Question

QUESTIONS ARE ASKED BETWEEN IMAGES! the shaded reen boxes are where I need help with the answers. Thank you! Instructions: Complete the each of following

| QUESTIONS ARE ASKED BETWEEN IMAGES! the shaded reen boxes are where I need help with the answers. Thank you! Instructions: | ||||||||||||||

| Complete the each of following seven tabs in this MS Excel Workbook using the information contained in them: | ||||||||||||||

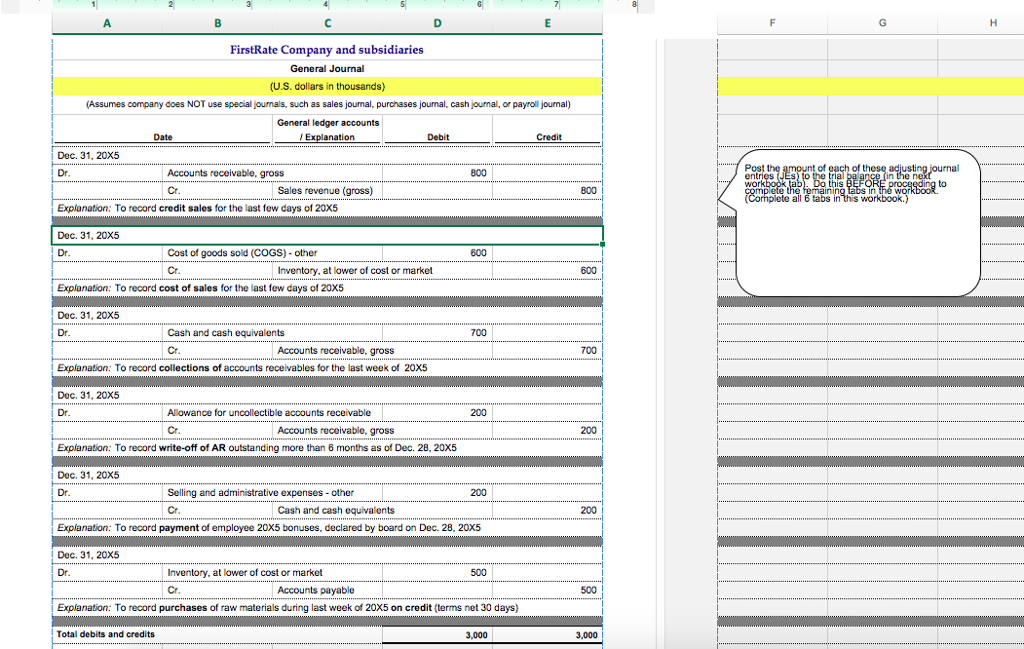

| Post the Journal Entries (to record the transactions of FirstRate Company during the final week of its fiscal year ended [FYE] | ||||||||||||||

| Dec. 31, 20X5) to the consolidated Trial Balance of the company as of December 31, 20X5 | ||||||||||||||

