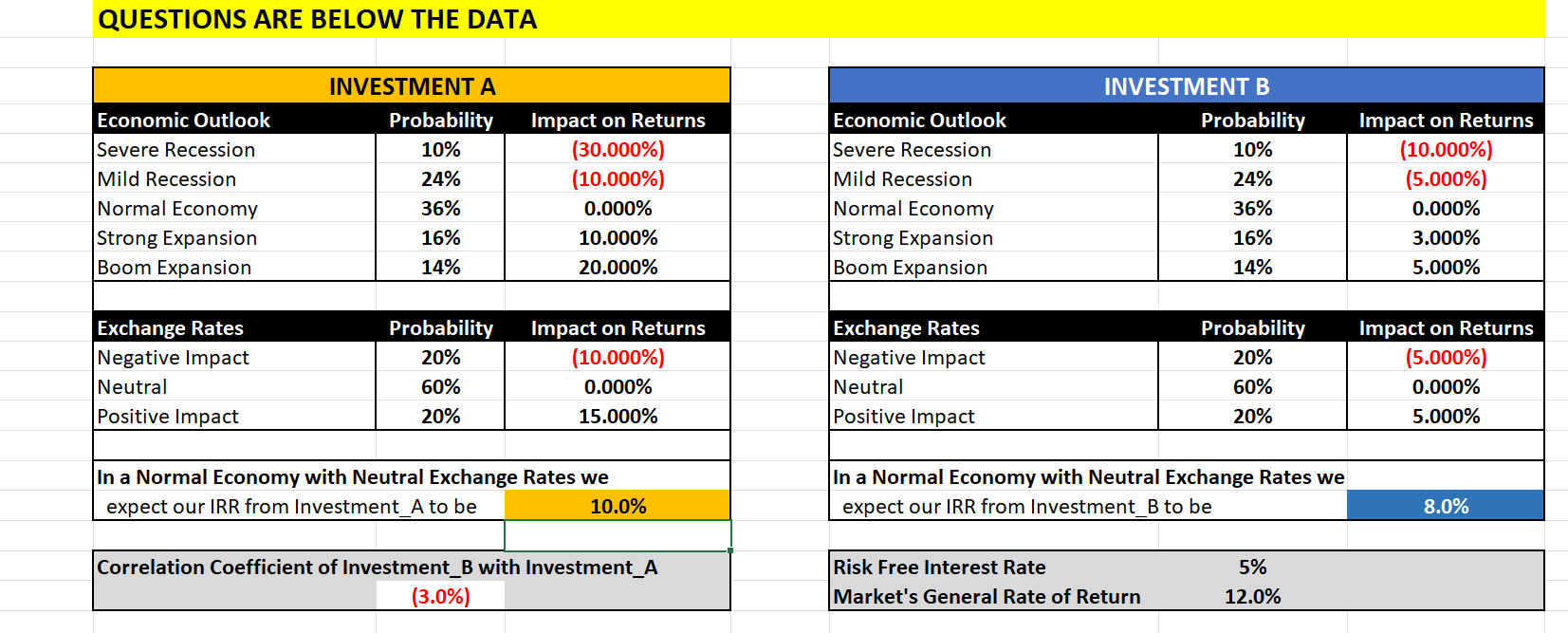

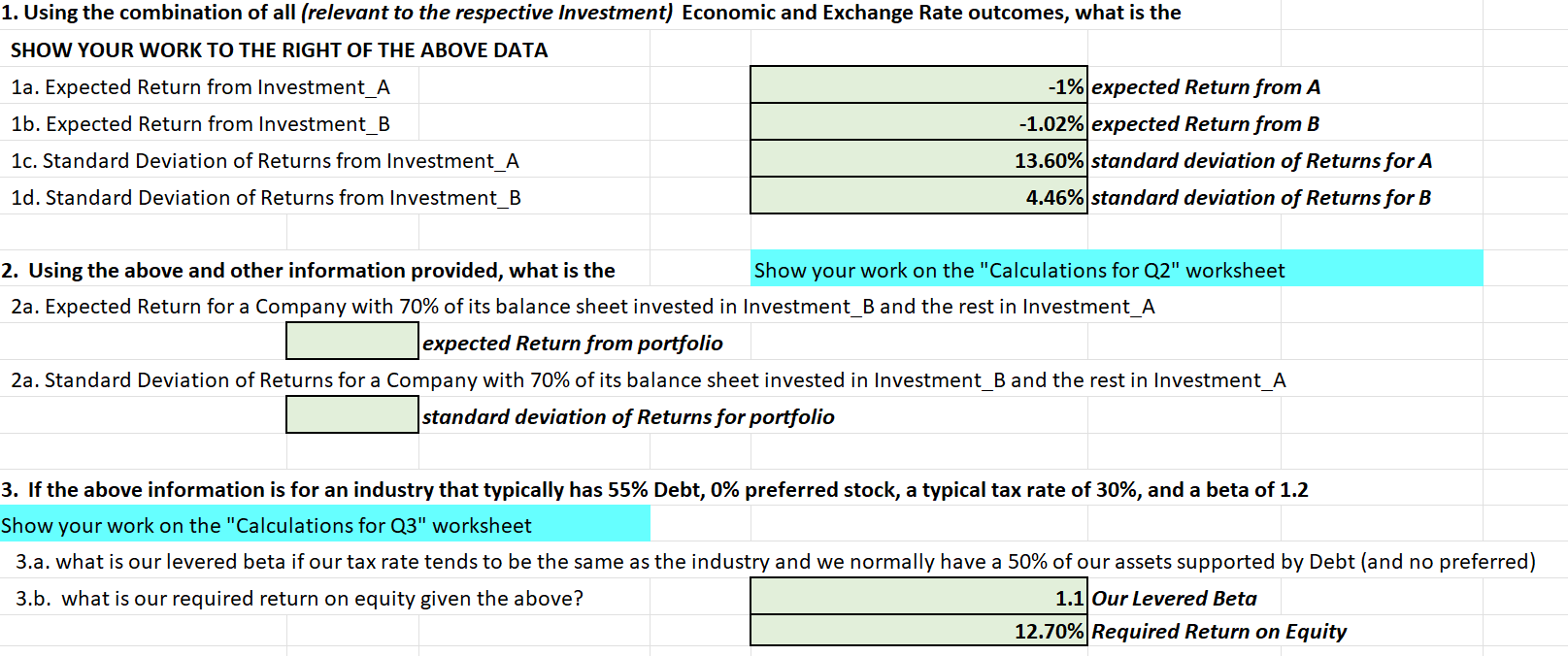

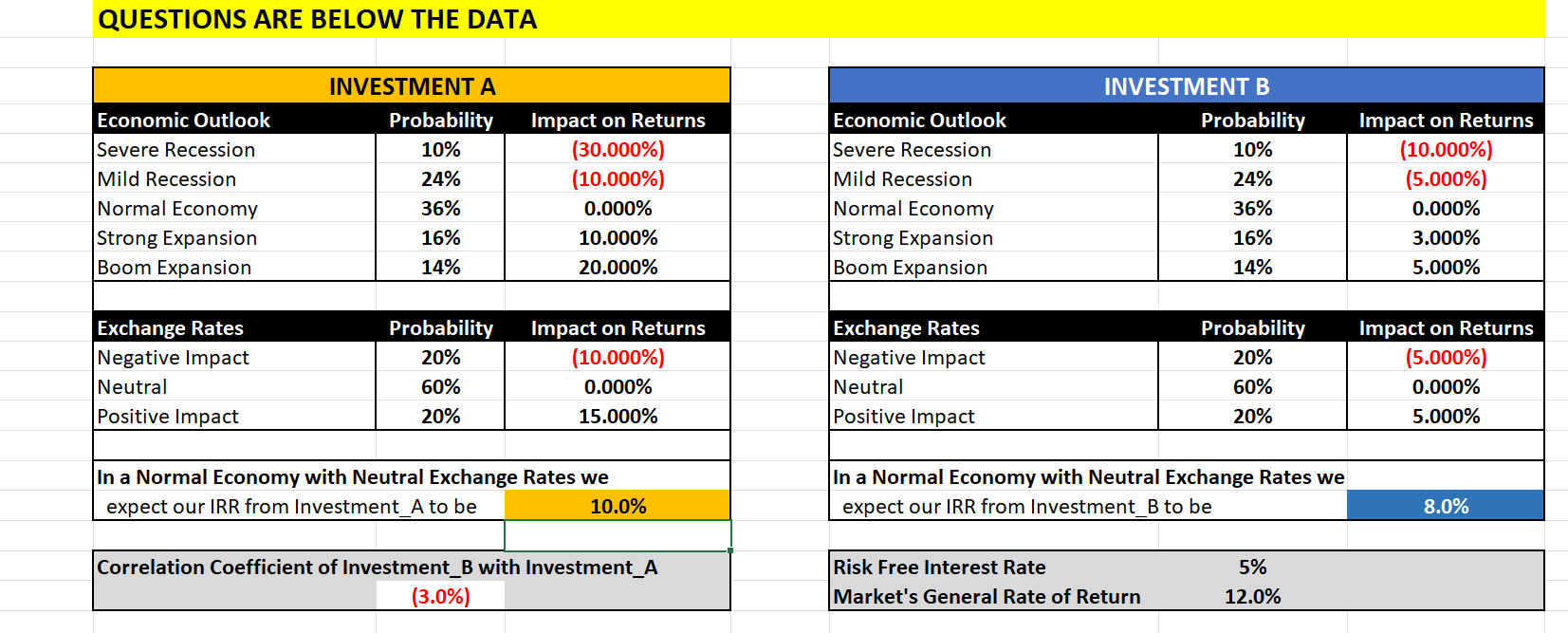

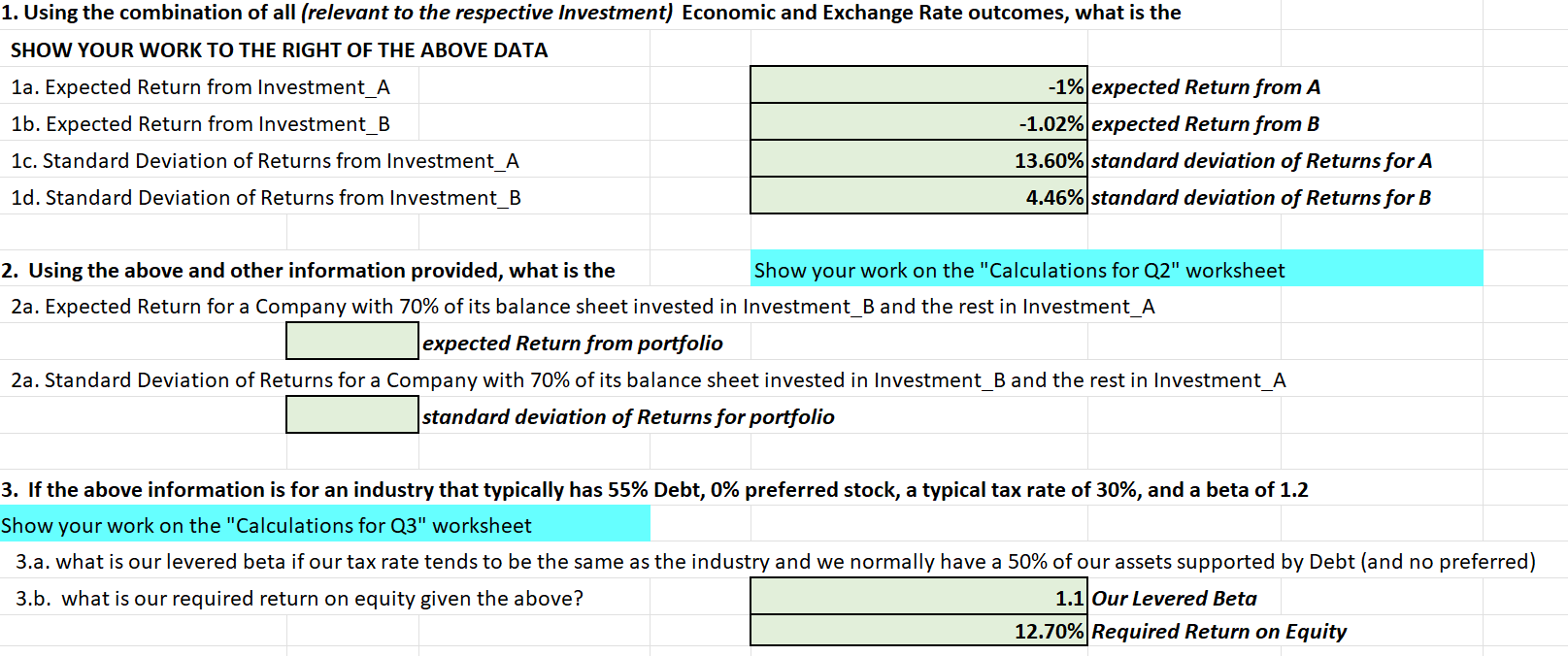

QUESTIONS ARE BELOW THE DATA SHOW YOUR WORK TO THE RIGHT OF THE ABOVE DATA 1a. Expected Return from Investment_A expected Return from A 1b. Expected Return from Investment_B expected Return from B 1c. Standard Deviation of Returns from Investment_A standard deviation of Returns for A 1d. Standard Deviation of Returns from Investment_B standard deviation of Returns for B 2. Using the above and other information provided, what is the Show your work on the "Calculations for Q2" worksheet 