Question

Questions: a) The payback period for proposals 1 & 2, respectively: ___________________ b) The return on average investment for Proposal 1 & 2, respectively: ___________________

Questions:

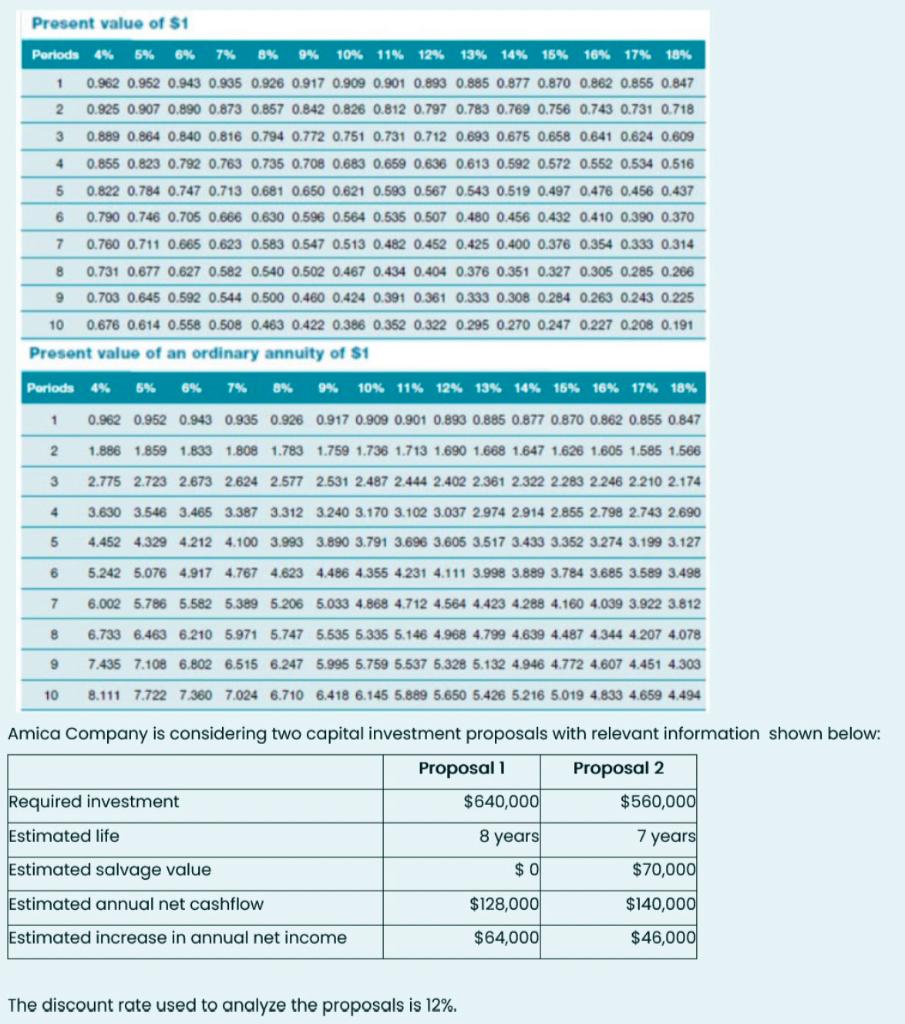

a) The payback period for proposals 1 & 2, respectively: ___________________

b) The return on average investment for Proposal 1 & 2, respectively: ___________________

c) the internal rate of return (IRR) for Proposal 1 & 2, respectively (Note: Ignore salvage value, if any): __________________

d) The present value of the annual net cashflow for Proposals 1 & 2, respectively: _____________________

e) The net present value (NPV) of the annual net cashflow for Proposal 1: _________________________

f) The net present value (NPV) of the annual net cashflow for Proposal 2: ______________________

Please show all the calculations. Thank you.

Present value of $1 Periods 4% 5% 6% 7% 8% 9% 10% 11% 12% 13% 14% 15% 16% 17% 18% 1 0.962 0.952 0.943 0.935 0.926 0.917 0.909 0.901 0.893 0.885 0.877 0.870 0.862 0.855 0.847 2 0.925 0.907 0.890 0.873 0.857 0.842 0.826 0.812 0.797 0.783 0.769 0.756 0.743 0.731 0.718 3 0.889 0.864 0.840 0.816 0.794 0.772 0.751 0.731 0.712 0.693 0.675 0.658 0.641 0.624 0.609 4 0.855 0.823 0.792 0.763 0.735 0.708 0.683 0.659 0.636 0.613 0.592 0.572 0.552 0.534 0.516 5 0.822 0.784 0.747 0.713 0.681 0.650 0.621 0.593 0.567 0.543 0.519 0.497 0.476 0.456 0.437 6 0.790 0.746 0.705 0.666 0.630 0,596 0.564 0.535 0.507 0.480 0.456 0.432 0.410 0,390 0.370 7 0.750 0.711 0.665 0.623 0.583 0.547 0.513 0.482 0.452 0.425 0.400 0.376 0.354 0.333 0.314 8 0.731 0.677 0.627 0.582 0.540 0.502 0.467 0.434 0.404 0.376 0.351 0.327 0.305 0.285 0.206 9 0.703 0.645 0.592 0.544 0.500 0.460 0.424 0.391 0.361 0.333 0.308 0.284 0.263 0.243 0.225 10 0.676 0.614 0.558 0.508 0.463 0.422 0.386 0.362 0.322 0.295 0.270 0.247 0.227 0.208 0.191 Prosent value of an ordinary annuity of $1 Periods 4% 5% 6% 7% 8% 10% 11% 12% 13% 14% 15% 16% 17% 18% 1 0.962 0.952 0.943 0.935 0.926 0.917 0.909 0.901 0.893 0.885 0.877 0.870 0.862 0.855 0.847 2 1.886 1.859 1.833 1.808 1.783 1.759 1.736 1.713 1.690 1.668 1.647 1.626 1.805 1.585 1.566 3 2.775 2.723 2.673 2.624 2.577 2.531 2.487 2.444 2.402 2.361 2.322 2283 2.246 2.210 2.174 4 5 6 3.630 3.546 3.465 3.387 3.312 3.240 3.170 3.102 3.037 2.974 2.914 2.855 2798 2.743 2.690 4.452 4.329 4.212 4.100 3.993 3.890 3.791 3.696 3.605 3.517 3.433 3.352 3.274 3.199 3.127 5.2425.076 4.917 4.767 4.623 4.486 4.355 4.231 4.111 3.998 3.889 3.784 3.685 3.589 3.498 6.002 5.786 5.582 5.389 5.206 5.033 4.868 4.712 4.564 4.423 4.288 4.160 4.039 3.922 3.812 6.733 6.463 6.210 5.971 5.747 5.535 5.336 5.146 4.968 4.799 4.639 4.487 4 344 4.207 4.078 7.435 7.108 6.802 6.515 6.247 5.995 5.759 5.537 5.328 5.132 4.946 4.772 4.607 4.451 4,303 7 8 9 10 8.111 7.722 7.380 7.024 6.710 6.418 6.145 5.889 5.650 5.426 5.216 5.019 4.833 4.659 4.494 Amica Company is considering two capital investment proposals with relevant information shown below: Proposal 1 Proposal 2 Required investment $640,000 $560,000 Estimated life 8 years 7 years $ 0 Estimated salvage value Estimated annual net cashflow Estimated increase in annual net income $70,000 $140,000 $128,000 $64,000 $46,000 The discount rate used to analyze the proposals is 12%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started