Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Questions are objectives Mh the below by entering the appropriate code l mental analy Opportunity t Suks 18. Acest that cannot be changed by any

Questions are objectives

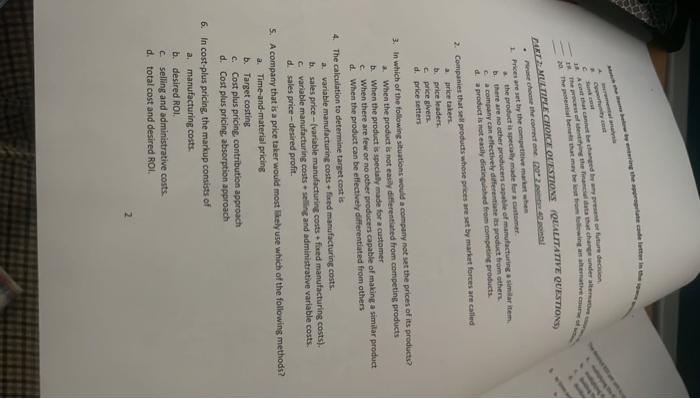

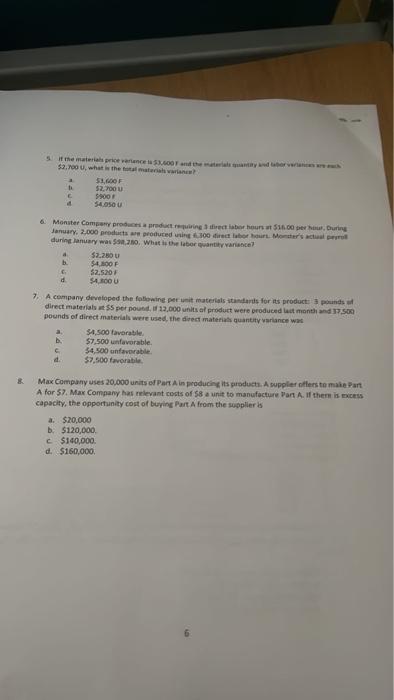

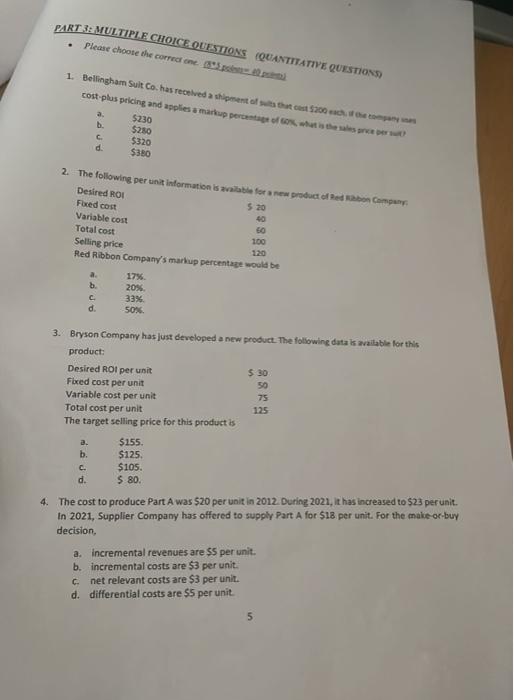

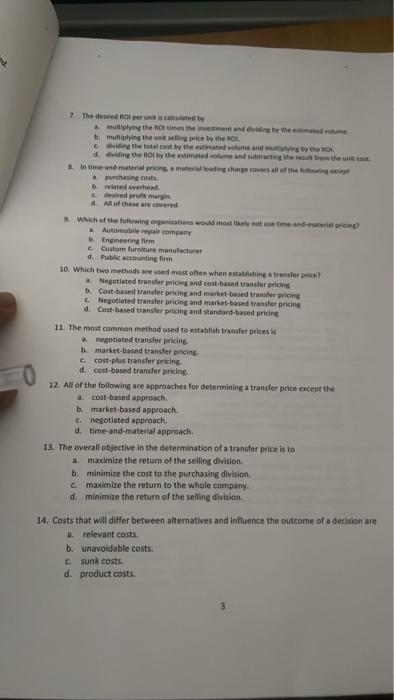

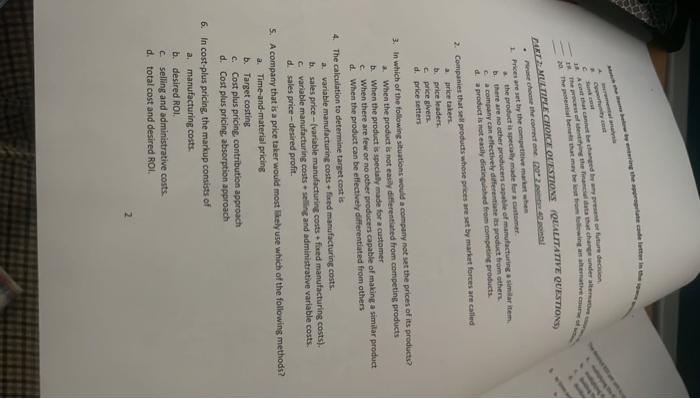

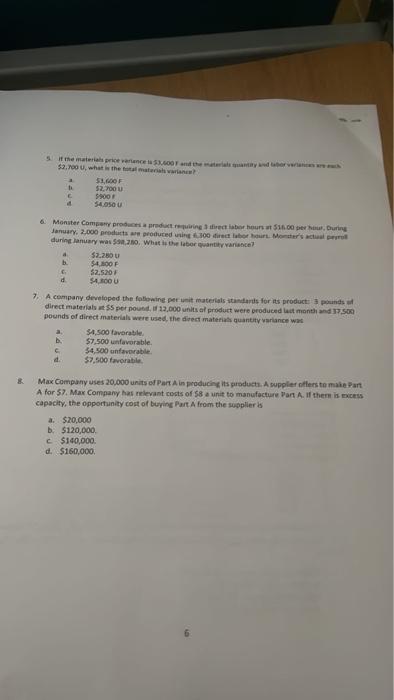

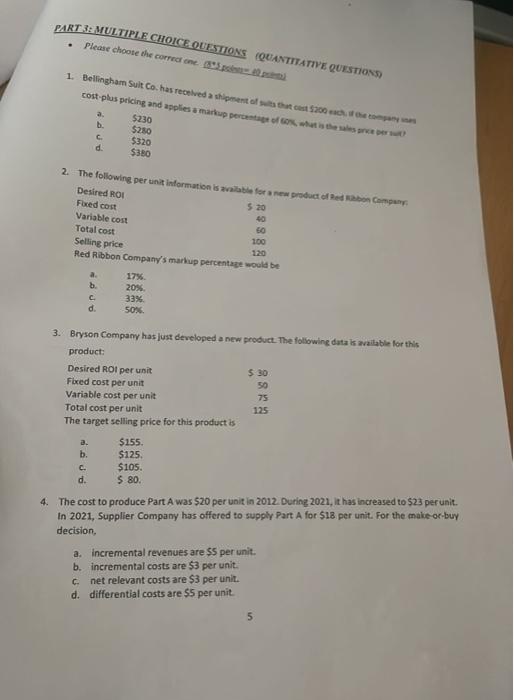

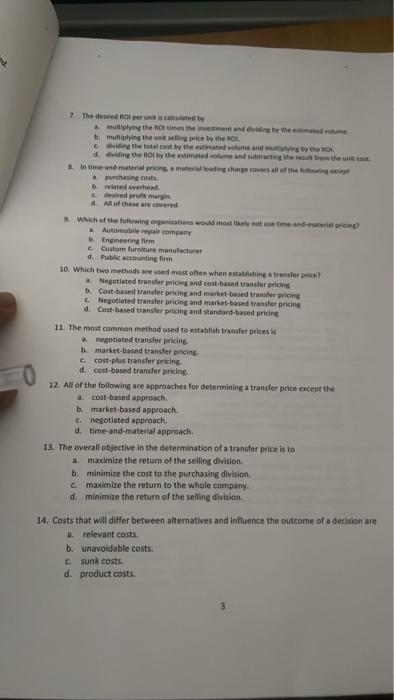

Mh the below by entering the appropriate code l mental analy Opportunity t Suks 18. Acest that cannot be changed by any present or future decision 18. The process of identifying the financial data that change under alternative s 20 The potential bene that may be lost from following an alternative course of CARE MULTIPLE CHOICE QUESTIONS (QUALITATIVE QUESTIONS) Please choose the correct one (202.ponte: 42 pointal . 1. Prices are set by the competitive market when the product is specially made for a customer. b. there are no other producers capable of manufacturing a similar item ca company can effectively differentiate its product from others. d. a product is not easily distinguished from competing products. 2. Companies that sell products whose prices are set by market forces are called a price takers b. price leaders c. price givers. d. price setters 3. In which of the following situations would a company not set the prices of its products? a. When the product is not easily differentiated from competing products b. When the product is specially made for a customer When there are few or no other producers capable of making a similar product d. When the product can be effectively differentiated from others 4. The calculation to determine target cost is a. variable manufacturing costs + fixed manufacturing costs. b. sales price-(variable manufacturing costs + fixed manufacturing costs). c. variable manufacturing costs selling and administrative variable costs. d. sales price-desired profit. 