Questions 87 & 88 please. Thank you!

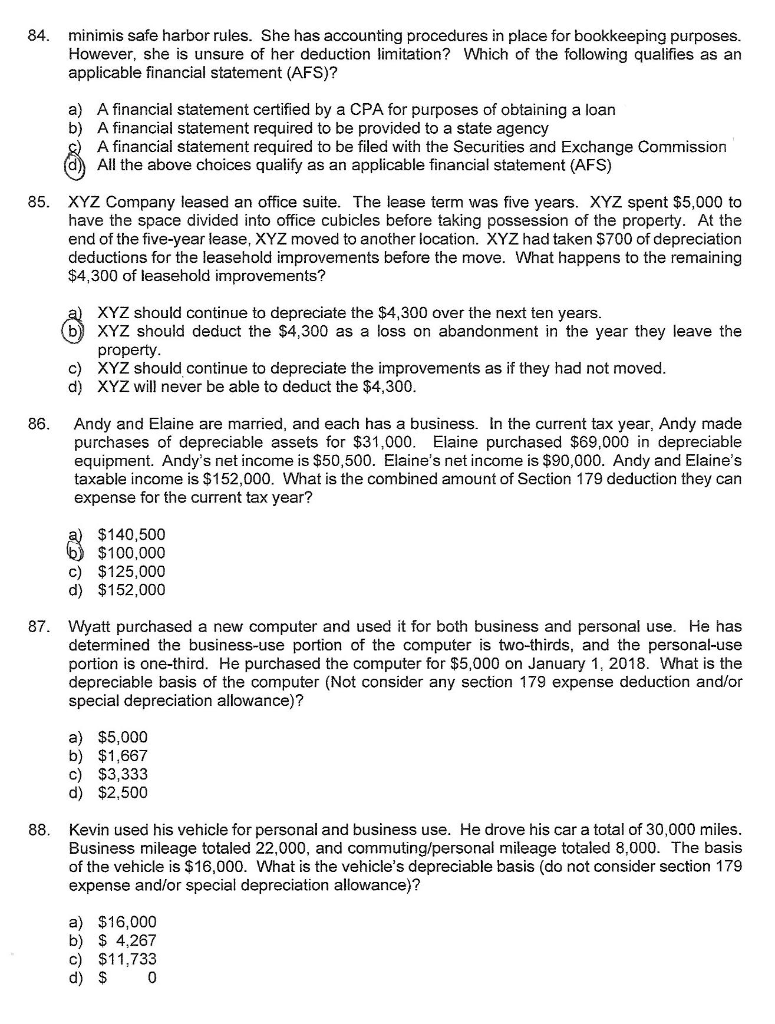

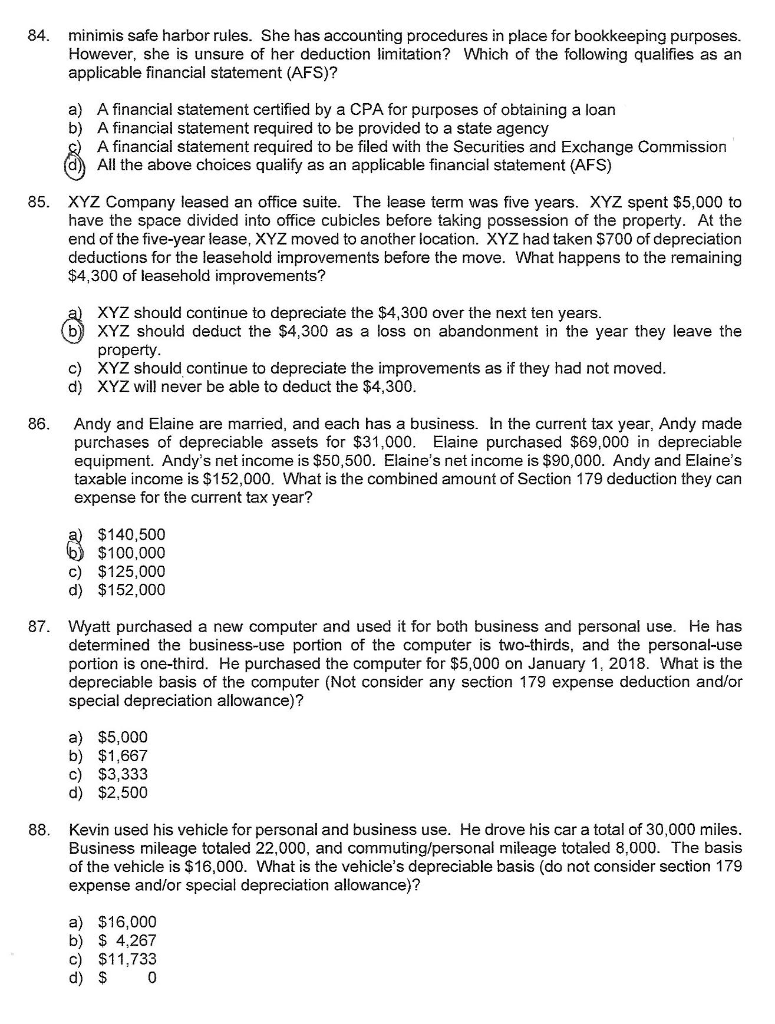

84. minimis safe harbor rules. She has accounting procedures in place for bookkeeping purposes. However, she is unsure of her deduction limitation? Which of the following qualifies as an applicable financial statement (AFS)? a) A financial statement certified by a CPA for purposes of obtaining a loan b) A financial statement required to be provided to a state agency $) A financial statement required to be filed with the Securities and Exchange Commission (d) All the above choices qualify as an applicable financial statement (AFS) 85. XYZ Company leased an office suite. The lease term was five years. XYZ spent $5,000 to have the space divided into office cubicles before taking possession of the property. At the end of the five-year lease, XYZ moved to another location. XYZ had taken $700 of depreciation deductions for the leasehold improvements before the move. What happens to the remaining $4,300 of leasehold improvements? a) XYZ should continue to depreciate the $4,300 over the next ten years. XYZ should deduct the $4,300 as a loss on abandonment in the year they leave the property. c) XYZ should continue to depreciate the improvements as if they had not moved. d) XYZ will never be able to deduct the $4,300. Andy and Elaine are married, and each has a business. In the current tax year, Andy made purchases of depreciable assets for $31,000. Elaine purchased $69,000 in depreciable equipment. Andy's net income is $50,500. Elaine's net income is $90,000. Andy and Elaine's taxable income is $152,000. What is the combined amount of Section 179 deduction they can expense for the current tax year? a) $140,500 6) $100,000 c) $125,000 d) $152,000 87. Wyatt purchased a new computer and used it for both business and personal use. He has determined the business-use portion of the computer is two-thirds, and the personal use portion is one-third. He purchased the computer for $5,000 on January 1, 2018. What is the depreciable basis of the computer (Not consider any section 179 expense deduction and/or special depreciation allowance)? a) $5,000 b) $1,667 C) $3,333 d) $2,500 88. Kevin used his vehicle for personal and business use. He drove his car a total of 30,000 miles. Business mileage totaled 22,000, and commuting/personal mileage totaled 8,000. The basis of the vehicle is $16,000. What is the vehicle's depreciable basis (do not consider section 179 expense and/or special depreciation allowance)? a) $16,000 b) $ 4,267 c) $11,733 d) $ 0