Answered step by step

Verified Expert Solution

Question

1 Approved Answer

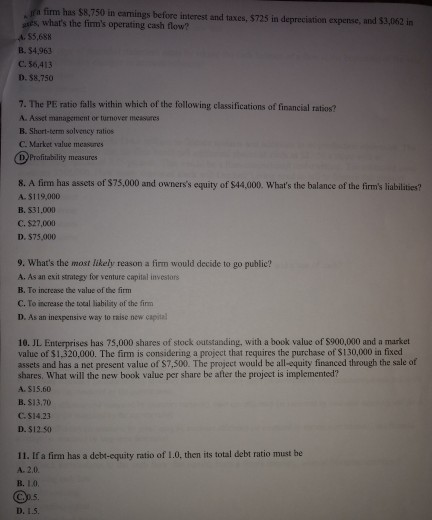

questions 6,8,9,10 I have 7 &11 a firm has $8,750 in eanings before interest and taxes, $725 in depreciation expense, and S3,062 in what's the

questions 6,8,9,10 I have 7 &11

a firm has $8,750 in eanings before interest and taxes, $725 in depreciation expense, and S3,062 in what's the firm's operating cash flow? A. $5,688 B. 34,963 C. 56,413 D. $8,750 7The PE ratio falls within which of the following classifications of financial ratios? A. Asset management or turnover measures B. Short-term solvency ratios C.Market value measures DProfitability measures 8. A firm has assets of $75,000 and owners's equity of $44.000. What's the balance of the firm's liabilities? A- $119,000 B. S31,000 C. $27,000 D. $75,000 9. What's the most likely reason a firm would decide to go public? A. As an exit strategy for venture capital investors B. To increase the value of the firm C. To increase the tocal liability of the firm D. As an inexpensive way to raise new capital 10. JL Enterprises has 75,000 shares of stock outstanding, with a book value of $900,000 and a market value of $1,320,000. The firm is considering a project that requires the purchase of $130,000 in fixed assets and has a net present value of $7,500. The project would be all-equity financed through the sale of shares. What will the new book value per share be after the project is implemented? A. $15.60 B. $13.70 C. $14.23 D. $1230 11. If a firm has a debt-equity ratio of 1.0, then its total debt ratio must be A. 2.0 Gos. D. 1.5Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started