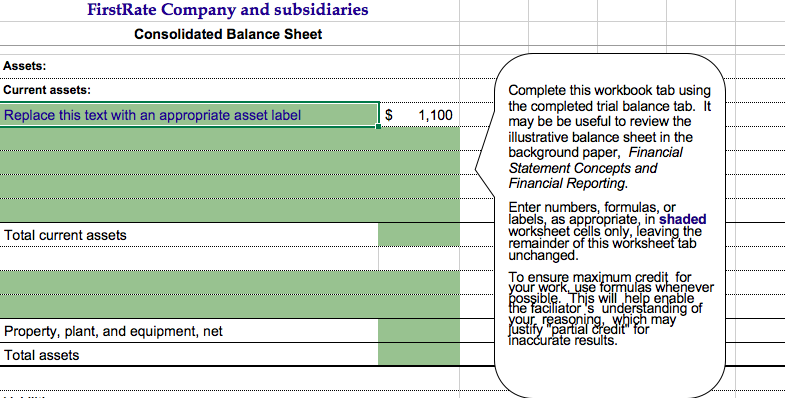

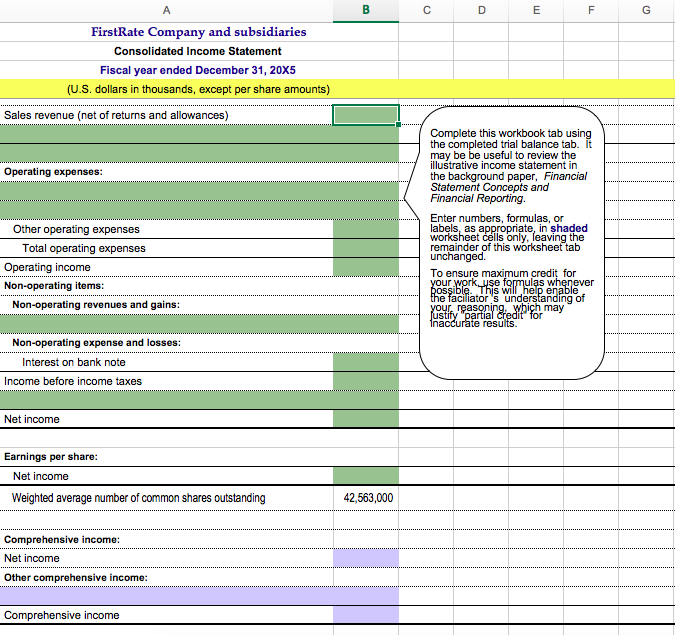

| Consolidated Balance Sheet of the company as of December 31, 20X5 | ||||||||||||||

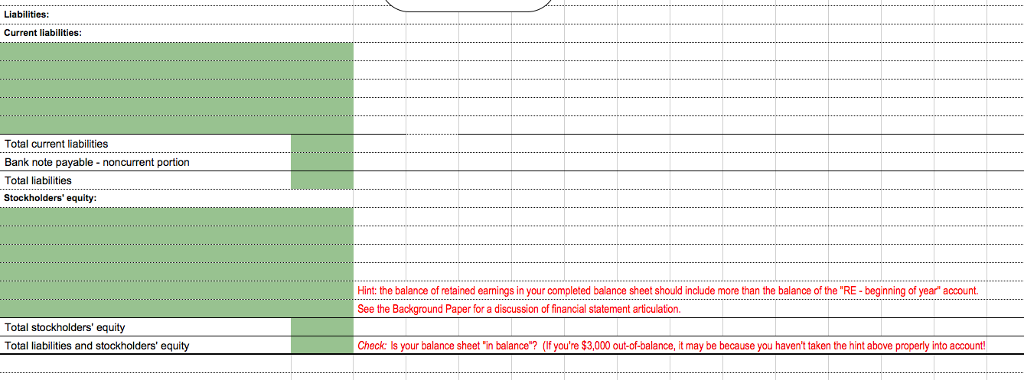

| Consolidated Income Statement, including comprehensive income, of the company for its FYE December 31, 20X5 | ||||||||||||||

