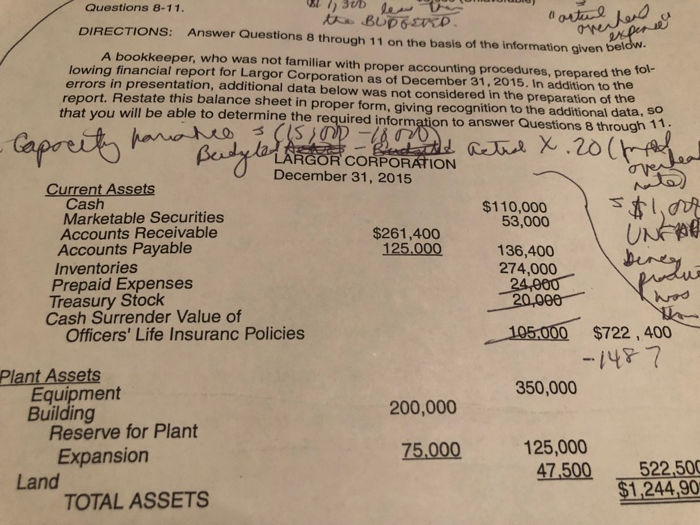

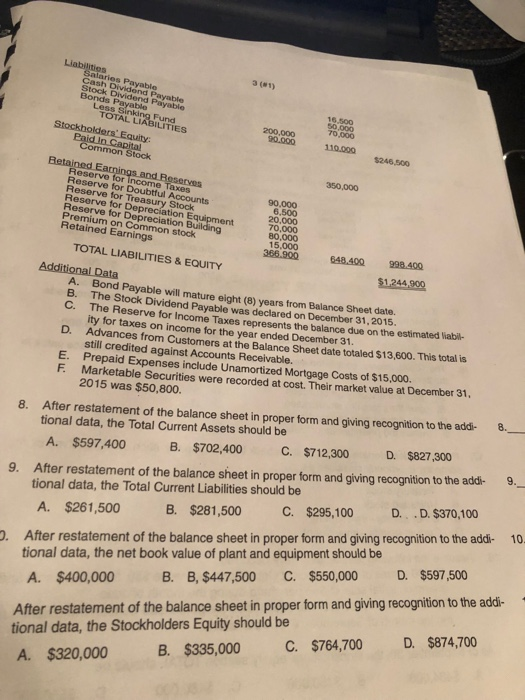

Questions 8-11. DIRECTIONS: Answer Questions 8 through 11 on the basis of the information given bel A bookkeeper, who was not familiar with proper accounting procedures, prepared the lowing financial report for Largor Corporation as of December 31,2015. In addition to the errors in presentation, additional data below was not considered in the preparation of the report. Restate this balance sheet in proper form, giving recognition to the additional data, fol that you will be able to determine the required information to answer Questions 8 through SO RGOR CORPORATION December 31, 2015 Current Assets Cash Marketable Securities Accounts Receivable Accounts Payable Inventories $110,000 53,000 $261,400 136,400 274,000 Prepaid Expenses Treasury Stock Cash Surrender Value of 105:000 $722, 400 Officers' Life Insuranc Policies Plant Assets 350,000 Equipment Building 200,000 Reserve for Plant Expansion 75.000 125,000 47500 522,50 TOTAL ASSETS 3 (#1) Stock Bonds Payable 16,500 Less Sinking Fund 20000 110. 240560s TOTAL LIABILITIES 70,000 Stockho mmon Stock 350,000 eserve for Reserve for Doubtful Accounts Reserve for Treasury Stock Reserve for Deprecation Eq Reserve for Depreciation Buil Premium on Common stock Retained Earnings 90,000 6,500 70,000 80,000 15,000 366.900 648.400 998.400 TOTAL LIABILITIES&EQUITY 1244,900 Additional Data A. Bond Payable will mature eight (8) years from Balance Sheet date. B. The Stock Dividend Payable was declared on December 31, 2015 C. The Reserve for Income Taxes represents the balance due on the estimated iabl- ity for taxes on income for the year ended December 31 D. Advances from Customers at the Balance Sheet date totaled $13,600. This total is still credited against Accounts Receivable. E. Prepaid Expenses include Unamortized Mortgage Costs of $15,000. F. Marketable Securities were reco ded at cost. Their market value at December 31, 2015 was $50,800. 8.- After restatement of the balance sheet in proper form and giving recognition to the add- tional data, the Total Current Assets should be 8. D. $827,300 C. $712,300 B. $702,400 A. $597,400 9. After restatement of the balance sheet in proper form and giving recognition to the addi- 9 tional data, the Total Current Liabilities should be After restatement of the balance sheet in proper form and giving recognition to the addi- tional data, the net book value of plant and equipment should be B. $281,500 C. $295,100 D. D. $370,100 10 A. $261,500 . D. $597,500 A. $400,000 After restatement of the balance sheet in proper form and giving recognition to the addi- A. $320,000 B. B, $447,500 C. $550,000 D. $874,700 tional data, the Stockholders Equity should be C. $764,700 B. $335,000