5. A company that is a price taker would most likely use which of the following methods? a. Time-and-material pricing b. Target costing c. Cost plus pricing, contribution approach d. Cost plus pricing, absorption approach 6. In cost-plus pricing, the markup consists of a. manufacturing costs. b. desired ROI. c. selling and administrative costs. d. total cost and desired ROI. 2 5. If the materials price varience to $3,600 F and the materials quantity and tabor verances are ch $2.700 U, what is the total material varian? $1,600 F $2,700 U b 5900 $4,050 U 4 6. Monster Company produces a product requiring 3 direct labor hours at $16.00 per hour, During January, 2,000 products are produced using 6.300 direct labor hours Monster's actual pero during January was 558,280. What is the labor quantity variance? $2.280 U $4,800 F . $2.520F d $4,800 U 7. A company developed the following per unit materials standards for its product: 3 pounds of direct materials at $5 per pound. If 12,000 units of product were produced last month and 17,500 pounds of direct materials were used, the direct materials quantity variance was a $4,500 favorable b. $7,500 unfavorable. C 54,500 unfavorable. d. $7,500 favorable. 8. Max Company uses 20,000 units of Part A in producing its products. A supplier offers to make Part A for 57. Max Company has relevant costs of $8 a unit to manufacture Part A. If there is excess capacity, the opportunity cost of buying Part A from the supplier is a. $20,000 b. $120,000 c $140,000. d. $160,000. PART 3: MULTIPLE CHOICE QUESTIONS (QUANTITATIVE QUESTIONS) Please choose the correct one (83 pop . 1. Bellingham Suit Co. has received a shipment of sults that cast $200 each of the company ses cost-plus pricing and applies a markup percentage of 60%, what is the sales price per sult? a. $230 b. $280 C $320 d. $380 2. The following per unit information is available for a new product of Red Ribbon Company Desired ROI 5.20 Fixed cost Variable cost 40 60 Total cost 100 Selling price 120 Red Ribbon Company's markup percentage would be a. 17%. b. 20%. C. 33% d. 50%. 3. Bryson Company has just developed a new product. The following data is available for this product: $.30 Desired ROI per unit 50 Fixed cost per unit 75 Variable cost per unit 125 Total cost per unit The target selling price for this product is a. $155. b. $125. $105. d. $ 80. 