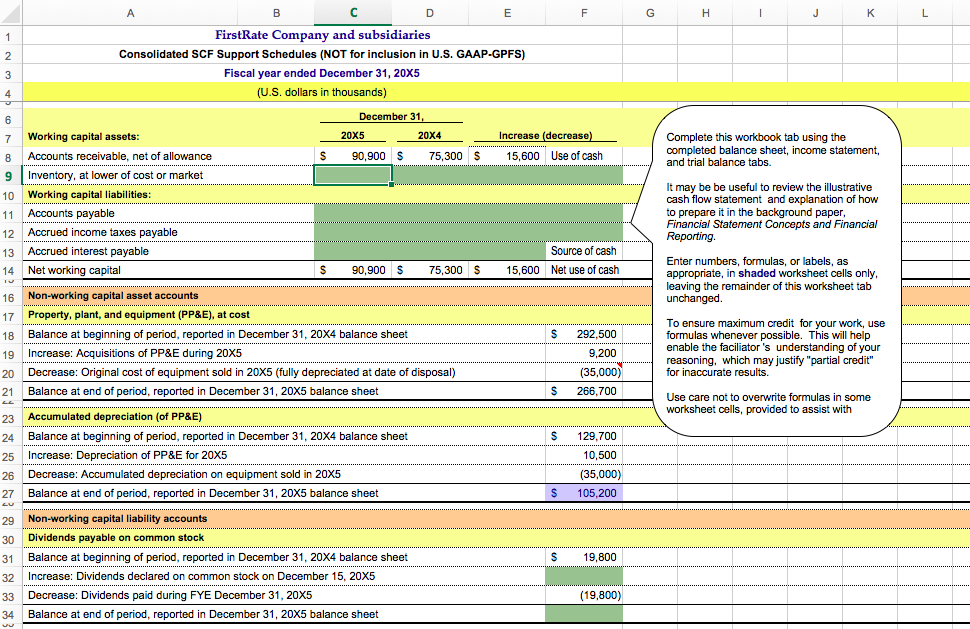

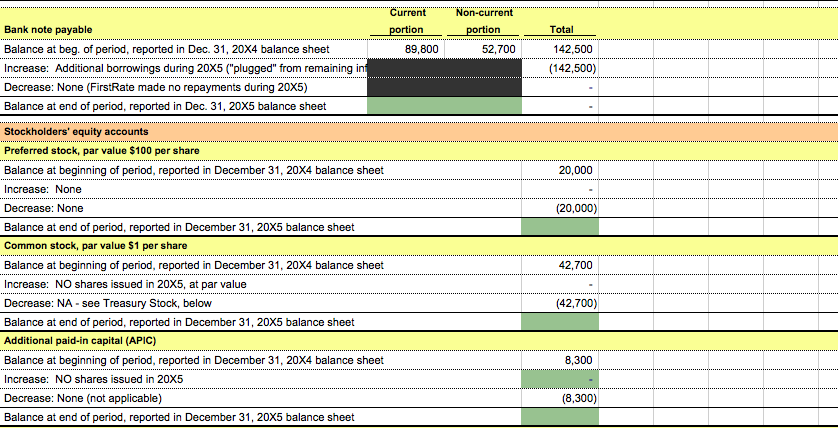

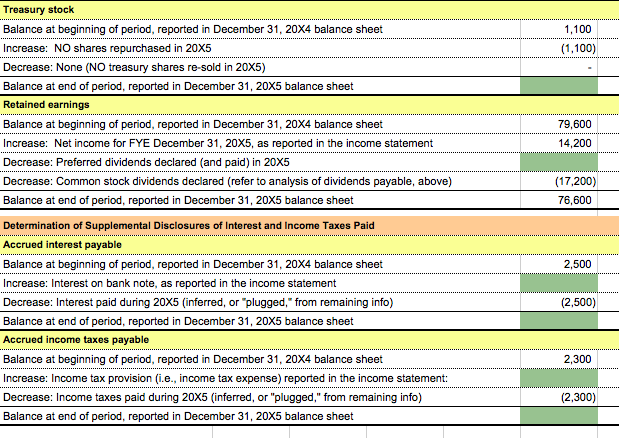

| Statement of Cash Flows (SCF) Support Schedule, which provides information useful for preparing the SCF | ||||||||||||||

