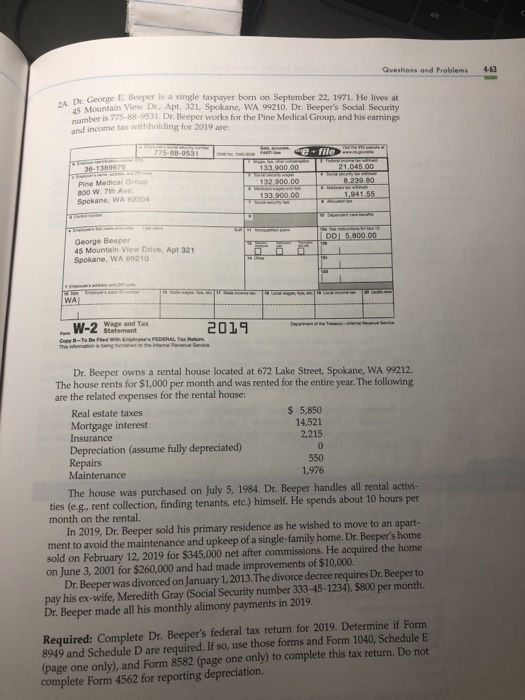

Questions and Problems 4-63 2A. Dr. George E. Beeper is a single taxpayer born on September 22, 1971. He lives at 45 Mountain View Dr. Apt. 321, Spokane, WA 99210. Dr. Beeper's Social Security number is 775-88-9531, Dr. Beeper works for the Pine Medical Group, and his earnings and income tax withholding for 2019 are: 775.88-9531 e file 133,900.00 21.045.00 36-1389670 Pine Medical Groun 800 W 7th Ave Spokane, WA 92204 132.900.00 133 900.00 8 239.80 1,941 55 DD 5.800.00 George Beeper 45 Mountain View Drive, Apt 321 Spokane, WA 99210 WA 2019 Statement Copy B-To Be Fed's FEDERAL Tax Return song Dr. Beeper owns a rental house located at 672 Lake Street, Spokane, WA 99212. The house rents for $1,000 per month and was rented for the entire year. The following are the related expenses for the rental house: Real estate taxes $ 5,850 Mortgage interest 14,521 Insurance 2,215 Depreciation (assume fully depreciated) 0 Repairs 550 Maintenance 1,976 The house was purchased on July 5, 1984. Dr. Beeper handles all rental activi- ties (e.g., rent collection, finding tenants, etc.) himself. He spends about 10 hours per month on the rental. In 2019, Dr. Beeper sold his primary residence as he wished to move to an apart- ment to avoid the maintenance and upkeep of a single-family home. Dr. Beeper's home sold on February 12, 2019 for $345,000 net after commissions. He acquired the home on June 3, 2001 for $260,000 and had made improvements of $10,000. Dr.Beeper was divorced on January 1, 2013. The divorce decree requires Dr. Beeper to pay his ex-wife, Meredith Gray (Social Security number 333-45-1234), $800 per month. Dr. Beeper made all his monthly alimony payments in 2019. Required: Complete Dr. Beeper's federal tax return for 2019. Determine if Form 8949 and Schedule D are required. If so, use those forms and Form 1040, Schedule E (page one only), and Form 8582 (page one only) to complete this tax return. Do not complete Form 4562 for reporting depreciation. Questions and Problems 4-63 2A. Dr. George E. Beeper is a single taxpayer born on September 22, 1971. He lives at 45 Mountain View Dr. Apt. 321, Spokane, WA 99210. Dr. Beeper's Social Security number is 775-88-9531, Dr. Beeper works for the Pine Medical Group, and his earnings and income tax withholding for 2019 are: 775.88-9531 e file 133,900.00 21.045.00 36-1389670 Pine Medical Groun 800 W 7th Ave Spokane, WA 92204 132.900.00 133 900.00 8 239.80 1,941 55 DD 5.800.00 George Beeper 45 Mountain View Drive, Apt 321 Spokane, WA 99210 WA 2019 Statement Copy B-To Be Fed's FEDERAL Tax Return song Dr. Beeper owns a rental house located at 672 Lake Street, Spokane, WA 99212. The house rents for $1,000 per month and was rented for the entire year. The following are the related expenses for the rental house: Real estate taxes $ 5,850 Mortgage interest 14,521 Insurance 2,215 Depreciation (assume fully depreciated) 0 Repairs 550 Maintenance 1,976 The house was purchased on July 5, 1984. Dr. Beeper handles all rental activi- ties (e.g., rent collection, finding tenants, etc.) himself. He spends about 10 hours per month on the rental. In 2019, Dr. Beeper sold his primary residence as he wished to move to an apart- ment to avoid the maintenance and upkeep of a single-family home. Dr. Beeper's home sold on February 12, 2019 for $345,000 net after commissions. He acquired the home on June 3, 2001 for $260,000 and had made improvements of $10,000. Dr.Beeper was divorced on January 1, 2013. The divorce decree requires Dr. Beeper to pay his ex-wife, Meredith Gray (Social Security number 333-45-1234), $800 per month. Dr. Beeper made all his monthly alimony payments in 2019. Required: Complete Dr. Beeper's federal tax return for 2019. Determine if Form 8949 and Schedule D are required. If so, use those forms and Form 1040, Schedule E (page one only), and Form 8582 (page one only) to complete this tax return. Do not complete Form 4562 for reporting depreciation