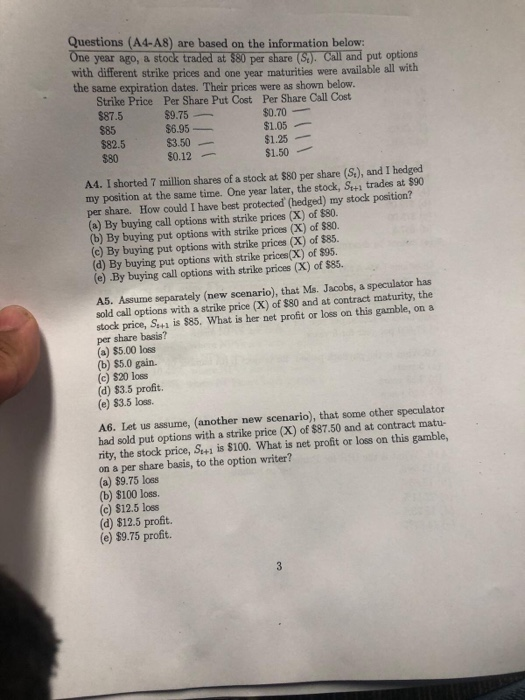

Questions (A4-A8) are based on the information below: One year ago, a stock traded at $80 per share (S). Call and put options with different strike prices and one year maturities were available all with the same expiration dates. Their prices were as shown below. Strike Price Per Share Put Cost Per Share Call Cost $87.5 $9.75 $0.70 $85 $6.95 $1.05 $82.5 $3.50 - $1.25 - $80 $1.50 $0.12 - A4. I shorted 7 million shares of a stock at $80 per share (S.), and I hedged my position at the same time. One year later, the stock, Se+ trades at $90 per share. How could I have best protected (hedged) my stock position? (a) By buying call options with strike prices (X) of $80. (b) By buying put options with strike prices (X) of $80. (c) By buying put options with strike prices (X) of $85. (d) By buying put options with strike prices(X) of $95. (e) .By buying call options with strike prices (X) of $85. A5. Assume separately (new scenario), that Ms. Jacobs, & speculator has sold call options with a strike price (X) of $80 and at contract maturity, the stock price, S.1 is $85. What is her net profit or loss on this gamble, on a per share basis? (a) $5.00 loss (b) $5.0 gain (c) $20 loss (d) $3.5 profit. (e) $3.5 loss. A6. Let us assume, another new scenario), that some other speculator had sold put options with a strike price (X) of $87.50 and at contract matu- rity, the stock price, Sc+1 is $100. What is net profit or loss on this gamble, on a per share basis, to the option writer? (a) $9.75 loss (b) $100 loss. (c) $12.5 loss (d) $12.5 profit. (e) $9.75 profit. Questions (A4-A8) are based on the information below: One year ago, a stock traded at $80 per share (S). Call and put options with different strike prices and one year maturities were available all with the same expiration dates. Their prices were as shown below. Strike Price Per Share Put Cost Per Share Call Cost $87.5 $9.75 $0.70 $85 $6.95 $1.05 $82.5 $3.50 - $1.25 - $80 $1.50 $0.12 - A4. I shorted 7 million shares of a stock at $80 per share (S.), and I hedged my position at the same time. One year later, the stock, Se+ trades at $90 per share. How could I have best protected (hedged) my stock position? (a) By buying call options with strike prices (X) of $80. (b) By buying put options with strike prices (X) of $80. (c) By buying put options with strike prices (X) of $85. (d) By buying put options with strike prices(X) of $95. (e) .By buying call options with strike prices (X) of $85. A5. Assume separately (new scenario), that Ms. Jacobs, & speculator has sold call options with a strike price (X) of $80 and at contract maturity, the stock price, S.1 is $85. What is her net profit or loss on this gamble, on a per share basis? (a) $5.00 loss (b) $5.0 gain (c) $20 loss (d) $3.5 profit. (e) $3.5 loss. A6. Let us assume, another new scenario), that some other speculator had sold put options with a strike price (X) of $87.50 and at contract matu- rity, the stock price, Sc+1 is $100. What is net profit or loss on this gamble, on a per share basis, to the option writer? (a) $9.75 loss (b) $100 loss. (c) $12.5 loss (d) $12.5 profit. (e) $9.75 profit