Answered step by step

Verified Expert Solution

Question

1 Approved Answer

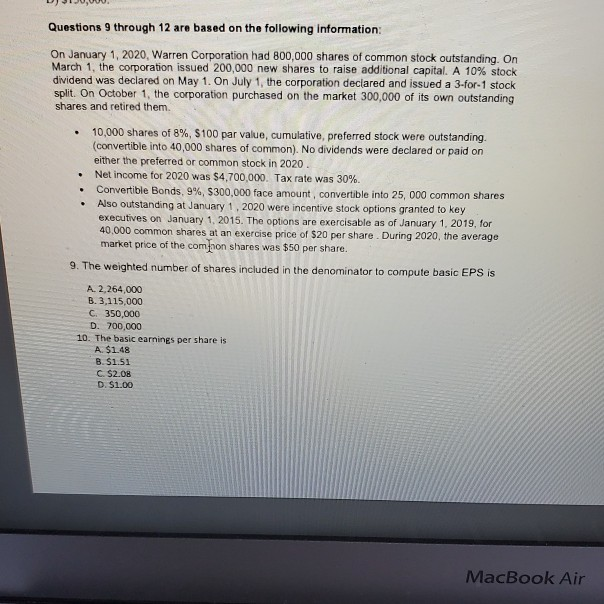

Questions 9 through 12 are based on the following information: On January 1, 2020, Warren Corporation had 800.000 shares of common stock outstanding. On March

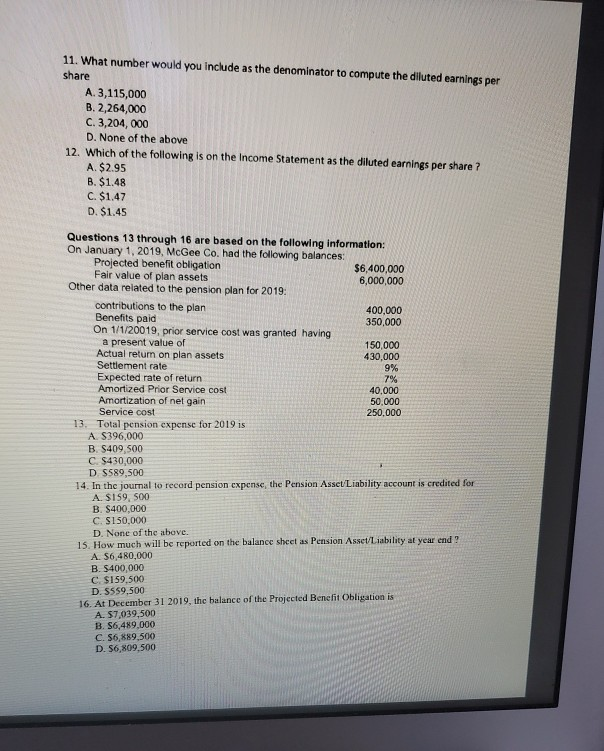

Questions 9 through 12 are based on the following information: On January 1, 2020, Warren Corporation had 800.000 shares of common stock outstanding. On March 1, the corporation issued 200,000 new shares to raise additional capital. A 10% stock dividend was declared on May 1. On July 1, the corporation declared and issued a 3-for-1 stock split. On October 1, the corporation purchased on the market 300,000 of its own outstanding shares and retired them. 10,000 shares of 8%, $100 par value, cumulative, preferred stock were outstanding (convertible into 40,000 shares of common). No dividends were declared or paid on either the preferred or common stock in 2020. Net income for 2020 was $4,700,000. Tax rate was 30%. Convertible Bonds, 9%, $300,000 face amount, convertible into 25,000 common shares Also outstanding at January 1, 2020 were incentive stock options granted to key executives on January 1, 2015. The options are exercisable as of January 1, 2019, for 40.000 common shares at an exercise price of $20 per share. During 2020, the average market price of the com non shares was $50 per share. 9. The weighted number of shares included in the denominator to compute basic EPS is A. 2,264,000 3.3,115,000 C. 350,000 D. 700,000 10. The basic earnings per share is A $1.48 B. $1.51 C $2.08 D. $1.00 MacBook Air 11. What number would you include as the denominator to compute the diluted earnings per share A. 3,115,000 B.2,264,000 C. 3,204,000 D. None of the above 12. Which of the following is on the Income Statement as the diluted earnings per share? A. $2.95 B. $1.48 C. $1.47 D. $1.45 79 Questions 13 through 16 are based on the following information: On January 1, 2019, McGee Co. had the following balances: Projected benefit obligation $6,400,000 Fair value of plan assets Other data related to the pension plan for 2019: 6,000,000 contributions to the plan 400,000 Benefits paid 350,000 On 1/1/20019, prior service cost was granted having a present value of 150,000 Actual retum on plan assets 430,000 Settlement rate 9% Expected rate of return Amortized Prior Service cost 40.000 Amortization of net gain 50.000 Service cost 250,000 13. Total pension expense for 2019 15 A S396,000 B. $409.500 C. $430,000 D S589,500 14. In the journal to record pension expense, the Pension Asset/Liability account is credited for A. SI59, SOO B. $400,000 C. $150.000 D. None of the above. 15. How much will be reported on the balance sheet as Pension Asset/Liability at year end ! A. 56,480,000 B. $400,000 C. $159.500 D. 5559,500 16. At December 31 2019, the balance of the Projected Benefit Obligation is A. 57.039,500 B. S6,489,000 C. 56,889,500 D. 56,809,500

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started