Answered step by step

Verified Expert Solution

Question

1 Approved Answer

QUESTIONS and PROBLEMS GROUP 1: on MULTIPLE CHOICE QUESTIONS medical expense 1. which of the following expenses is gross income limitation? O 5.1 A, the

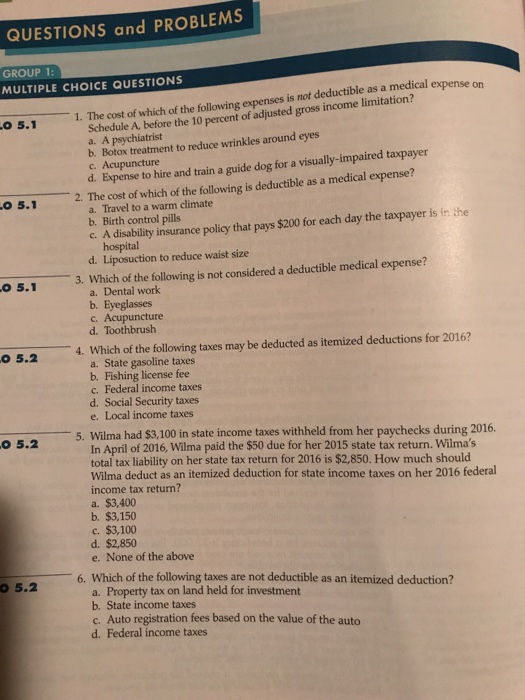

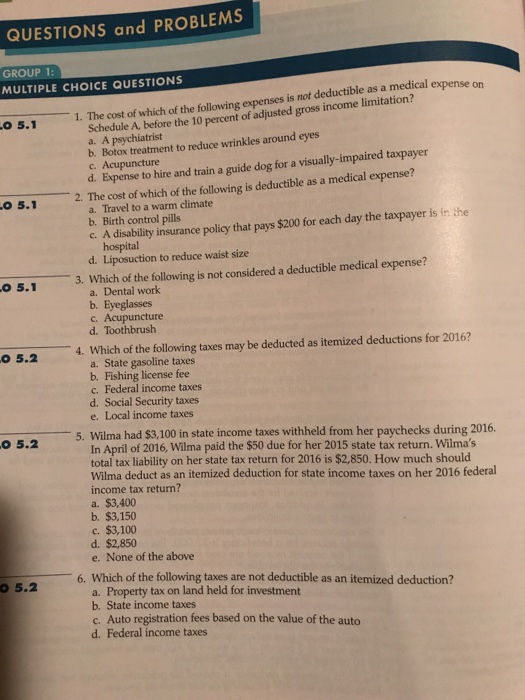

QUESTIONS and PROBLEMS GROUP 1: on MULTIPLE CHOICE QUESTIONS medical expense 1. which of the following expenses is gross income limitation? O 5.1 A, the 10 percent Schedule psychiatrist b. Botox treatment to reduce wrinkles around eyes taxpayer c. dog for a visually impaired d. Expense to hire and train a guide as a medical expense? 2. The cost of which of the following is deductible a. Travel to a warm climate is in the b, Birth control pills $200 for each day the taxpayer c, A disability insurance policy that pays O 5.1 hospital d. Liposuction to reduce waist size expense? 3. Which of the following is not considered a deductible medical work. o 5.1 b, Eyeglasses c. Acupuncture d. Toothbrush o 5.2 4. Which of the following taxes may be deducted as itemized deductions for 2016? a. State gasoline taxes b. Fishing license fee c, Federal income taxes d. Social Security taxes e. Local income taxes 5. Wilma had s3,100 in state income taxes withheld from her paychecks during 2016. o 5.2 In April of 2016, Wilma paid the $50 due for her 2015 state tax return. Wilma's total tax liability on her state tax return for 2016 is $2,850. How much should Wilma deduct as an itemized deduction for state income taxes on her 2016 federal income tax return? a. $3,400 b, $3,150 c. $3,100 d, $2,850 e. None of the above 6. Which of the following taxes are not deductible as an itemized deduction? o 5.2 a. Property tax on land held for investment b. State income taxes c. Auto registration fees based on the value of the auto d. Federal income taxes

QUESTIONS and PROBLEMS GROUP 1: on MULTIPLE CHOICE QUESTIONS medical expense 1. which of the following expenses is gross income limitation? O 5.1 A, the 10 percent Schedule psychiatrist b. Botox treatment to reduce wrinkles around eyes taxpayer c. dog for a visually impaired d. Expense to hire and train a guide as a medical expense? 2. The cost of which of the following is deductible a. Travel to a warm climate is in the b, Birth control pills $200 for each day the taxpayer c, A disability insurance policy that pays O 5.1 hospital d. Liposuction to reduce waist size expense? 3. Which of the following is not considered a deductible medical work. o 5.1 b, Eyeglasses c. Acupuncture d. Toothbrush o 5.2 4. Which of the following taxes may be deducted as itemized deductions for 2016? a. State gasoline taxes b. Fishing license fee c, Federal income taxes d. Social Security taxes e. Local income taxes 5. Wilma had s3,100 in state income taxes withheld from her paychecks during 2016. o 5.2 In April of 2016, Wilma paid the $50 due for her 2015 state tax return. Wilma's total tax liability on her state tax return for 2016 is $2,850. How much should Wilma deduct as an itemized deduction for state income taxes on her 2016 federal income tax return? a. $3,400 b, $3,150 c. $3,100 d, $2,850 e. None of the above 6. Which of the following taxes are not deductible as an itemized deduction? o 5.2 a. Property tax on land held for investment b. State income taxes c. Auto registration fees based on the value of the auto d. Federal income taxes

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started