Answered step by step

Verified Expert Solution

Question

1 Approved Answer

questions 8 and 9 8. Quest Coffee Blenders recorded sales revenue of $132,000 (incl. GST) and expenses of $77,000 (incl. GST) for the month ended

questions 8 and 9

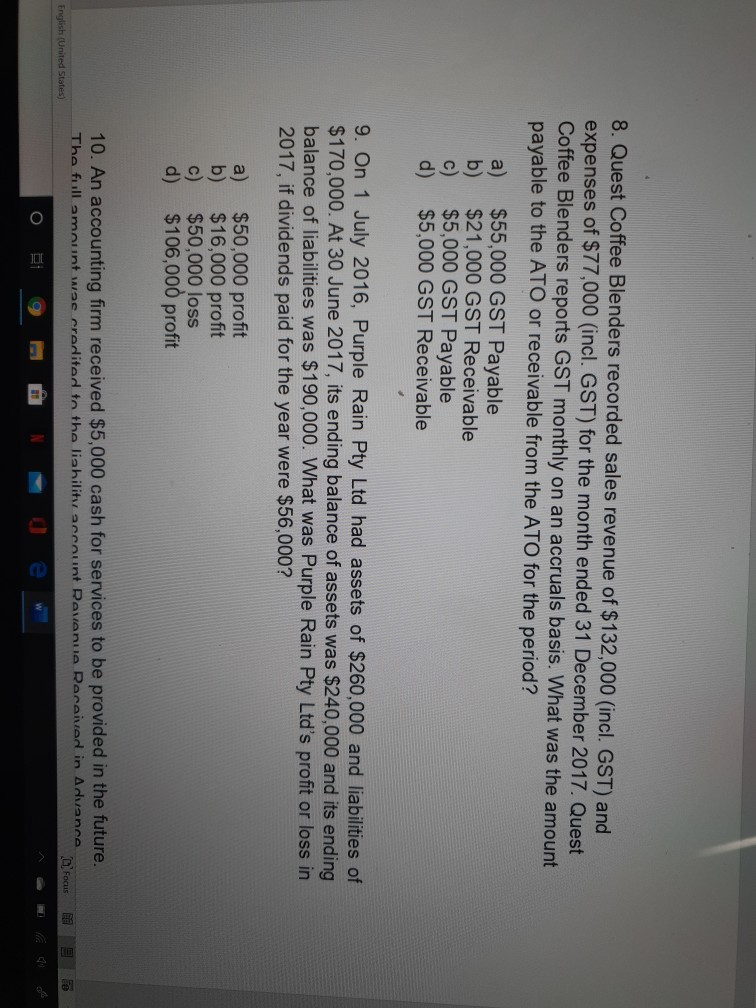

8. Quest Coffee Blenders recorded sales revenue of $132,000 (incl. GST) and expenses of $77,000 (incl. GST) for the month ended 31 December 2017. Quest Coffee Blenders reports GST monthly on an accruals basis. What was the amount payable to the ATO or receivable from the ATO for the period? a) $55,000 GST Payable b) $21,000 GST Receivable C) $5,000 GST Payable d) $5,000 GST Receivable 9. On 1 July 2016, Purple Rain Pty Ltd had assets of $260,000 and liabilities of $170,000. At 30 June 2017, its ending balance of assets was $240,000 and its ending balance of liabilities was $190,000. What was Purple Rain Pty Ltd's profit or loss in 2017, if dividends paid for the year were $56,000? a) b) $50,000 profit $16,000 profit $50,000 loss $106,000 profit d) 10. An accounting firm received $5,000 cash for services to be provided in the future. The full amount wae credited to the liability account Revenue Received in Advance Focus English (United States OStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started