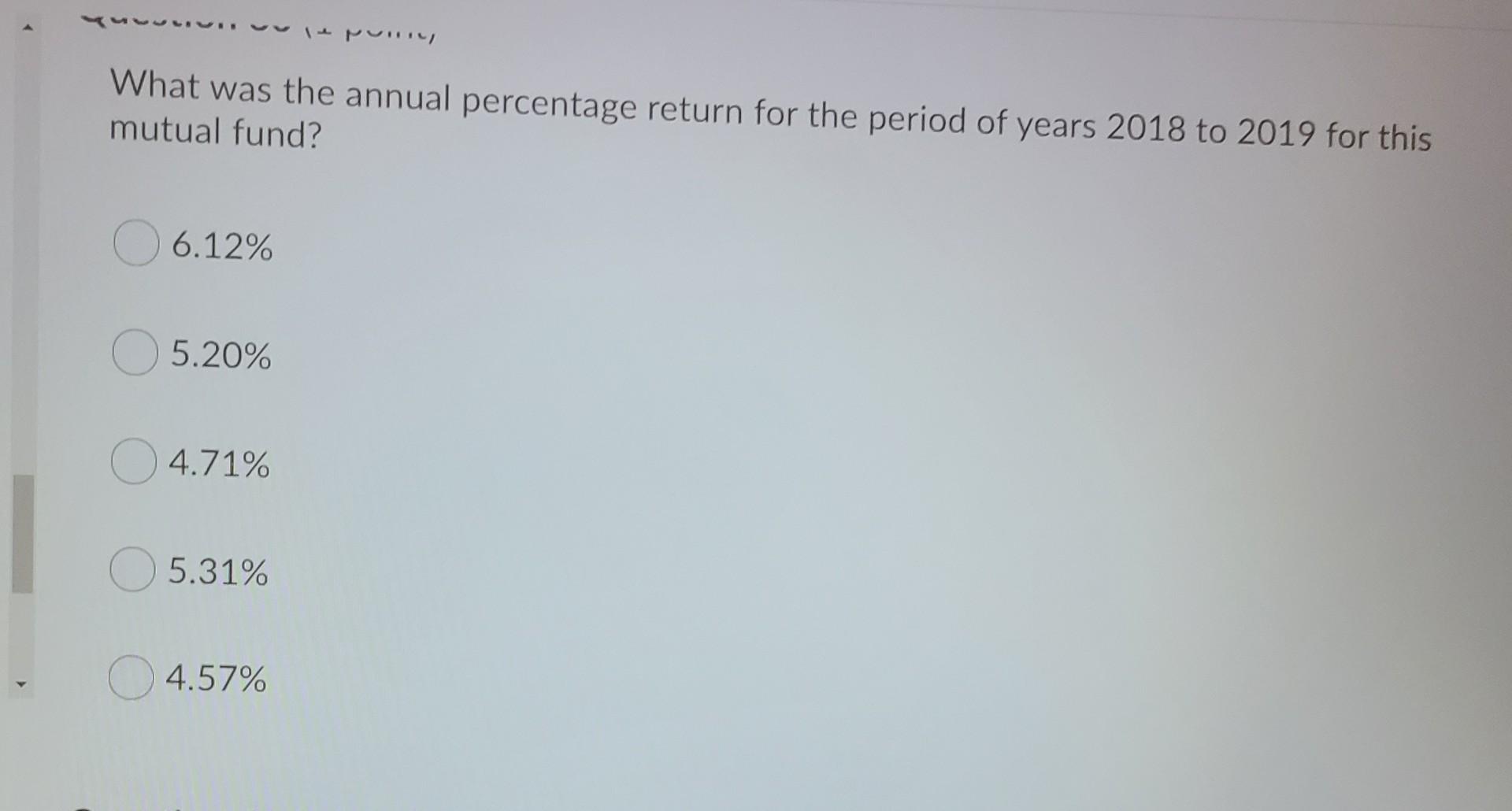

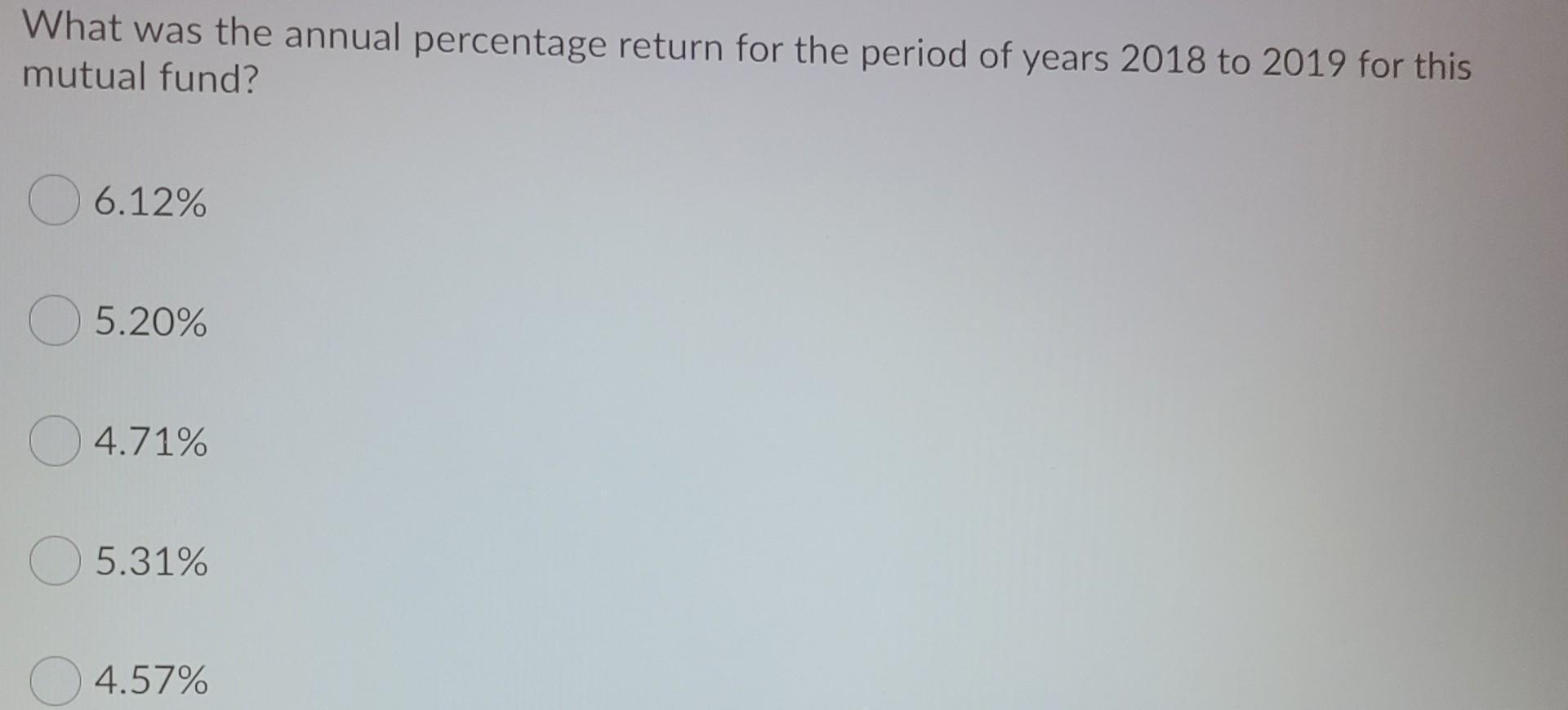

Questions 58 to 65 The following are the January prices for Fidelity International Growth Fund. Date Adjusted Closing Fund Price 12.4922 13.6116 Aug-2016 Aug-2017 Aug-2018 Aug-2019 Aug-2020 14.7706 15.4449 17.7529 Question 58 (1 point) What was the annual percentage return for the period of years 2016 to 2017 fe mutual fund? 9.39% 9.20% Bi B B 20 21 W Question 59 (1 point) What was the annual percentage return for the period of years 2017 to 2018 for this mutual fund? 9.09% 8.51% O 7.82% 8.29% 8.82% O B ge 20 21 LE 7 - 1080 ecer What was the annual percentage return for the period of years 2018 to 2019 for this mutual fund? 6.12% 5.20% 4.71% 5.31% 4.57% What was the annual percentage return for the period of years 2018 to 2019 for this mutual fund? 6.12% 5.20% 4.71% 5.31% 4.57% Time Left:2:06:55 Ahmad Issa: Attempt 1 Question 61 (1 point) What was the annual percentage return for the period of years 2019 to 2020 for this mutual fund? 15.70% 14.84% 12.82% 14.94% 13.25% Question 62(1 noint) O g B 20 21 W Sawyer has invested $1,500 in this fund in August 2016, how many units would they own? 118.51 119.70 120.07 111.69 124.74 Sawyer then decides to sell these funds on January 2020. How much would be their capital gains (or loss) be from their investment (dollar terms)? $631.68 O $709.54 $689.45 $713.05 $702.69 What would have been their percentage capital gain (or loss) from their investment? 45.74% 40.79% 42.11% 41.85% 41.54% lestion 65 (2 points) Question 65 (2 points) What would be their average annual rate of return from their investment? 9.431% 9.184% 8.725% 10.200% 9.669%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started