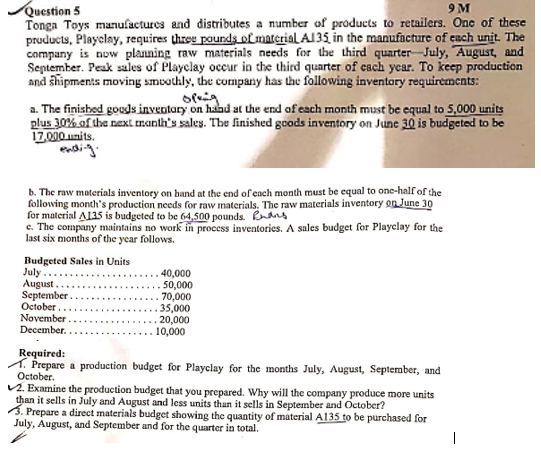

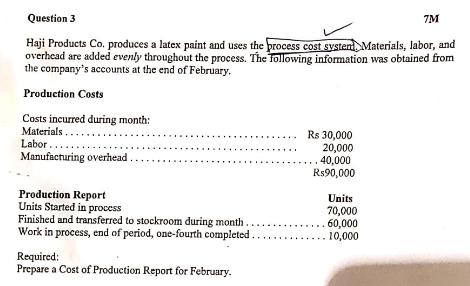

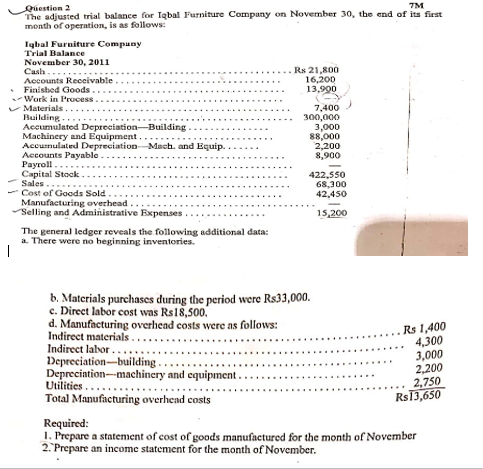

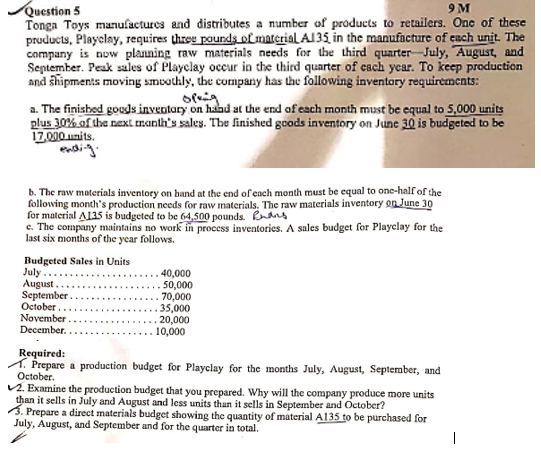

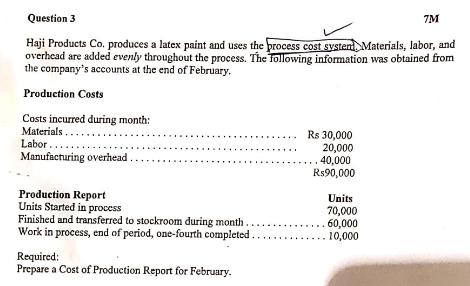

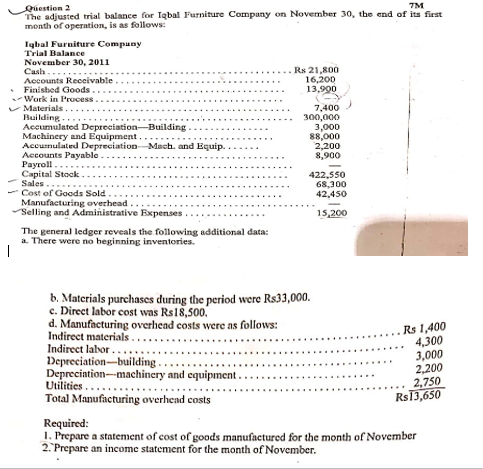

Questions 9M Tonga Toys manufactures and distributes a number of products to retailers. One of these products, Playclay, requires these pounds of material Al35 in the manufacture of each unit. The company is now planning raw materials needs for the third quarter July, August, and September. Peak sales of Playclay occur in the third quarter of each year. To keep production and shipments moving smoothly, the company has the following inventory requirements: a. The finished goods inventary on hand at the end of each month must be equal to 5,000 units plus 30% of the next tranth's sales. The finished goods inventory on June 30 is budgeted to be 17,000 units. b. The raw materials inventory on hand at the end of each month must be equal to one-half of the following month's production needs for raw materials. The raw materials inventory on June 30 for material A135 is budgeted to be 64,500 pounds. Ruders c. The company maintains no work in process inventories. A sales budget for Playclay for the last six months of the year follows. Budgeted Sales in Units July 40,000 August 50,000 September 70,000 October 35,000 November 20,000 December 10,000 Required: Prepare a production budget for Playclay for the months July, August, September, and October 2. Examine the production budget that you prepared. Why will the company produce more units than it sells in July and August and less units than it sells in September and October? 2. Prepare a direct materials budget showing the quantity of material A135 to be purchased for July, August, and September and for the quarter in total | Question 3 7M Haji Products Co. produces a latex paint and uses the process cost systen). Materials, labor, and overhcad are added evenly throughout the process. The following information was obtained from the company's accounts at the end of February. Production Costs Costs incurred during month: Materials .. Labor... Manufacturing overhead Rs 30,000 20,000 40,000 Rs90,000 Production Report Units Started in process Finished and transferred to stockroom during month.. Work in process, end of period, one-fourth completed. Units 70,000 .. 60,000 .. 10,000 Required: Prepare a Cost of Production Report for February. Question 2 7M The adjusted trial balance for Tqbal Furniture Company on November 30, the end of its first month of operation, is as follows: Iqbal Furniture Compuny Trial Balance November 30, 2011 Cash... Accounts Receivable Finished Goods Work in Process Materials Building Accumulated Depreciation Building Machinery and Equipment Accumulated Depreciation Machi and Equip. Accounts Payable Payroll Capital Stock Sales Cost of Goods Sold Manufacturing overhead Selling and Administrative Expenses The general ledger reveals the following additional data: a. There were no beginning inventories. Rs 21,800 16,200 13.990 7,400 300,000 3,000 88,000 2,200 8,900 422,550 68,300 42,450 15,200 | b. Materials purchases during the period were R$33,000. c. Direct labor cost was Rs18,500. d. Manufacturing overhead costs were as follows: Indirect materials, Indirect labor..... Depreciation--building Deprecintion---machinery and equipment Utilities Total Manufacturing overhead costs Required: 1. Prepare a statement of cost of goods manufactured for the month of November 2. Prepare an income statement for the month of November Rs 1,400 4,300 3,000 2.200 2,750 R$13,650