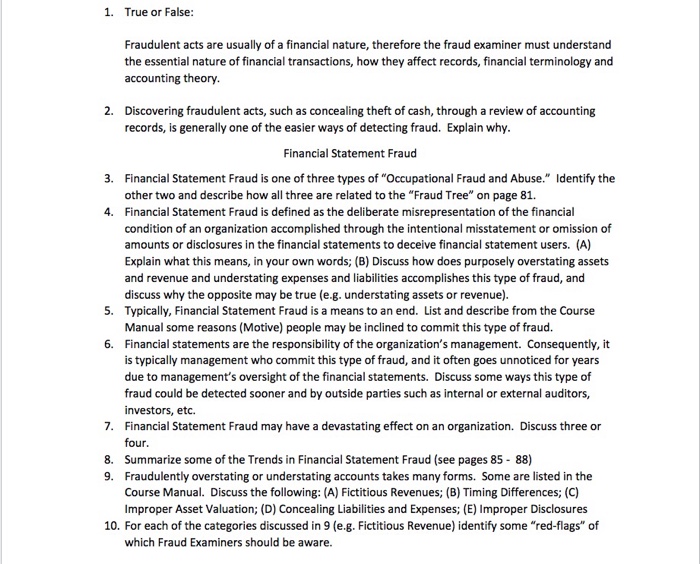

1. True or False: Fraudulent acts are usually of a financial nature, therefore the fraud examiner must understand the essential nature of financial transactions, how they affect records, financial terminology and accounting theory 2. Discovering fraudulent acts, such as concealing theft of cash, through a review of accounting records, is generally one of the easier ways of detecting fraud. Explain why Financial Statement Fraud 3. Financial Statement Fraud is one of three types of "Occupational Fraud and Abuse." Identify the other two and describe how all three are related to the "Fraud Tree on page 81. Financial Statement Fraud is defined as the deliberate misrepresentation of the financial condition of an organization accomplished through the intentional misstatement or omission of amounts or disclosures in the financial statements to deceive financial statement users. (A) Explain what this means, in your own words; (B) Discuss how does purposely overstating assets and revenue and understating expenses and liabilities accomplishes this type of fraud, and discuss why the opposite may be true (e.g. understating assets or revenue) Typically, Financial Statement Fraud is a means to an end. List and describe from the Course Manual some reasons (Motive) people may be inclined to commit this type of fraud. Financial statements are the responsibility of the organization's management. Consequently, it is typically management who commit this type of fraud, and it often goes unnoticed for years due to management's oversight of the financial statements. Discuss some ways this type of fraud could be detected sooner and by outside parties such as internal or external auditors, investors, etc. Financial Statement Fraud may have a devastating effect on an organization. Discuss three or four 4. 5. 6. 7. 8. Summarize some of the Trends in Financial Statement Fraud (see pages 85 88) 9. Fraudulently overstating or understating accounts takes many forms. Some are listed in the Course Manual. Discuss the following: (A) Fictitious Revenues; (B) Timing Differences; (C) Improper Asset Valuation; (D) Concealing Liabilities and Expenses; (E) Improper Disclosures 10. For each of the categories discussed in 9 (e.g. Fictitious Revenue) identify some "red-flags" of which Fraud Examiners should be aware