Questions 80 & 81 please. Thank you!

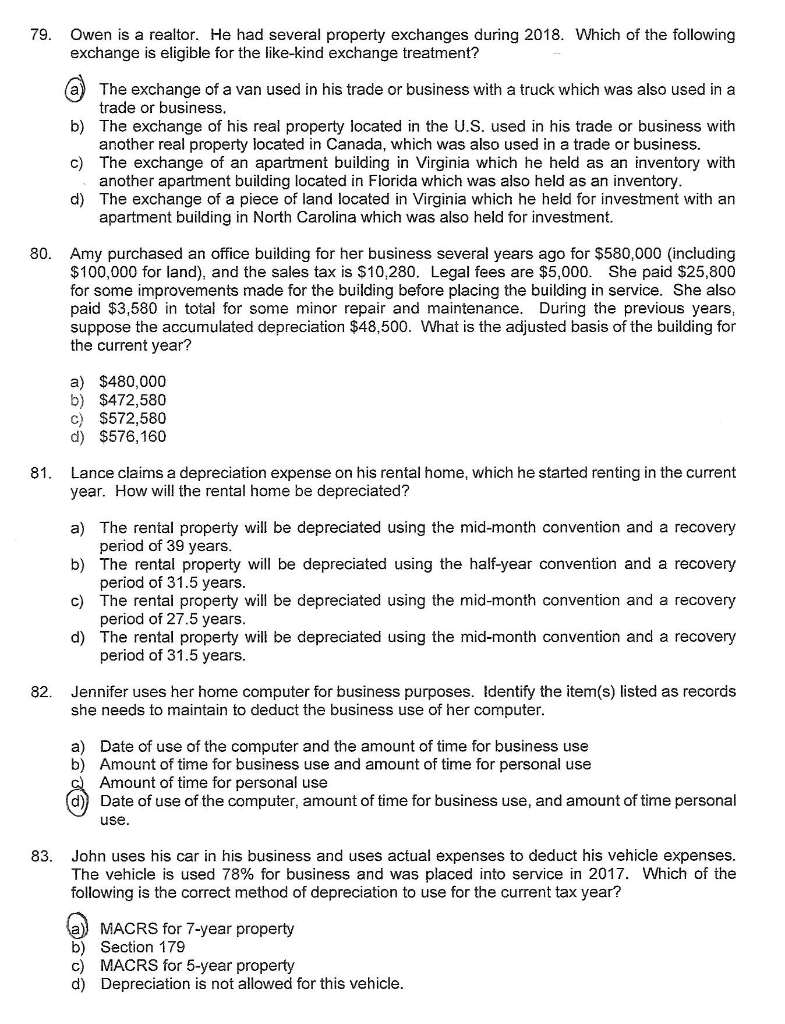

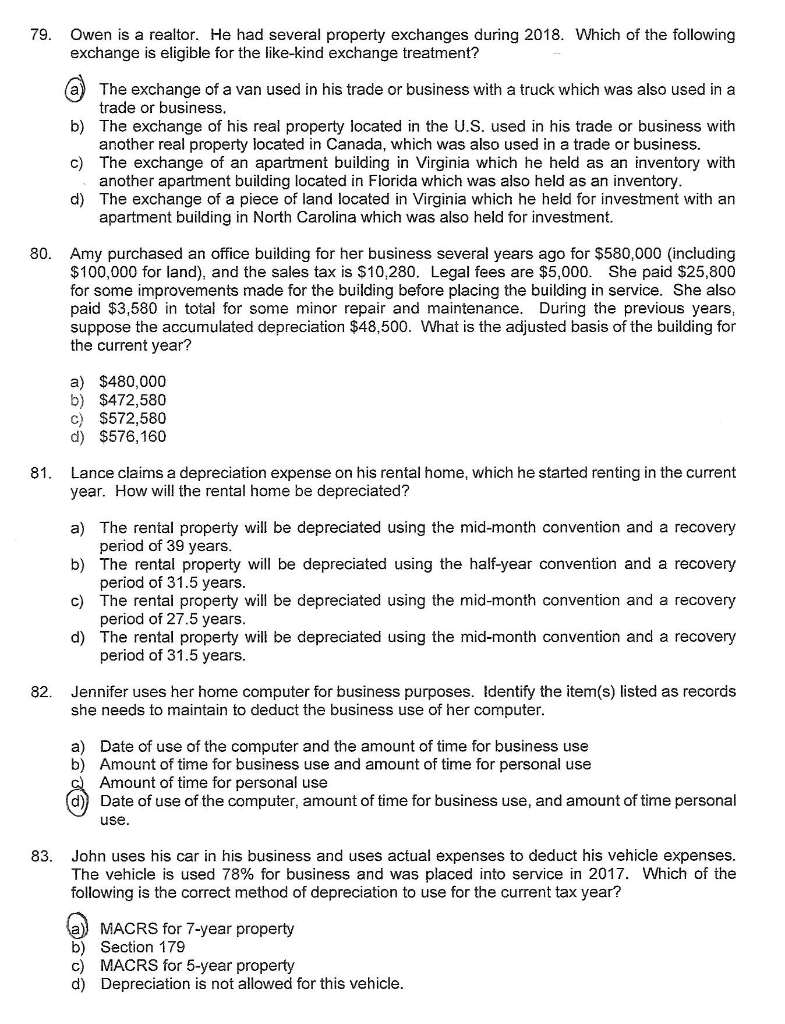

79. Owen is a realtor. He had several property exchanges during 2018. Which of the following exchange is eligible for the like-kind exchange treatment? (a) The exchange of a van used in his trade or business with a truck which was also used in a trade or business. b) The exchange of his real property located in the U.S. used in his trade or business with another real property located in Canada, which was also used in a trade or business. c) The exchange of an apartment building in Virginia which he held as an inventory with another apartment building located in Florida which was also held as an inventory. d) The exchange of a piece of land located in Virginia which he held for investment with an apartment building in North Carolina which was also held for investment. 80. Amy purchased an office building for her business several years ago for $580,000 (including $100,000 for land), and the sales tax is $10.280. Legal fees are $5,000. She paid $25,800 for some improvements made for the building before placing the building in service. She also paid $3,580 in total for some minor repair and maintenance. During the previous years, suppose the accumulated depreciation $48,500. What is the adjusted basis of the building for the current year? a) $480,000 b) $472,580 c) $572,580 d) $576,160 81. Lance claims a depreciation expense on his rental home, which he started renting in the current year. How will the rental home be depreciated? a) The rental property will be depreciated using the mid-month convention and a recovery period of 39 years. b) The rental property will be depreciated using the half-year convention and a recovery period of 31.5 years. c) The rental property will be depreciated using the mid-month convention and a recovery period of 27.5 years. d) The rental property will be depreciated using the mid-month convention and a recovery period of 31.5 years. 82. Jennifer uses her home computer for business purposes. Identify the item(s) listed as records she needs to maintain to deduct the business use of her computer. a) Date of use of the computer and the amount of time for business use b) Amount of time for business use and amount of time for personal use c) Amount of time for personal use Date of use of the computer, amount of time for business use, and amount of time personal use. 83. John uses his car in his business and uses actual expenses to deduct his vehicle expenses. The vehicle is used 78% for business and was placed into service in 2017. Which of the following is the correct method of depreciation to use for the current tax year? (a) MACRS for 7-year property b) Section 179 c) MACRS for 5-year property d) Depreciation is not allowed for this vehicle