2a. Expected Return for a Company with 70% of its balance sheet invested in Investment_B and the rest in Investment_A expected Return from portfolio 2a. Standard Deviation of Returns for a Company with 70% of its balance sheet invested in Investment_B and the rest in Investment_A standard deviation of Returns for portfolio 3. If the above information is for an industry that typically has 55% Debt, 0% preferred stock, a typical tax rate of 30%, and a beta of 1.2 Show your work on the "Calculations for Q3 " worksheet 3.a. what is our levered beta if our tax rate tends to be the same as the industry and we normally have a 50% of our assets supported by Debt (and preferred 3.b. what is our required return on equity given the above? Our Levered Beta QUESTIONS ARE BELOW THE DATA SHOW YOUR WORK TO THE RIGHT OF THE ABOVE DATA 1a. Expected Return from Investment_A expected Return from A 1b. Expected Return from Investment_B expected Return from B 1c. Standard Deviation of Returns from Investment_A standard deviation of Returns for A 1d. Standard Deviation of Returns from Investment_B standard deviation of Returns for B 2. Using the above and other information provided, what is the Show your work on the "Calculations for Q2" worksheet 2a. Expected Return for a Company with 70% of its balance sheet invested in Investment_B and the rest in Investment_A expected Return from portfolio 2a. Standard Deviation of Returns for a Company with 70% of its balance sheet invested in Investment_B and the rest in Investment_A standard deviation of Returns for portfolio 3. If the above information is for an industry that typically has 55% Debt, 0% preferred stock, a typical tax rate of 30%, and a beta of 1.2 Show your work on the "Calculations for Q3 " worksheet 3.a. what is our levered beta if our tax rate tends to be the same as the industry and we normally have a 50% of our assets supported by Debt (and preferred 3.b. what is our required return on equity given the above? Our Levered Beta