Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Questions and Problems 1. An insurer sells a very large number of policies to people with the following loss distribution: $100,000 with probability 0.005 $

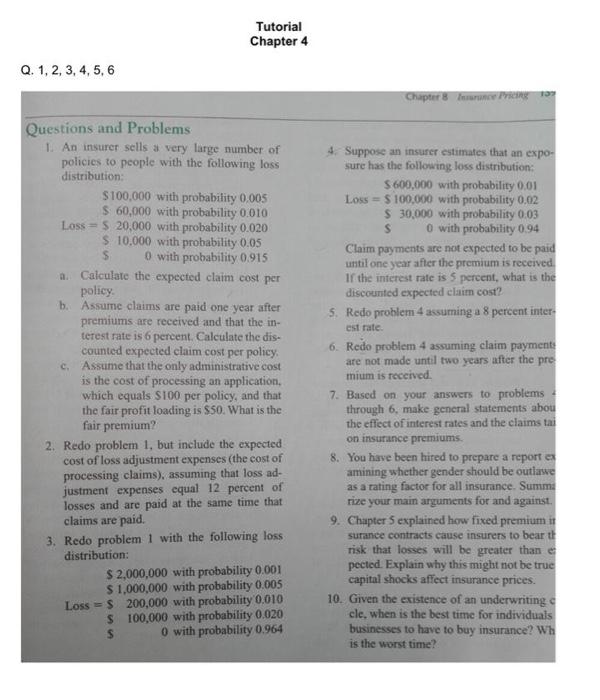

Questions and Problems 1. An insurer sells a very large number of policies to people with the following loss distribution: $100,000 with probability 0.005 $ 60,000 with probability 0.010 Loss = $ 20,000 with probability 0.020 $ 10,000 with probability 0.05 $ 0 with probability 0.915 a. Calculate the expected claim cost per policy. b. Assume claims are paid one year after premiums are received and that the in- terest rate is 6 percent. Calculate the dis- counted expected claim cost per policy. c. Assume that the only administrative cost is the cost of processing an application, which equals $100 per policy, and that the fair profit loading is $50. What is the fair premium? 2. Redo problem 1, but include the expected cost of loss adjustment expenses (the cost of processing claims), assuming that loss ad- justment expenses equal 12 percent of losses and are paid at the same time that claims are paid. 3. Redo problem 1 with the following loss distribution: $ 2,000,000 with probability 0.001 $ 1,000,000 with probability 0.005 200,000 with probability 0.010 100,000 with probability 0.020 0 with probability 0.964 Loss = $ $ $ Chapter 8 Insurance Pricing 1 4. Suppose an insurer estimates that an expo- sure has the following loss distribution: $600,000 with probability 0.01 Loss = $100,000 with probability 0.02 $ 30,000 with probability 0.03 S 0 with probability 0.94 Claim payments are not expected to be paid until one year after the premium is received. If the interest rate is 5 percent, what is the discounted expected claim cost? 5. Redo problem 4 assuming a 8 percent inter- est rate. 6. Redo problem 4 assuming claim payments are not made until two years after the pre- mium is received, 7. Based on your answers to problems through 6, make general statements abou the effect of interest rates and the claims tai on insurance premiums. 8. You have been hired to prepare a report ex amining whether gender should be outlawe as a rating factor for all insurance. Summa rize your main arguments for and against. 9. Chapter 5 explained how fixed premium in surance ontracts cause insurers to bear th risk that losses will be greater than e pected. Explain why this might not be true capital shocks affect insurance prices. 10. Given the existence of an underwriting c cle, when is the best time for individuals businesses to have to buy insurance? Wh is the worst time?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started