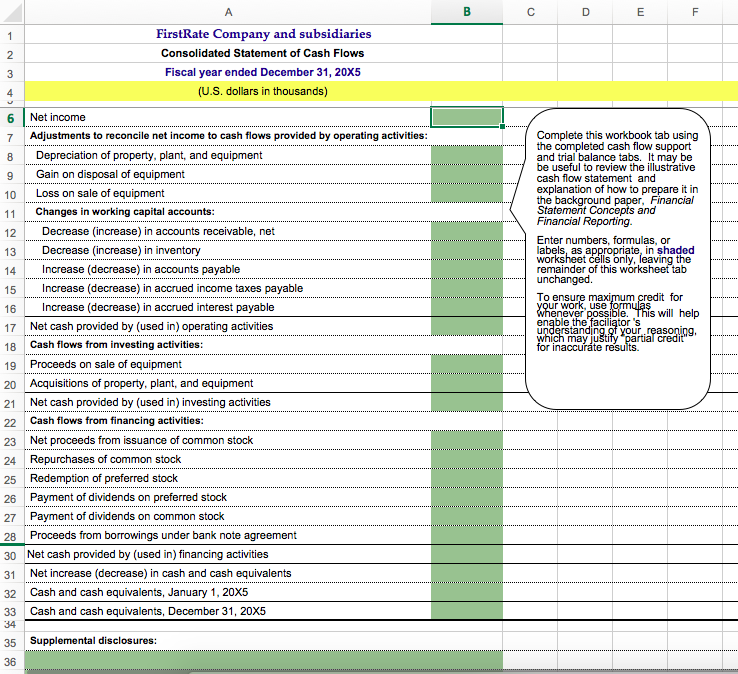

| Consolidated Statement of Cash Flows (SCF) of the company for its FYE December 31, 20X5 | ||||||||||||||

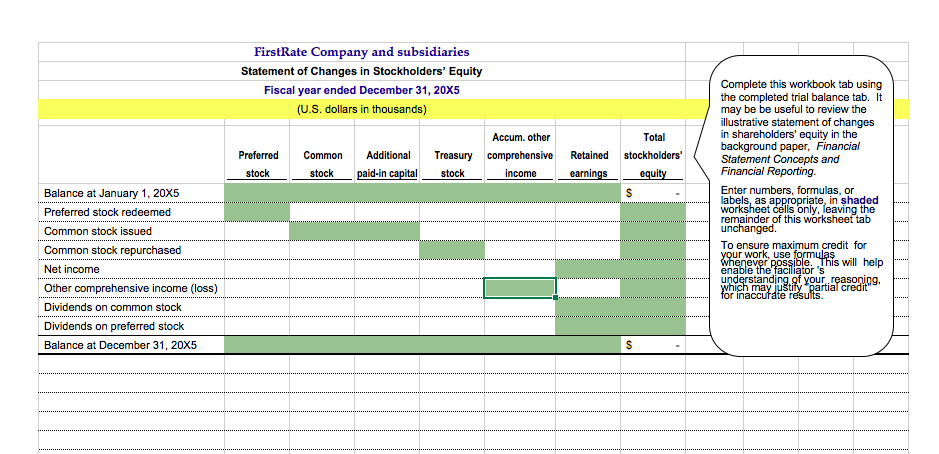

| Consolidated Statement of Changes in Shareholders' Equity of the company for its FYE December 31, 20X5 | ||||||||||||||

| Complete the assignment by working "from left to right." That is, first, complete the Trial Balance, followed by the Balance Sheet, then the | ||||||||||||||

| Income Statemet tab, etc. | ||||||||||||||

| Below are images from excel: Image 1: General Journal - i dont know why image 1 is small so i typed it aout below Accounts Receivalbe: Debit $800 Sales revenue (gross): Credit $800 COGS-other $600 Inventory, at lower cost or market $600 Cash and cash equivalents: $700 Accounts receivable, gross: $200 Allowance for uncollectible accounts receivable: $200 Accounts receivable, gross: $200 Selling and administrative cost or market: $500 Cash and cash equiv.: $200 Inventory, at lower cost or market: $500 Accounts payable: $500 Total Debits: $3000 | Total Credits: $3000

| ||||||||||||||

Image 2: Balance Sheet- ***PLEASE FILL IN GREEN SHADED BOXES WITH INFO FROM IMAGE 1

Image 3: Income Statement- **PLEASE FILL IN GREEN SHADED BOXES WITH INFO FROM IMAGE 1&/OR 2

Image 4, 5, 6: Support Schedules- PLEASE FILL IN SHADED GREE NBOXES WITH INFOR FROM IMAGES 1, 2, &/OR 3

Image 7: Statement of Cash Flows- PLEASE FILL IN SHADED GREEN BOXES FROM IMAGES 1, 2, 3, 4, 5, &/OR 6

Image 8: Statement of Changes in Stockholders' Equity- PLEASE FILL IN SHADED GREEN BOXES WITH INFO FROM IMAGES 1, 2, 3, 4, 5, 6, &/OR 7

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started