4. The cost to produce Part A was $20 per unit in 2012. During 2021, it has increased to $23 per unit. In 2021, Supplier Company has offered to supply Part A for $18 per unit. For the make-or-buy decision, a. incremental revenues are $5 per unit. b. incremental costs are $3 per unit. c. net relevant costs are $3 per unit. d. differential costs are $5 per unit. C. 5 7. The desired ROI per unit is calculated by & multiplying the ROI times the investment and dividing by the estimated volume b. multiplying the unit selling price by the ROI e dividing the total cost by the estimated volume and multiplying by the O d. dividing the Rot by the estimated volume and subtracting the result from the unit cout a. In time-and-material pricing, a material loading charge covers all of the following except a purchasing costs. brelated overhead. e desired profit margin d. All of these are covered Which of the following organizations would most likely not a d-material pricing? a Automobile repair company b. Engineering firm e Custom furniture manufacturer d. Public accounting firm 10. Which two methods are used most often when establishing a transfer price? a. Negotiated transfer pricing and cost-based transfer pricing b. Cost-based transfer pricing and market-based transfer pricing c. Negotiated transfer pricing and market-based transfer pricing d. Cost-based transfer pricing and standard-based pricing 11. The most common method used to establish transfer prices is a negotiated transfer pricing, b. market-based transfer pricing. c. cost-plus transfer pricing. d. cost-based transfer pricing. 0 12. All of the following are approaches for determining a transfer price except the a. cost-based approach. b. market-based approach. c. negotiated approach. d. time-and-material approach. 13. The overall objective in the determination of a transfer price is to a. maximize the return of the selling division. b. minimize the cost to the purchasing division c. maximize the return to the whole company. d. minimize the return of the selling division. 14. Costs that will differ between alternatives and influence the outcome of a decision are a. relevant costs. b. unavoidable costs. c. sunk costs. d. product costs

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started